If you’re looking to buy a home or refinance, you’ll likely encounter a conventional loan. It’s a popular choice for many borrowers and can offer several benefits. Let’s delve into what a conventional loan entails, how it operates, and the qualifications needed to secure one.

What is a conventional loan?

Conventional loans are mortgages which are not insured or backed by the government and are available with either a fixed or adjustable interest rate. These loans are often considered conforming loans, which meet the down payment and income requirements set by Fannie Mae and Freddie Mac and conform to the loan limits set by the Federal Housing Finance Administration (FHFA).

Furthermore, while there may be stricter requirements to qualify compared to government-backed mortgages, conventional loans offer a range of down payment options, mortgage insurance flexibility, and less restrictive property guidelines.

How to qualify for a conventional loan?

If you are looking to qualify for a conventional loan, there are certain requirements that you must meet. These requirements may vary depending on the lender you choose. Review the list of requirements and connect with a loan officer to learn more about qualifying for a conventional loan.

Conventional Loan Requirements

To be eligible for a conventional loan, you need to fulfill the following requirements:

Down Payment

Conventional loans offer down payments ranging from 3% to 20%. The specific amount depends on your financial situation, loan type, and property. Here’s a breakdown:

- 3% Down Conventional Loan : Conventional loans that offer a 3% down payment are usually tailored for first-time buyers or individuals with lower incomes. There are several programs, including traditional Conventional 97% LTV Loan, Freddie Mac’s Home Possible Loan, and Fannie Mae’s Home Ready Loan, that require only a 3% down payment. Keep in mind that these programs might have income limits, credit score requirements, or property location restrictions.

- 5% Down Conventional Loan: If you are interested in a 5% down payment on a conventional loan, you can choose between a fixed or adjustable mortgage rate. Although private mortgage insurance (PMI) is required, you might be eligible for a lower interest rate in comparison to a 3% down payment option.

- 10% Down Conventional Loan: If you decide to make a down payment of just 10%, you may still be required to pay for Private Mortgage Insurance (PMI). However, in the long run, it will cost you less compared to making a down payment of only 5% or 3%.

- For conventional loans on a second home, you must make a down payment of at least 10%. Investment property mortgages, on the other hand, require a down payment of 15% or more.

- 20% Down Conventional Loan: Although it is no longer a requirement to have a 20% down payment for conventional loans, there are still advantages to making a substantial down payment. By putting down 20% or more, you can avoid paying for private mortgage insurance (PMI). Additionally, a larger down payment will lower your monthly mortgage payments and make you eligible for better loan terms, which could also help you save money in the long run.

Private Mortgage Insurance

Private mortgage insurance, or PMI, protects the lender if you default on your conventional loan when your down payment is less than 20% of the property value. The cost of PMI depends on your loan type, credit score, and the size of your down payment. Generally, a higher credit score and a larger down payment will result in a lower PMI premium. Once you reach 20% equity in your home, typically through a combination of rising home value and your monthly payments, you can request your lender to cancel PMI, reducing your monthly mortgage payment.

Credit Score

Your credit score demonstrates your financial responsibility to lenders. Typically, a minimum credit score of 620 is required to qualify, although this requirement can vary by lender. However, aiming for a higher score could help secure more favorable loan terms.

Debt-to-Income Ratio

This ratio shows how much of your monthly income goes towards debt (like car loans and student loans). A lower DTI is better because it shows lenders you have more income available to pay your mortgage. Most lenders prefer a DTI for conventional loans below 50%.

Loan Size

There’s a limit on how much you could borrow for a conventional conforming loan. This limit is set by The Federal Housing Finance Agency (FHFA) and depends on where you live. In most areas for 2024, the limit for a single-family home is $766,550, but it can be higher in expensive areas for conforming loans.

How To Get a Conventional Loan Pre Approval

Getting pre-approved for a conventional loan is a crucial first step in your homebuying journey. A pre-approval letter strengthens your offer, clarifies your budget, and helps to streamline the mortgage process. Here’s a breakdown of the steps involved:

- Assess your finances: Begin by reviewing your credit score and history to ensure you’re financially stable. Your credit score should be 620 or higher, so if it’s lower, focus on improving it before applying.

- Talk to a loan officer: Contact a loan officer who can guide you through the application process for conventional loan approval. During a free consultation, you can discuss your financial situation, goals, and any questions you may have about the process.

- Gather your documents: Collect important documents which serve to verify your financial stability. Recent pay stubs, tax returns, W-2’s, and bank statements are just a few of the documents you need to have easily accessible to streamline the application process.

- Submit an application: This involves providing personal information, financial documents, and authorization for a credit check. The lender will assess your creditworthiness, income, assets, and debt-to-income ratio (DTI) to determine how much you can afford to borrow.

Where to get a conventional loan?

Direct Mortgage Loans offers a diverse range of conventional loan products for purchase, refinance, renovating, manufactured and more. Get started by speaking with a loan officer to discuss which option is right for you.

Conventional Mortgage FAQ’s

What is the minimum down payment for a conventional loan?

The minimum down payment is 3%; however, you may be required to make a higher down payment depending on your credit score and other factors. Even if it’s not required, putting more money down could save you money on private mortgage insurance (PMI) and interest payments in the long run.

Are conventional loans assumable?

In most cases, conventional loans are not assumable. This means that if you are purchasing a house with a conventional mortgage, you will not be able to take over the seller’s existing loan. This is because conventional mortgage contracts normally include a “due-on-sale clause.” This clause grants the lender the right to demand full repayment of the loan if the property is sold.

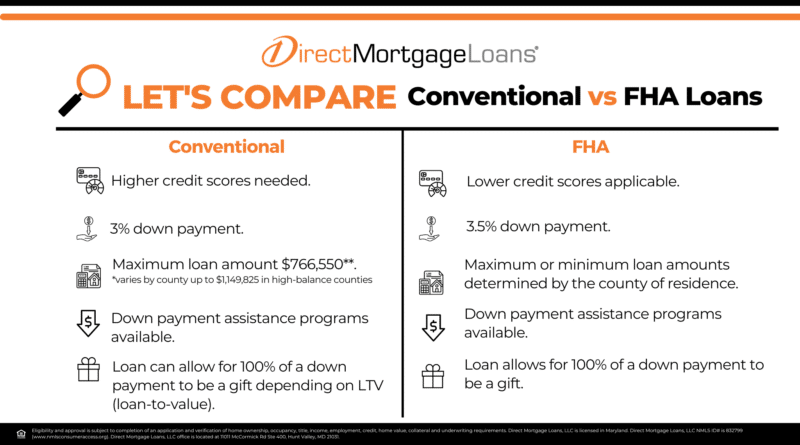

What is the difference between FHA and conventional loan?

FHA and conventional loans are two popular options for financing a home. Nevertheless, there are some key differences between the two which you should know about.

FHA loans are provided by lenders approved by the Federal Housing Administration and guaranteed by the government. These loans usually have more relaxed eligibility requirements compared to conventional loans, and FHA loans may require smaller down payments. However, you will need to pay Mortgage Insurance Premiums (MIPs) for at least 11 years, or the full term of the loan.

On the other hand, conventional loans are not backed by any government agency and may have stricter lending standards. They may require larger down payments than FHA loans, and if you provide less than 20% as a down payment, you will have to pay for private mortgage insurance (PMI). However, you can request your lender to cancel PMI when your balance reaches 80% of the original home value.

Can you get a conventional loan on a mobile home?

Yes, it is possible to get a conventional loan for a mobile or manufactured home through specialized programs offered by Freddie Mac and Fannie Mae. These programs are the Freddie Mac MH Advantage Program and the Freddie Mac conventional manufactured homes program. However, it is important to note that there are specific eligibility criteria that must be met to qualify for these loans.

Is a conventional loan better than FHA?

There is no correct answer as to whether a conventional loan is better than an FHA loan, as the choice depends on your financial situation. If you have good or excellent credit, a conventional loan is typically a better option. However, if you have a lower credit score, an FHA loan may be a better choice.

It is important to note that these are general guidelines, and the choice between a conventional loan and an FHA loan may differ depending on your specific financial situation. Therefore, it is best to speak with a Loan Officer to discuss the different loan types and select the one that best suits your needs.

Can you get down payment assistance with a conventional loan?

There are a variety of down payment assistance programs available for those who are interested in obtaining a conventional loan for purchasing a home. Two popular examples of such programs include the Fannie Mae HomeReady program and the Freddie Mac Home Possible loan.

These programs offer low down payment mortgages and relaxed credit score requirements to make homeownership more affordable and attainable. Additionally, if you are eligible, you may qualify for a conventional loan with a zero-down payment by combining it with a state’s down payment assistance program.

How many conventional loans can I have?

You can have multiple conventional loans, but Fannie Mae, a major conventional loan provider, will only allow you to finance up to 10 properties at a time. This includes your primary residence, vacation homes, and investment properties.

Eligibility and approval is subject to completion of an application and verification of home ownership, occupancy, title, income, employment, credit, home value, collateral, and underwriting requirements. Credit requirements and down payment minimums may change over time. Reach out to a mortgage professional to discuss current qualification requirements. Direct Mortgage Loans, LLC NMLS ID# is 832799 (www.nmlsconsumeraccess.org). Direct Mortgage Loans, LLC office is located at 11011 McCormick Rd Suite 400 Hunt Valley, MD 21031. Equal housing lender.