A VA loan is a great opportunity, but there’s a lot about a VA loan that often gets misunderstood. In this article, we’re going to go through all of the ins and outs of VA home loan facts, to create a guide to buying a home with a veteran loan.

We hope that the following pages will reveal the inner workings of veteran loan benefits and facts, making this the only veteran home loan guide you’ll ever need.

What is a VA loan and how does it work?

A VA loan is a flexible, $0-down payment mortgage loan option, partially backed by the Department of Veterans Affairs. People utilize VA loans to purchase a primary property or refinance an already existing mortgage.

After you assure you are eligible and have the certificate, you will have to get pre-qualified. For this, you need to find a certified VA lender and receive an estimate on how much of a house you can afford.

Following, you will have to get pre-approved. This is a very significant step in the loan process. Your lender will verify your information to give a final decision on your purchasing capabilities. As a result of verification, you will be issued a preapproval letter which puts you in a more advantageous position when buying a home.

Once you are ready to submit an offer, you will work with your agent to put in a competitive offer on the home.

Here is where the process deviates from a conventional loan as you’ll need to go through the VA appraisal and underwriting processes. The VA appraisal will assure that the home meets the VA’s minimum property requirements. In accordance, if the underwriters determine everything is favorable, you will be clear to close your loan.

As a result, you will close on your home loan. From there your lender will guide you through the paperwork and documents needed to complete.

VA Loan Eligibility

Before requesting a VA Home Loan Certificate of Eligibility, ensure that you are truly eligible for this type of loan product. There are a few circumstances that qualify you for a VA loans:

- Served 90 consecutive days of active service during wartime.

- Served 181 consecutive days of active service (not during wartime).

- Have 6 years of service in the National Guard or Reserves.

- A spouse of a service member who passed away during duty or a service-related disability.

There are also additional factors that could qualify you for VA loans:

- Served from November 1, 1955 (Vietnam War Era).

- A service member or Veterans mobilized to perform full-time National Guard duty for not less than 90 cumulative days, including at least 30 days consecutively.

- A veteran, service member, or certain surviving spouse with VA-guaranteed home loans in areas that the President declares are major disasters and your residence has substantial damage. With this, you are now eligible to a first time use funding fee charge on a new VA-guaranteed loan rather than a subsequent use funding fee. The new VA-guaranteed loan must be for the repair or construction of the dwelling and closed within three years of the presidential declaration of the disaster.

If any of the above applies to you, you are eligible for a VA loan.

Requesting a VA Home Loan Certificate of Eligibility

First things first, you will need to come prepared. It is important to gather the information you will need to receive this certificate depending on your status. Here is a breakdown of what you need for each qualifying status:

How To Request COE

Once you are prepared, you will have to request the Certificate of Eligibility (COE). You can request this by going online or, by filling out Request for a Certificate of Eligibility (VA Form 26-1880) and mailing it to the address on the form.

How to Apply for a VA Home Loan

VA loans have many benefits that are difficult to match. These government-backed loans have no down payments, no private mortgage insurance, and low interest rates.

If you are an active-duty service member, a veteran, a member of the National Guard, or the surviving spouse of a service member, you may be eligible for a VA loan. To understand how to apply for a VA home loan, keep reading.

Step 1: Find a VA-approved lender

The first step is to find a loan officer that the Department of Veterans Affairs approves for issuing VA loans. You can find this information on most lenders’ websites. At Direct Mortgage Loans, we can offer VA loans to those who meet the eligibility criteria.

Step 2: Obtain a Certificate of Eligibility (COE)

For pre-approval, we will need your certificate of eligibility. This information will verify your eligibility for a VA loan based on your service history. Typically, this will take only a few minutes and can be done online through the VA’s eBenefits portal.

Step 3: Apply for a VA home loan

Following steps one and two, you will now apply for a home loan. During the application process, your lender will verify your income, credit, and employment using the VA financing requirements. Typical documents that we will need are:

- Tax returns

- W-2s (past 2 years)

- Pay stubs

- DD214

- Rental history

- Employment verification

- Driver’s license

Step 4: Find a Home

Finally, you are now ready to shop for your dream home with a real estate agent. When you a home you like, submit an offer. If your offer is accepted, then your lender will issue a loan estimate. All you have left is the underwriting and approval process.

Find A Certified VA Loan Officer Near You!

What are the benefits of using a VA Loan?

As an eligible recipient of a VA Loan, you can receive several benefits by using this loan product.

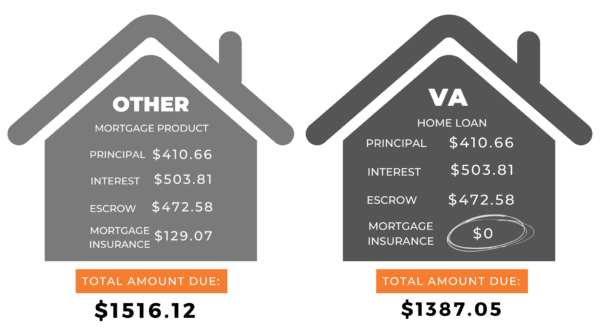

- 100% Financing and No Mortgage Insurance

- You can finance 100% of the loan with no mortgage insurance. This can save you hundreds of dollars per month compared to a Conventional loan. You can also finance 100% with a cash-out refinance.

- Debt Ratio Flexibility

- There is flexibility on debt ratios unlike other mortgage products.

- Relaxed Home Eligibility

- Home eligibility for a VA loan include stick-built houses, condos, or even manufactured homes.

- Possible Waived Funding Fee

- If you are a disabled veteran, your funding fee could be waived.

- If you are over 10% disabled through the VA, you are considered exempt of the funding fee for VA mortgages.

- The funding fee for the IRRRL is reduced to .5% regardless of service history or prior usage. The VA does not require an appraisal or income verification for the IRRRL, thus making the refinance process streamlined.

- No Loan Amount Caps

- Currently, there is no cap on loan amounts, so you could use your VA loan for a jumbo loan amount. *As of May 2021. This is dependent on veteran loan entitlement and county loan limits.

Why would you use a VA loan?

As a qualified veteran, active duty member, or eligible spouse, you have earned VA housing benefits that include: no down payment, no monthly mortgage insurance. Here are some reasons why someone might choose to use a VA loan:

- You’re a veteran or active-duty military member: VA loans are specifically designed for current and former members of the military and their families. If you’re eligible for a VA loan, it can be a great way to finance your home purchase.

- You want to buy a home with no down payment: VA loans offer 100% financing, which means you can buy a home without making a down payment. This can be a huge advantage, especially for first-time homebuyers who may not have a lot of money saved up.

- You want a competitive interest rate: VA loans typically offer lower interest rates than conventional loans. This can save you a significant amount of money over the life of your loan.

- You have a less-than-perfect credit score: VA loans have more lenient credit requirements than conventional loans. If you have a lower credit score, a VA loan may be a good option.

You want to refinance an existing VA loan: If you already have a VA loan, you may be able to refinance it through the VA’s Interest Rate Reduction Refinance Loan (IRRRL) program. This can lower your interest rate and monthly payment.

It’s important to note that VA loans come with some requirements, such as a funding fee, that can add to the cost of your loan. However, the benefits of a VA loan can outweigh the costs for many borrowers. Be sure to consult with a mortgage professional to determine whether a VA loan is right for you.

VA Refinancing

Refinancing your home allows you to pull cash from your home’s equity for your own purposes. Examples: Pay off debts, make improvements to your home, pay for your child’s education, buy a Harley, etc.

Additionally, VA refinancing offers great options for energy efficient improvements. You could borrow up to 103% of the value of the property for energy improvements. Examples: If you need a new heater, windows, etc.

Already have a great VA Home Loan rate? We have interest rate reduction loans to ensure you are getting the best loan possible. This requires limited documentation and can be done with no money out of pocket. VA refinances are called I.R.R.R.Ls (Interest Rate Reduction Refinance Loan) for short.

Notes: On a VA Streamline Home Loan, you cannot pull cash-out from the proceeds. Additionally, you don’t have to occupy the property to refinance. VA Streamlines are very limited on closing costs. In some instances, your new loan amount is just about the same as your payoff.

If you have an investment loan, contact your lender about streamlining the investment property. This could reduce your monthly payment, save you money, and increase your profit margin.

Learn More About Refinancing

The Advantages and Disadvantages of VA Loans

For eligible veterans, active-duty members, or qualifying spouses, VA loans can be a great option with many advantages. However, as with any mortgage loan option, there are potential disadvantages that should be considered before making a decision. By examining the VA loan pros and cons listed below, you’ll be better equipped to make a beneficial decision for your individual situation.

Advantages of VA Loans

- There’s No Down Payment Required

- This is one of the biggest advantages of a VA loan. VA loan applicants can borrow as much as a lender is willing to lend while putting $0 down. Other loans, like FHA loans, will usually require a minimum down payment amount of 3.5 percent. One of the main benefits of a VA loan is that VA loan applicants can borrow as much as a lender is willing to lend while putting $0 down. Other loans, such as FHA loans, typically require a minimum down payment of at least 3.5%.

- It Doesn’t Require Private Mortgage Insurance

- Typically other common loans will require private mortgage insurance when a borrower does not put 20% down at closing. However, VA loans never require private mortgage insurance, no matter the 0% down payment. Other common loans will require private mortgage insurance when a borrower doesn’t put 20% down at closing. However, VA loans never require private mortgage insurance, regardless of the 0% down payment.

- Credit Score Flexibility (no min. score & lower interest rates)

- Another pro is that the Department of Veterans Affairs does not set a minimum credit score for the VA loans it guarantees. This assures that lenders assess the full profile of the applicant rather than basing qualification on minimum credit score requirements. Another advantage of the VA loan program is that the Department of Veterans Affairs does not establish a minimum credit score for loans guaranteed by the department. This ensures that lenders will base the full profile of the applicant when making a decision, versus basing qualification on minimum credit score requirements.

- There’s No Prepayment Penalty

- With VA loans, the borrower has the freedom to pay off the mortgage early or make additional payments without the possibility of being penalized for it. Again, with FHA and conventional loan products, prepayment penalties are a possibility. For VA loan borrowers, this can help with saving money in the long run. VA loans offer borrowers the freedom to pay off their mortgage early or make additional payments without being penalized for it. For VA loan borrowers, this can help save money in the long run, as opposed to FHA and conventional loans which may charge prepayment penalties.

Disadvantages of VA Loans

- It’s Only for Primary Residences

- VA loans are intended for borrowers buying primary residence homes only. Therefore, if you are looking to buy a second home or investment property, this loan option is not applicable. The VA loan is not intended for borrowers looking to purchase second homes or investment properties; this loan is meant only for those buying primary residences.

- A VA Funding Fee Is Required Upfront

- The VA Funding Fee is a common fee VA borrowers will be required to pay upfront. This helps keep the program up and running. The VA has announced they will be reducing their VA funding fee for all loans closing on or after April 7th, 2023.

- It’s Limited to Those Who are Eligible

- Obviously, a con of this loan product is that it is only applicable for veterans and their spouses. This means that there is limited eligibility and that the program is not open for many borrowers. The fact that this loan product is only available to those who meet the VA loan eligibility conditions is obviously a disadvantage. This means that the program has a limited pool of applicants and is not available to all borrowers.

*Rates are subject to creditworthiness and eligibility. Eligibility and approval is subject to completion of an application and verification of home ownership, occupancy, title, income, employment, credit, home value, collateral and underwriting requirements. Direct Mortgage Loans, LLC NMLS ID# is 832799 (www.nmlsconsumeraccess.org). Direct Mortgage Loans, LLC office is located at 11011 McCormick Rd Suite 400 Hunt Valley, MD 21031. Equal housing lender.*