What is a Fixed-Rate Mortgage?

A fixed-rate mortgage simply means the home loan has a set rate for the entire term of the loan. The most common fixed-rate mortgages are 15-year and 30-year loans, and while both of their interest rates are fixed over their lifetimes, they each offer different advantages and disadvantages for homebuyers.

What’s the difference between a 15-year mortgage and a 30-year mortgage?

The main difference between the two is the length of the mortgage term. For example, a 15-year mortgage will be paid off quicker in return for higher monthly payments. On the other hand, a 30-year mortgage is paid off slower with smaller monthly payments.

Comparing a 15 year vs 30 year Mortgage

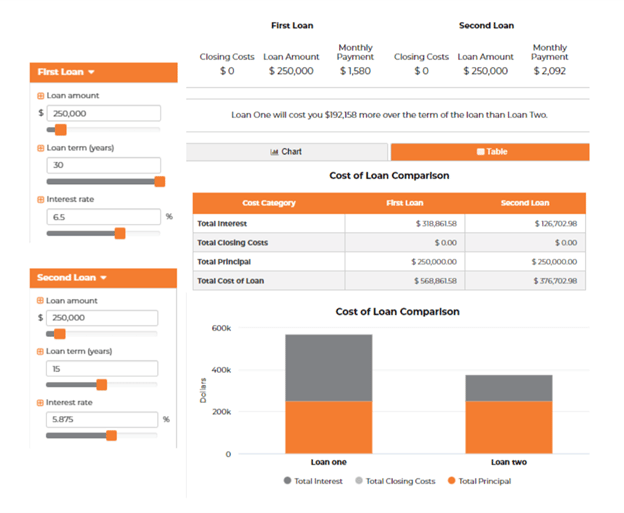

To better understand the difference between the two mortgage loans, let’s look at an example using Direct Mortgage Loans’ mortgage calculator! Suppose you want to purchase a $250,000 home loan and want to figure out which mortgage would be cheaper to pay off in the long run. Based on the calculation, the 15-year mortgage would be cheaper than a 30-year mortgage in terms of the total cost of the loan. Specifically, over the life of the 30-year loan, it would cost you $192,158 more than a 15-year loan. Although you will save more over the life of the loan, don’t let the possibility of a lower interest rate stop you from getting what you can comfortably afford!

Is it cheaper to pay off a 30-year mortgage in 15 years?

In that case, your 30-year mortgage would be cheaper, because you will be saving yourself 15 years of interest payments over the course of the loan. However, doing that is not really any different from choosing a 15-year mortgage in the first place.

What are the pros and cons of getting a 15-year mortgage versus a 30-year mortgage?

When can 15 be more than 30? When it leaves more money in your pocket! Most people choose a 30-year fixed-rate loan to finance their homes, but a 15-year fixed-rate mortgage can offer many of the same benefits while saving you interest expenses. Here are some of the advantages of choosing a 15-year mortgage.

- Lower interest rate than 30-year fixed mortgages.

- Lower total cost of interest over the life of the loan.

- Builds home equity faster.

- You could own your house faster.

What are the advantages and disadvantages of a 30-year mortgage?

Taking out a 30-year mortgage may seem like a long-term commitment, but it offers many advantages especially if you plan to live in your home for many years to come. Here are some advantages that make this mortgage the most popular option for financing a home:

- Lower monthly payments compared to a 15-year mortgage.

- Offers stability with monthly payments and any unforeseen expenses.

- It could create space in your budget to qualify to buy a more expensive home.

- More cash flow for investing, retirement, renovations, etc.

On the contrary, make sure you’re aware of the disadvantages that come along with this type of mortgage.

- The interest rate could be higher compared to a 15-year mortgage.

- Pay more in interest over the life of the loan.

- Slow growth in home equity.

Is it better to get a 15-year mortgage or pay extra on a 30-year mortgage?

In the long run, a 15-year mortgage could save you a lot of money. However, if you lose your job or your income changes, your higher monthly payment could cause financial hardship compared to a 30-year mortgage. This is just one factor to consider before deciding which loan option is best for you. Use our Home Affordability Calculator to determine how much you can comfortably afford to help guide your decision!

What is a disadvantage of getting a 15-year mortgage instead of a 30-year mortgage?

Although there are some great benefits to a 15-year mortgage there are some drawbacks to be aware of before deciding if this loan option is right for you.

- Higher monthly mortgage payments compared to a 30-year mortgage.

- Less cash left over for emergency funds, investments, and other expenses.

- This may result in a smaller budget for the home purchase.

Is it worth paying extra on a 15-year mortgage?

Your specific situation ultimately determines the answer. Paying off your mortgage early may end up saving you thousands of dollars. However, before you consider doing this, it’s important to be aware of the following: when you should pay off your mortgage early and when it’s best to avoid it!

If you already have enough money to pay off your mortgage payment and any other expenses, it may be smart to consider contributing some extra payments to your mortgage. The more you put towards the additional payment, the quicker you will pay off the loan, save money on interest, and shorten the loan term. Keep in mind, an extra payment doesn’t have to be a large amount. For example, even contributing $40 extra a month will draw in some major savings. Don’t assume a crazy amount extra is necessary to contribute. All in all, make sure you have a good 6 months’ worth of liquid savings on hand and are comfortable paying off other expenses before considering paying more towards your mortgage.

If you have additional debt to repay, it may be best to skip paying off your mortgage early. Many times, student loans, credit card debt, etc. have higher interest rates than mortgage loans. This means that you should focus on paying those down before you consider paying more on your mortgage. Paying your mortgage off early, especially if you have other debt to worry about, could be more costly in the long run. Examine your financial statements and budget to determine what is right for you.

Leave A Comment

You must be logged in to post a comment.