HOME BUYING PROCESS

We provide a stress-free and personalized home buying experience.

Our knowledgeable team will work with you every step of the way to ensure your home purchase is a smooth one.

Note: This is a simplified version of our process and is for illustrative purposes only. Not all loans follow the same format and some steps are not shown here.

WHAT SOME OF OUR HAPPY CLIENTS HAVE TO SAY

Simplify the loan process and get expert advice

Corey was the easiest person to work with. She was always was available when we needed something. Easy to work with and so friendly!

Working with DM Loans from the start was exceptional! I have not purchased a new home for a very long time and the team made me feel very relaxed as I was navigated with ease through this process. Their expertise assured me the comfort I needed to get my beautiful home! I will definitely be telling my family and friends what a great experience I had! Thank you!

We have used Daryl for 3 loans ! He always goes above and beyond for his clients ! He has been amazing, we refer him to everyone we know! Daryl is a rockstar !

Direct Mortgage is a great company. I worked with a few people but my loan officer was great Ms Angela and she was a sweet heart so amazing to work with, she help me in every step of the way to purchase my new home. I closed on 6-17-24. I have recommended Direct Mortgage to several people I know already they are a great choice to go with I promise.

I didn't know buying a house could be so easy! My realtor recommended Direct Mortgage Loans and I couldn't be more thankful that he did. DML went above and beyond my expectations!

Direct Mortgage Loans' processes are very transparent and straightforward, ìf you want to do business with DML , they have best deal and the likes of Pamela, Jennifer, Naylor in a team are very hardworking and reliable combinations. All you is just your truthfulness and have clean pass records. I am happy doing business with DML.

DML has an amazing team that will help you with any questions. Purchasing my first home was the easiest process with DML guidance.

From start to finish my loan and closing was a breeze. I’ve worked with Bill P for years, and I’ve always had the same results. I highly recommend Direct Mortgage!, Ken

Gina DeCicco and Rebekah Graham were the most amazing team. I have worked in the real estate industry for 22 years and we had a clear to close in 12 days which is unheard of. Not only that, we had to sell our house at the same time and they assisted our buyers as well!!! Another CTC in 3 weeks!!! We were blown away by the responses, quick turn around and personal service we received. Great job ladies!!!

This is the 4th time we have used Chad and his team for a new home or a refinance. Once again it was quick and easy. They are always honest, quick to respond to any questions, and keep us updated on everything throughout the process. Can’t recommend enough!!

Blake and his team were fantastic. They were able to walk us through the entire process and always made sure we had our questions answered. Blake took the time to explain all the loan details to make sure we understood and were comfortable with everything. We would definitely recommend them to anyone looking to start their home buying process! They gained our trust and we're really we decided to work with them

The entire team at Direct Lending were great! Caleb and Kim were absolutely amazing! We definitely recommend the team at Direct Lending!!

So thankful for Direct Mortgage and especially Paul. He helped more than I could ever imagine through this whole process. It made my first time home buying experience an exceptional and easy one. Being able to contact and speak with him and my processer Debbie directly every time I emailed or called with questions was greatly appreciated. They went beyond my expectations and would 100% use them again and recommend them to others.

The Gray team is amazing! Very thorough and quick process. I would recommend them to anyone!

Amanda Brune is the absolute best! She’s responsive and always ready to answer any questions with her extensive knowledge and experience. Buying a house can be super intimidating, but Amanda made the mortgage process stress free!

For first time home buying all my questions were answered an explained to me very hands on an meet all my expectations with everything an got me in under what I wanted to spend with great communication would definitely would recommend to some in the process of buying a house

Ms Pam and her team were absolutely amazing, they handled my first home purchase with great ease and I am very impressed. Thank you Ladies , it was so comforting to know that I had a tribe of ladies who believed in me. Omoh

Cale to of DML did an awesome job with our mortgage. Extremely helpful, great communication and went beyond what I expected.

Ami and Ash provided exceptional service to us. They have worked with us on 2 home loans and 1 refinance over the past 7 years, and they've been kind, patient, helpful, accurate, and above all knowledgeable and instructive. We know that we can always call Ami and Ash if we ever have any questions.

Ami and Ash are by far the most caring and hard working loan officers I've ever had the please of working with. They both went above and beyond to make this experience an amazing one! I've already referred multiple people to them, and will shout their professionalism from the rooftops!! Thank you Ami and Ash!

Corey and Jamie are very kind, professional and great to work with. They made the home buying process easy for me and I’ll be using them in the future. Thank you for everything

Direct Mortgage Loans has provided me with an extraordinary experience. The trio of Ami, Amanda, and Ash truly embodies excellence in the mortgage industry. Ami's insightful guidance, Amanda's meticulous approach, and Ash's unwavering commitment have simplified the intricate world of mortgages. Opting for Direct Mortgage Loans was unequivocally the wisest choice for my home loan requirements. The personalized attention and combined knowledge of this exceptional trio ensured a smooth, stress-free journey from start to finish. If you seek unmatched service and expertise for your home loan, Direct Mortgage Loans with Ami, Amanda, and Ash is unequivocally the optimal selection.

I worked with Donny McCord this year when buying a home and his efficiency and service was unmatched! He answered all questions knowledgeably and worked hard to help me buy sooner than I thought I’d be able to! Highly recommend working with Direct Mortgage Loans

Amazing service. Always available and ready to answer any questions you may have.

Caleb & his team's communication is top notch! Always willing to give an update or talk through a scenario. Their local condo knowledge and experience is invaluable. Highly recommend!

I had the pleasure of spending a full day with my friends at Direct Mortgage Loans during their annual DML Fest. You can feel the company culture immediately. Their energy is contagious and everything they do is centered around both their customers and putting their LO's in positions to succeed.

Matt Mieras and his team handled things absolutely flawlessly. We had some challenges in the past that made our prior mortgage difficult, but it was no problem for Matt and his team. We are in our new home and absolutely thrilled! We will definitely use them again and send our friends to them without hesitation.

Oliver and his team are very dedicated and helping you. They will not stop,until everything is done.

Quinn was amazing to work with exceptional customer service, communication was always on point including the entire team GREAT job. I would recommend DML to anyone whom looking to be a homeowner or refinancing.

I just want to thank the Whole team at Direct Mortgage Loans for helping me in getting my first home...It could have been a lot worse if I did not have the guidance and support of this Team...Special Thanks to Paul Gordon! even in his vacation time he went the extra mile to help me by answering my calls and text. Thank you all.

Amy and her team were amazing! She was extremely creative and helping my wife and I to find the best solution and mortgage product available for our situation. She stuck with us through the changes they came along and made sure that she saw us across the finish line.

My husband and I refinanced with the Dobz Group a few years ago. The service was great! They were attentive to our needs, creative with their solutions, and responsive. I would 100% recommend their services!

I had a wonderful experience with Direct Mortgage Loans. The team was incredibly attentive and friendly throughout the entire process. They made sure to address all my questions and concerns, making me feel valued as a customer. I highly recommend their services to anyone in need of a mortgage. Thank you, Direct Mortgage Loans, for your exceptional service!

Bo and Lindsey are the easiest people to work with. They will talk you through everything step by step. Taking away all nerves you may. I was so scared at first until I started the process. No matter what hr Bo gets back with you. Definitely 💯 worth it to got to Bo and Lindsey

DML was so great to work with in buying our first home! Kevin was our loan officer and was so readily available to answer all of our questions, and put things in more “simple” terms for us since we had no experience ever taking out a loan on anything. He never made us feel rushed or stressed because of how much we didn’t know - he always was happy to answer our questions and address our concerns. So happy with the service from DML!

The Amy Wolf team made the whole home buying process so easy and stress free. Dale, Roni and Rachel are great at what they do. As a first time homebuyer I’m so glad I had them to help me along the way. Can’t recommend them enough!!!

We started our journey with Direct Mortgage Loans not knowing if we'd be able to accomplish a dream we had. We are a large family on a single income that isn't grand by any means. We needed a bigger home with a bigger yard so that we could live comfortably. The house we wanted seemed out of reach and unattainable bcus we had to sell a home in order to purchase the dream home. Our credit scores weren't great either so there were many obstacles! Kolleen Organek with Direct Mortgage Loans reviewed our information and went into immediate action. Not only did she find a way to up our credit score and get us pre-approved but she also walked us through every single step very carefully, got us a conventional loan which we thought was impossible and got us a low interest rate and we are now the owners of our dream home! This team is compassionate, understanding and extremely willing to go the extra 100 miles to get things done right! If you have the opportunity to work with a lender don't pass up Direct Mortgage Loans! Kolleen Organek is a powerhouse! We couldn't be happier!

Direct mortgage lending company is a comprehensive wraparound service that provided us with support from beginning to end in the procedures of pursuing our new home. I would recommend them to anyone, especially if the person is a first time home buyer. The processes are user-friendly, and questions are encouraged while answers are provided in a timely fashion. Kolleen was a true support every step of the way!! What an amazing team!! Thank you to Caleb, Kyle, Veronica, Jennifer, and Jen, and all the members of the team who helped make my dreams. Come, true! And even though I know that my realtor is not a part of this team, it was because of her that this team came into my life. Enough cannot be sad for such a comprehensive network of people working in the real estate business. The housing market is better for individuals like this that have this level of dedication.

Meagan Gray is amazing at what she does. Very knowledgeable, helpful, and quick at helping you through the stressful process of home buying. She made it a breeze for my boyfriend and I, who had never bought a house before.

Andy Cynthia &Rachel are a mega team! They did everything they said they’d do to make sure we closed! We appreciate them so much for making homeownership a reality for us. We highly recommend their services!

A personal thank you to Corey Glowacki, you are awesome!! thank you to the whole team for all that you do!!! you all were wonderful!! you have made this such a positive experience for me! you guys are true professionals!!!

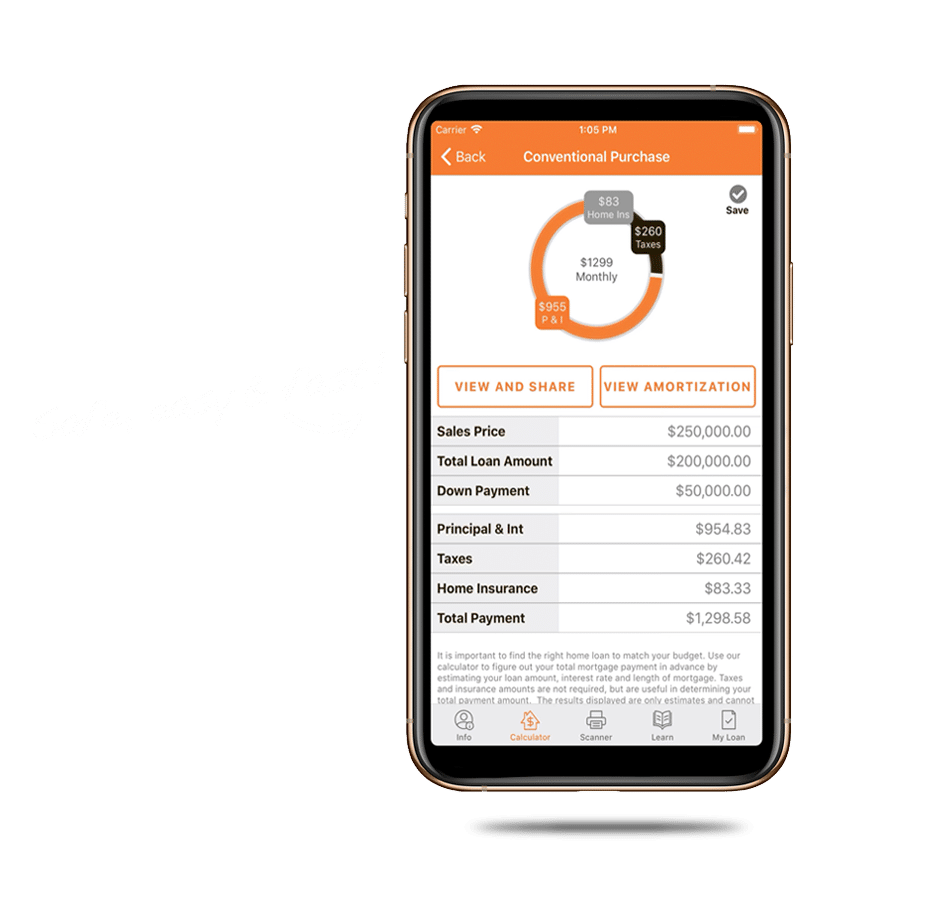

The team at Amy Wolff of Direct Mortgage loans was amazing to work with. The app for your phone makes everything so easy! They keep the lines of communication open and check in often. They got the loan closed on time and with not stress. Call them, you will be glad you did.

11/10 for the group at DML. Savannah and Cynthia were my team and they made the entire process as painless as possible. They texted me helpful reminders and emailed me everything I needed to help me keep track. This was literally the least stressful part of buying a home which is kind of wild! I'm a single mom so the home shopping and buying process was overwhelming but I had these two amazing women cheering me on in the background and I wish they could help me with everything!

Wanna talk about fast,detailed,and efficient?!You've definitely found the right mortgage company Mrs Vanessa and her team made my loan process quick and easy! I definitely couldn't have asked for better assistance, they truly came through for my family and i.

The is a very professional company. The beginning with Monica was so smooth and she is a super person to work with throughout the whole process. Misty was fantastic and kept us informed the entire time. They always return your calls and constantly reassure you at all times. Janeth was great to work with at the end. Overall highly recommend this company to anyone who wants a honest and stress free loan.

Corey was fantastic and so helpful and responsive throughout the entire process. As a first time homebuyer, I had a ton of questions and she and my realtor worked together in tandem to answer everything quickly and patiently! She was always very reassuring and during the entire process.

This is my first time working with Corey and the team at Direct mortgage loans. She came highly recommended from my realtor Cory Willems. I had multiple lenders send me quotes and Corey was by far the most knowledgeable and helpful. Professionalism and kindness go along way in my book. Every question I had was answered and I never felt like this was just a real estate transaction. I felt like this was a partnership and the start of something great. Corey went above and beyond to support me during the whole process and even after closing on the house. If you want a top tier lender who will go the extra mile for you Corey is your girl. I can’t thank you enough. God bless

Corey has helped numerous clients of mine and done an excellent job - she communicates, educates and is very attentive to their needs. Highly recommend!

Corey and her team at DML are awesome!! Communication couldn't be better and they are always on top of things. Highly recommend to anyone looking to purchase or refinance. They will get it done!

Corey was amazing to work with. Very communicative and got everyone to the finish line without a single hiccup. Highly recommend

Corey was amazing to work with. As a first time home buyer- she worked tirelessly on my behalf, and would drop everything in to work numbers for me to put offers in whenever I needed it (which was often). She was professional, kind, and always answered all of my questions along the process. She was very responsive to my texts and calls at all times, and she made my home buying experience everything I had dreamed of. Could not recommend her more. An amazing experience!!

Corey was great to work with! I called her on a Sunday morning needing a pre-approval immediately and she had it to my realtor within the hour. I highly recommend her!

Cory glowacki at dricect mortgageWas awesome. I have been trying to buy a house for ever she really took charge and got everything done for me it was an amazing experience.

We have had a great experience with Direct Mortgage! Corey and her team were very patient and helpful from the beginning. We would definitely recommend them!

Corey was fabulous to work with! Her communication is top tier. She made things so quick and easy for everyone involved!

If you're in need of a lender, you couldn't do any better than Corey and the team at DML! I started working with Corey when I began searching for my first home. I knew very little about the process and was full of questions. Corey never made me feel like I was a bother. She was always available to answer any questions I had. She never hesitated to run numbers for me, to answer my texts or calls, or to explain a part of the process I was unfamiliar with. She's incredibly knowledgeable and very adept at navigating you through the entire process.But even more important is her genuinely upbeat, excited, and enthusiastic personality. Having such a kind and confident person lead me through the lending process really helped me keep a level head and be excited about purchasing my first home. Working with Corey felt like I was working with a close friend. I will definitely work with her again!

Corey was absolutely fantastic! She was such a help every step of the way and made us feel so comfortable and at ease the whole time. She was a pleasure to work with and we would recommend her and her expertise to anyone! Her and her whole DML team are true professionals!

I can’t recommend Corey and her team enough when searching for your perfect lender! Corey is always there to answer any questions you may have along the way, and eager to help see what programs best suit you. Highly recommend!

Corey and her team are outstanding! As a first time homebuyer, I was very nervous about the entire process and had a ton of questions; Corey and her team walked me through every single step and answered any question I had. They were so friendly, helpful, and thorough! They provide consistent updates throughout the process and respond to emails/calls so quickly. I truly enjoyed working with them. I highly recommend them to anyone, and especially to first time homebuyers!

Corey was super informative and helpful from the beginning. She worked late nights & weekends to help us get an offer accepted. Corey, Caryn and the rest of her team made the entire process seamless and smooth. Any conditions that underwriting came up with, they were there to help quickly and easily fulfill them. Corey even attended our closing to make sure that everything went smooth. She’s a first-time homebuyers dream! You won’t regret using her as your lender!

Corey's team was amazing. They closed my loan in a very short turnaround, were incredibly communicative and organized, and helped me all along the way. I would not change a thing about it - perfection in customer service from start to finish.

I had the pleasure of working with Corey Glowacki to secure a loan for my first home, and I can't recommend her enough. Not only is she professional and knowledgeable, but she's also incredibly friendly and funny, which made the process so much more enjoyable.From the very beginning, Corey took the time to get to know me and understand my needs, which made me feel at ease right away. She has a way of explaining complex concepts in a way that's easy to understand, and she was always available to answer any questions I had, no matter how small.But what really stood out to me about Corey was her sense of humor and positive attitude. She made the process feel like a partnership rather than a transaction, and I always felt like she had my best interests at heart.Thanks to Corey, I was able to secure a fantastic interest rate and loan terms that were tailored to my specific needs. I couldn't be happier with the outcome!Overall, if you're looking for a loan officer who is not only professional and knowledgeable but also a genuine, kind, and honest person, look no further than Corey Glowacki. I rated her 5 stars without hesitation and I look forward to working with her again when it’s time to refinance!

Corey was FANTASTIC as our lender! As first time homebuyers, she ensured we were comfortable with every step of the homebuying process and always explained everything to us in easy-to-understand terms. Any time we had questions, we could text or email her and she responded within an hour. When we first met with her, she took our budget and ran multiple options for us based on different down payments and different house prices, so we could see what our monthly payment would look like. This allowed us to see what we could actually afford and helped us shop for houses within our budget. She even went so far as to lock in our rate when she saw the markets trending upwards, to ensure we had the best rate possible for the time. Hands down recommend Corey for any homebuyer! She's the best!!

Corey was extremely helpful and knowledgeable about the entire mortgage process. She helped me to secure a lower rate than I expected and was very friendly throughout everything. I have already referred several friends to her and will continue to do so in the future. Choosing anyone else for your mortgage needs would be a major mistake and will cost you a lot of money in the long run. I trust her and will continue to do business with her ANY time I need a mortgage in the future.

I can’t say enough good things about Corey and the DML team. We inquired about refinancing on a whim and Corey and her team did not disappoint! They communicated consistently and answered all my questions quickly. Very smooth transaction and overall an excellent experience. I have recommended Corey to several people and will continue to do so!

Corey and her team were with us every step up of the way. They worked diligently to make sure that we were able to have a quick closing (less than a month) and patiently guided us through the process of applying and securing necessary documents. Corey and her team responded promptly to our questions and ensured that we understood the process. During our interactions, they demonstrated professionalism but also were personable and seemed to be as excited as we were to buy our house. I highly recommend contacting Corey to assist you with your mortgage needs.

Corey was amazing...our Journey began 2 years ago. My credit score was poor and needed work. Corey kept in contact throughout, letting me know what was hurting my score and helped my husband and I get to where we needed to be to obtain a mortgage. I was a first home buyer and unfamiliar with the steps and process. Corey was amazing,patient and very informative answering all my questions. Today,after our 2 year journey, my husband and I closed on our first home!!!! Thank you so much to Corey and her team!! They are amazing, I would highly recommend her wether it be first home,or refinancing!! It has been a pleasure working with her!!(closing was pushed back some,but no fault to Corey and her team) Together with Corey and her team WE DID IT!!!

It was a pleasure working with Corey. She was so wonderful and gracious to me throughout the entire process. Corey was friendly, knowledgeable, and accessible. She kept me in the loop and was readily available when I reached out to her. Corey definitely helped to make my family and I home buying experience go smoothly. If you're looking for a great home buying experience I highly recommend her services to you.

Corey is great! She helped us with our mortgage for the purchase of our home. We could not have asked for a more responsive team! Every step of the way we received updates and always knew where our loan was in the process. We closed on time and without any issues. I definitely recommend Corey if you are looking for a mortgage professional!