Non QM Loan

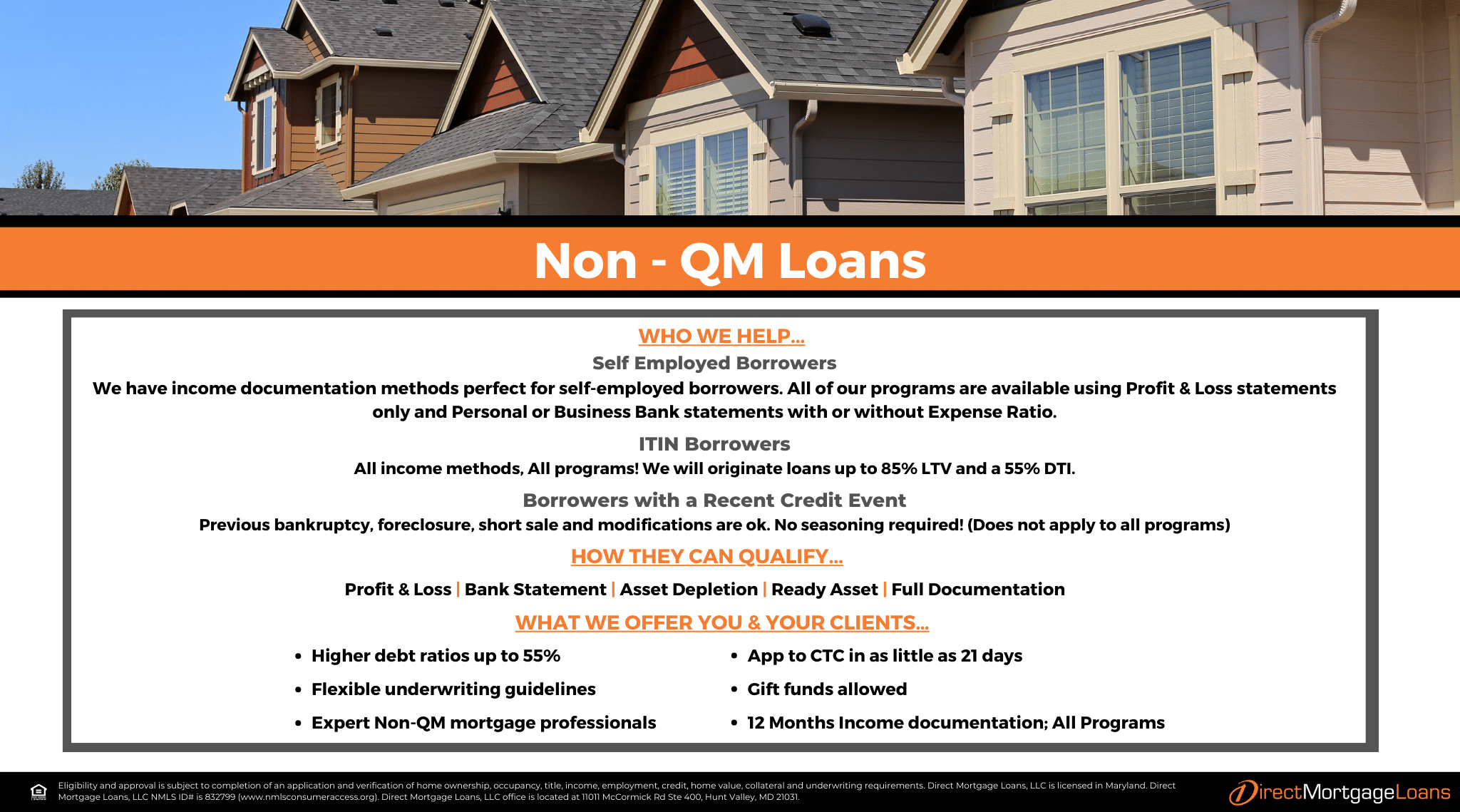

A non qualified mortgage loan is one that does not comply with the requirements set forth by the Consumer Financial Protection Bureau (CFPB) and/or the standards set by the federal government. Direct Mortgage Loans offers a variety of non qm loan products that provide advantageous benefits for our borrowers.

- Range of down payment options.

- Buyers with lower credit scores could qualify for a mortgage.

- Less stringent income documentation.

- Program types include Bank Statement, Investor Cash Flow, Asset Qualifier, ITIN, and more.

What is a Non QM loan?

A loan that fails to meet the Consumer Financial Protection Bureau’s (CFPB) criteria for a Qualified Mortgage (QM) is known as a non QM loan, which stands for non Qualified Mortgage.

Non QM loans are available to borrowers who may not meet the standard criteria for a traditional loan, such as having a higher debt-to-income ratio or a non-traditional credit history. Unlike traditional mortgages, these types of loans can be helpful for those who are self-employed, have variable income, or are looking to buy an investment property.

What are the benefits of a Non QM mortgage?

The benefits of a non QM loan may include:

- Flexibility: Non QM loans can be more flexible in terms of underwriting criteria, allowing for borrowers who may not meet the strict guidelines of a traditional mortgage to still be approved for a loan.

- Higher loan amounts: Non QM loans may offer higher loan amounts than traditional mortgages, allowing borrowers to finance more expensive properties, or to access larger amounts of financing.

- Faster approval process: Since non QM loans are often underwritten in-house by the lender, they may be approved more quickly than traditional mortgages, which could involve a longer approval process.*

- More options for self-employed borrowers: Non QM loans may be more accommodating to self-employed borrowers who may have difficulty proving their income through traditional means.

- Potential for lower rates: Since non QM loans are considered higher risk, they may come with higher interest rates, but in some cases, borrowers may be able to secure lower rates than they would with a traditional mortgage due to the flexibility of the loan terms.**

It’s important to note that non QM loans may come with higher interest rates, fees, and stricter repayment terms, so it’s important to carefully consider your options and work with a reputable lender to ensure you fully understand the terms of the loan.

Are Non QM loans safe?

The downside to non QM loans is that they may be more expensive and riskier than a traditional QM loan. Additionally, there may be more paperwork involved, and the terms of the loan may not be as favorable as with a QM loan.

Ultimately, it is important to consider all your options and to carefully evaluate the terms of any loan you are considering. If you are considering a non QM loan, for a smooth borrowing experience, find a reputable lender (like Direct Mortgage Loans) who can guide you through the loans’ advantages and disadvantages.

How do Non Qualified mortgage loans work?

Non QM loans are a type of alternative mortgage loan that is designed for borrowers who do not meet the typical requirements of a conventional loan. These loans are typically used by borrowers who are self-employed, have non-traditional forms of income, have a low credit score, or cannot provide the necessary documentation for a conventional loan.

Non QM loans are typically structured differently than conventional loans, and often require larger down payments and higher interest rates. These loans may also include additional fees such as a loan origination fee. The loan terms and conditions of a non QM loan will vary depending on the lender.

What are common Non QM mortgage loan programs?

Some common non QM loan programs include:

- Bank Statement Loans: These loans are designed for self-employed borrowers who have difficulty providing traditional income verification documents.

- Stated Income Loans: These loans allow borrowers to qualify based on their stated income, rather than their verifiable income.

- Alternative Documentation Loans: These loans allow borrowers to provide alternative forms of documentation, to qualify for a loan.

- Investor Cash Flow: These loans allow borrowers to use the cash flow on a home to qualify for an investment property.

How can I qualify for a Non QM loan?

To qualify for a loan from a non qualified mortgage lender, borrowers will typically need to meet certain requirements such as having a source of income, a minimum credit score, and the ability to make a down payment. Also, borrowers may need to provide additional documentation and financial records to prove their ability to repay the loan.

Non QM Loan Requirements

To be eligible for a non qualified mortgage loan, borrowers generally need to fulfill specific criteria based on the program they are applying for. Typically, borrowers must demonstrate a stable source of income, attain a minimum credit score, and make a down payment. Furthermore, borrowers may be asked to provide additional documentation and financial records to verify their capacity to repay the loan.

How To Apply For A Non Qualified Mortgage

- Connect with a lender: Contact a Direct Mortgage Loans Loan Officer to discuss your financing needs and start the process.

- Collect required documents: Before applying for a non QM loan, gather essential documentation such as proof of income, tax returns, and bank statements. Be prepared to provide additional documentation to verify your income and employment history.

- Submit your application: Start your loan application by filling out the necessary forms. You can apply easily (and securely) from your desktop or mobile phone using the DML App.

- Obtain pre-approval: After submitting your application, your loan officer will review your information and issue a pre-approval letter.*** This letter outlines the eligible loan amount, interest rate, and other key loan terms.

- Search for a property: With pre-approval in hand, begin searching for a property that suits your needs and budget. Work with a real estate agent to facilitate the process.

- Close the loan: Upon finding a suitable property and agreeing on the purchase price, the lender will conduct a final underwriting review and issue a loan commitment letter. Once received, proceed to close the loan and take ownership of your new home

How can I find Non QM mortgage lenders near me?

If you’re looking for non QM mortgage lenders near you, Direct Mortgage Loans offers a variety of non-qualifying loans, and our expert loan officers are well-versed in these programs. Simply connect with one of our mortgage lenders today!

FAQ’s About Non QM Lending

Do Non QM loans have higher interest rates?

Non QM loans usually have higher interest rates than traditional financing options. The reason for this is that these loans are perceived as riskier for lenders. Nevertheless, non QM loans may be more accessible for qualifying since factors beyond credit scores and income are also considered.

What credit score do you need for Non QM mortgages?

While the requirements may differ depending on the lender and program, generally, a higher credit score is needed for non-QM mortgages compared to conventional loans. Typically, the minimum credit score required ranges from 640 to 680 or higher.

Are Non QM loans more expensive?

Non QM mortgage products could be more expensive than traditional home loans due to their higher risk for lenders. Unlike conventional mortgages that are backed by Fannie Mae or Freddie Mac, or government-backed mortgages, there is a lack of guarantee, making them riskier for lenders. To compensate for this added risk, lenders may require higher down payments and interest rates. This may result in a higher overall cost for borrowers.

What is the difference between non conforming and Non QM?

Non conforming loans usually refer to mortgages that do not meet the standards of a conventional loan. On the other hand, non QM loans refer to non-qualified mortgages. In other words, these loans do not adhere to standard guidelines set by government-sponsored enterprises.

*When compared to turn times for conventional programs. Approval times may vary depending on individual circumstances.

**Rates are subject to market changes

*** Eligibility and approval is subject to completion of an application and verification of home ownership, occupancy, title, income, employment, credit, home value, collateral and underwriting requirements. Direct Mortgage Loans, LLC NMLS ID# is 832799 (www.nmlsconsumeraccess.com). Direct Mortgage Loans, LLC office is located at 11011 McCormick Rd Ste 400, Hunt Valley, MD 21031.