If you are a veteran, active-duty service member, or a surviving spouse, you may be eligible for a VA loan. A VA loan provides a variety of benefits which could help you purchase a home. This information will cover everything you need to know, including eligibility requirements, the application process, and the advantages and disadvantages of this loan.

What is a VA loan?

A VA loan is a flexible, zero down payment mortgage loan option, partially backed by the Department of Veterans Affairs. People utilize VA loans to purchase a primary property or refinance an already existing mortgage.

How does a VA home loan work?

VA home loans are intended to help veterans, active-duty service members, and eligible surviving spouses fulfill their dream of owning a home. While the Department of Veterans Affairs (VA) partially backs these loans, they are not directly issued by the VA. Instead, private lenders such as banks, credit unions, and mortgage companies, like Direct Mortgage Loans, offer them.

The main difference lies in the VA’s guarantee on a portion of the loan. This guarantee significantly reduces the risk for lenders, making them more willing to offer favorable terms to borrowers. For instance, no down payment is required, and no mortgage insurance is needed.

VA Loans Eligibility

To apply for a VA home loan, you’ll need a Certificate of Eligibility (COE) verifying your military service history. This document helps lenders confirm you meet the eligibility requirements.

- Served 90 consecutive days of active service during wartime.

- Served 181 consecutive days of active service (not during wartime).

- Have 6 years of service in the National Guard or Reserves.

- A spouse of a service member who passed away during duty or a service-related disability.

There are also additional factors that could qualify you for VA loans:

- Vietnam Era Service: Served on active duty between October 17, 1981, and August 1, 1990.

- National Guard/Reserves with Title 32 Service: Served for at least 90 cumulative days, with 30 days consecutively, under specific Title 32 sections.

- Disaster Relief: Veterans impacted by a presidential disaster declaration may be eligible for special VA loan considerations.

VA Loan Qualifications

Once you have confirmed your eligibility, you will need to gather important information and documents to submit to receive the Certificate of Eligibility (COE). Below is a breakdown of the specific requirements based on your qualifying status:

How To Request VA Home Loan Certificate of Eligibility

You can request a Certificate of Eligibility (COE) for a VA home loan online or by mail. Complete VA Form 26-1880 on the VA website or download the form and mail it to the address listed on the last page of the form.

How to Apply for a VA Home Loan

If you’re eligible and looking to apply for a VA home loan, there are some general steps to take. Here’s a breakdown of the application process:

Step 1: Find a VA-approved lender

The first step is to find a loan officer approved by the Department of Veterans Affairs for issuing VA loans. You can find this information on most lenders’ websites. At Direct Mortgage Loans, we offer VA loans to those who meet the eligibility criteria.

Step 2: Obtain a Certificate of Eligibility (COE)

For pre-approval, we will need your certificate of eligibility. This information will verify your eligibility for a VA loan based on your service history. Typically, this will take only a few minutes and can be done online through the VA’s eBenefits portal.

Step 3: Apply for a VA home loan

Following steps one and two, you will now apply for a home loan. During the application process, your lender will verify your income, credit, and employment using the VA financing requirements. Typical documents that we will need are:

- Tax returns

- W-2s (past 2 years)

- Pay stubs

- DD214

- Rental history

- Employment verification

- Driver’s license

Step 4: Find a Home

Finally, you are now ready to shop for your dream home with a real estate agent. When you have found a home you like, submit an offer. If your offer is accepted, then your lender will issue you a loan estimate and start the loan approval process.

Contact A Certified VA Loan Officer Near You!

Veteran Loan Benefits

As an eligible recipient of a VA Loan, you can receive several benefits by using this loan product.

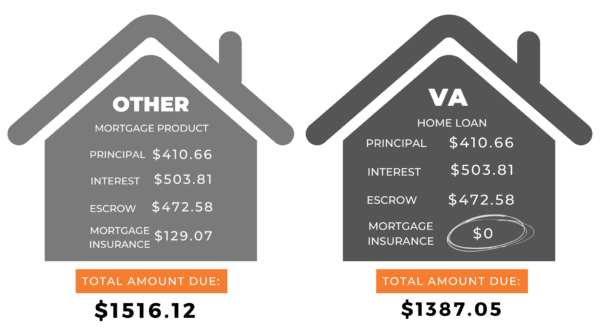

- 100% Financing and No Mortgage Insurance

- You can finance 100% of the loan with no mortgage insurance. This can save you hundreds of dollars per month compared to a Conventional loan. You can also finance 100% with a cash-out refinance.

*The VA Funding Fee is financed into your loan amount, impacting your monthly mortgage payment. This fee serves as insurance and is included in your loan.

- Debt Ratio Flexibility: VA loans offer flexibility compared to conventional loans. This means that even if your current debt is high, you may still qualify for a VA loan. This could make it easier for you to own a home.

- Relaxed Home Eligibility: Your VA benefits could be used for different types of housing, such as condos which meet VA guidelines and certain manufactured homes.

- Possible Funding Fee Waived: If you have a VA disability rating of 10% or more, you may not have to pay the one-time VA funding fee when getting a VA loan. This can help lower your upfront costs.

- Streamlined IRRRL Refinance Process: With a VA loan, the IRRL refinance process could offer a lower funding fee of 0.5%, and is available to eligible veterans, regardless of how long they have served or if they have previously used a VA loan. Additionally, you may not need appraisals or income verification for the refinance process.

Why would you use a veteran home loan?

As a qualified veteran, active duty member, or eligible spouse, you have earned VA housing benefits that include: no down payment, no monthly mortgage insurance. Here are some reasons why someone might choose to use a VA loan:

- You’re a veteran or active-duty military member: VA loans are specifically designed for current and former members of the military and their families. If you’re eligible for a VA loan, it can be a great way to finance your home purchase.

- You want to buy a home with no down payment: VA loans offer 100% financing, which means you can buy a home without making a down payment. This can be a huge advantage, especially for first-time homebuyers who may not have a lot of money saved up.

- You want a competitive interest rate: VA loans typically offer lower interest rates than conventional loans. This can save you a significant amount of money over the life of your loan.

- You have a less-than-perfect credit score: VA loans have more lenient credit requirements than conventional loans. If you have a lower credit score, a VA loan may be a good option.

You want to refinance an existing VA loan: If you already have a VA loan, you may be able to refinance it through the VA’s Interest Rate Reduction Refinance Loan (IRRRL) program. This can lower your interest rate and monthly payment.

It’s important to note that VA loans come with some requirements, such as a funding fee, that can add to the cost of your loan. However, the benefits of a VA loan can outweigh the costs for many borrowers. Be sure to consult with a mortgage professional to determine whether a VA loan is right for you.

Refinancing VA Mortgage

When you refinance a VA mortgage, you have two main options. The first option is a VA Streamline Refinance (IRRRL). This allows homeowners to replace their existing VA loan with a new VA loan with a lower interest rate. The process typically involves less paperwork and is faster than standard refinancing.

The second option is a VA Cash Out Refinance. With this option, you could tap into your home equity and receive a new loan that is higher than your current balance. The extra money is given to you in cash and can be used for things like consolidating debt, making home improvements, or other needs.

If you have an investment loan, contact your lender about streamlining the investment property. This could reduce your monthly payment, save you money, and increase your profit margin.

Learn More About Refinancing

The Advantages and Disadvantages of VA Loans

A VA loan could be a great option for eligible borrowers. However, as with any mortgage loan option, there are both advantages and disadvantages which should be considered before deciding. By examining the pros and cons of VA loans listed below, you’ll be better equipped to make a beneficial decision for your individual situation.

Advantages of VA Loans

- There’s No Down Payment Required: VA loans do not require a down payment, unlike FHA and conventional loans, which typically require at least 3.5% to 5% down.

- It Doesn’t Require Private Mortgage Insurance: Private Mortgage Insurance (PMI) is an additional monthly cost on conventional loans for borrowers who put down less than 20%. VA loans eliminate this expense, which could help you save on your overall monthly payment.

- Benefit Never Expires: If you qualify for a VA home loan, you can use this benefit at any time, regardless of when you served, if you meet the eligibility requirements.

- Credit Score Flexibility: The Department of Veteran Affairs does not require a minimum credit score. Instead, lenders consider your entire financial profile, including debt-to-income ratio and credit history, which could be beneficial for veterans who may not have a perfect credit score.

- No Prepayment Penalty: Borrowers can pay off their mortgage early or make extra payments without having to pay any prepayment penalties.

Disadvantages of VA Loans

- Only for Primary Residences: VA loans can only be used to finance primary residences, not vacation homes, investment properties, or non-primary residence refinancing.

- Upfront VA Funding Fee: The VA Funding Fee is an upfront fee the borrower must pay to help keep the program operational. This fee adds to the upfront costs of purchasing a home, so it’s important to consider this when budgeting for your home purchase.

- Limited Eligibility: This loan is only for active-duty service members, veterans and surviving spouses. This means the program is limited to these applicants and is not available to everyone.

How do I find the best lenders for VA loans?

When looking for the best lender for VA Loans, the most important factor is to ensure that the lender is VA approved and has experience in assisting military borrowers through the process. Furthermore, Direct Mortgage Loans is a VA approved lender with extensive experience to ensure that you get the most from your home loan benefits.

*By refinancing your existing loan, total finance charges may be higher over the life of your loan. Rates are subject to creditworthiness and eligibility. Eligibility and approval is subject to completion of an application and verification of home ownership, occupancy, title, income, employment, credit, home value, collateral and underwriting requirements. Direct Mortgage Loans, LLC NMLS ID# is 832799 (www.nmlsconsumeraccess.org). Direct Mortgage Loans, LLC office is located at 11011 McCormick Rd Suite 400 Hunt Valley, MD 21031. Equal housing lender.*