Have you made a budget for your home buying journey? Part of the process is making sure that you can afford your home, while providing a sufficient down payment for your home purchase. Finding funds for your down payment can be tricky, but with some planning, you will be buying a home in no time!

You might have heard that you need 20% down in order to purchase a home- this is a common misconception. A lot of mortgage programs now allow home buyers to put as little as 3% down.

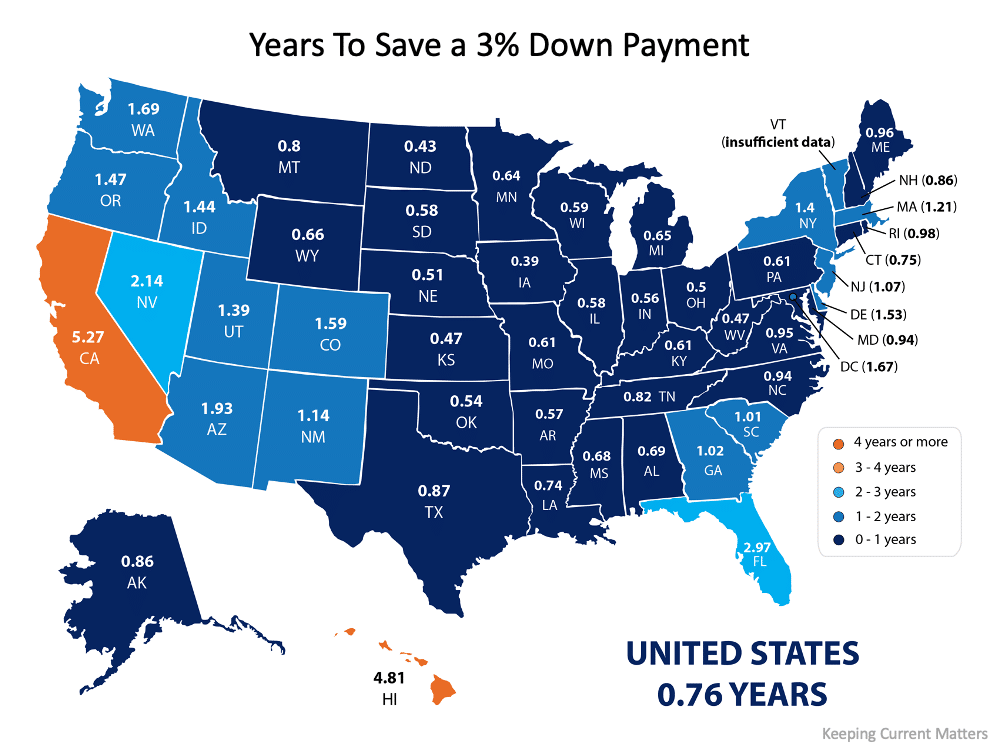

According to Keeping Current Matters, on average, it takes approximately 9 months in the United States for the average home buyer to save money for a 3% down payment.

More than half of the United States will take up to 1 year to save for a down payment, 32 states to be exact. Below are more statistics for the average amount of time it takes to save for a 3% down payment:

- 14 states: 1-2 years

- 2 states: 2-3 years

- 2 states: 4 years or more

Below is a map that demonstrates on average how much time it takes for each state’s home buyers to save for a 3% down payment:

Source: Keeping Current Matters

As you can see, it might not take as long as you think to achieve your dream of home ownership! If you are interested in learning more about mortgage loan products that can require as low as 3% down, contact a team member today. Purchasing a home this year can be your reality!