When buying a home, understanding the role of a mortgage preapproval is key to a smooth and successful journey. Preapproval provides a clear idea of your budget and also demonstrates to sellers that you’re a serious buyer. However, preapprovals don’t last forever. Knowing how long they’re valid, and what to do if they expire could make all the difference in your home-buying experience. This article answers your questions about preapprovals, extensions, and next steps to ensure you’re always prepared.

Subscribe to our blog to receive notifications of posts that interest you!

What is a home loan preapproval?

A home loan preapproval is a mortgage lender’s confirmation of how much you could borrow based on your financial information, such as credit score, income, and debt. It’s an essential first step in the home-buying process, as it shows sellers you’re a serious buyer with financing already in place. Getting preapproved is a simple process that Direct Mortgage Loans could help you get started with today!

Preapproval vs Prequalification

When starting your home-buying journey, you may come across the terms “preapproval” and “prequalification.” While both involve assessing your financial readiness for a mortgage, they serve different purposes and carry varying levels of credibility. Understanding the distinction between these two processes could help you decide which one is right for your needs.

Preapproval

A preapproval involves a detailed review of your finances. Lenders verify your income, assets, and credit score to determine your loan eligibility. The process results in a preapproval letter, which could strengthen your offer when shopping for a home.

Prequalification

Prequalification, on the other hand, is less formal. It’s typically an estimate of what you may qualify for, based on self-reported financial information. While it’s quicker to learn your prequalification, it doesn’t hold the same weight as a preapproval.

What is a preapproval letter?

A preapproval letter is a document from your lender stating the amount you’ve been approved to borrow. It’s valid for a limited time and is often required by sellers to consider your offer. Think of a preapproval letter as your ticket to entering the housing market with confidence.

When should you get preapproved for a mortgage?

Timing matters when getting preapproved. Ideally, you should seek preapproval before starting your home search. This ensures you know your budget and can act quickly when you find the perfect property. Preapprovals do have an expiration date, so it’s best to start the process when you’re ready to seriously shop.

How long does it take to get a preapproval for a mortgage?

Getting a mortgage preapproval could take anywhere from one day to a week, depending on how quickly you can provide necessary financial documents for review. Mortgage lenders typically review your credit report, income statements, and other financial details during this time.

How long are preapprovals good for?

Mortgage preapprovals are generally valid for 60 to 90 days. This timeframe allows lenders to ensure your financial information remains accurate and relevant. If your preapproval expires, you’ll need to reapply, which may require updated documents and a new credit check. It’s wise to stay in touch with your lender to keep track of the expiration date and any necessary steps. Working with a lender like Direct Mortgage Loans allows you to stay updated through each step of the loan process.

Can a preapproval be extended?

Yes, preapprovals can often be extended. If your home search takes longer than expected, your lender may allow an extension. You’ll likely need to update your financial information, such as recent pay stubs or bank statements, to confirm your ongoing eligibility. Extensions are typically granted on a case-by-case basis.

What happens if my mortgage preapproval expires?

If your preapproval expires, you’ll need to reapply. This involves resubmitting financial documents and undergoing another credit check. Expired preapprovals don’t mean you’re ineligible but may reflect changes in your financial situation or the housing market. It’s crucial to act promptly if your preapproval lapses to avoid disruptions in your home-buying journey.

Home Loan Preapproval FAQ’s

How soon should you get preapproved for a mortgage?

It’s best to get preapproved when you’re ready to actively search for a home, ensuring your approval doesn’t expire prematurely.

Can I put an offer on a house without preapproval?

While it’s possible, most sellers prefer buyers with preapproval as it demonstrates financial readiness and seriousness. Partnering with Direct Mortgage Loans could help you understand exactly what you could afford, no matter what your current stage is in the homebuying process.

Can you be denied a mortgage if you are preapproved?

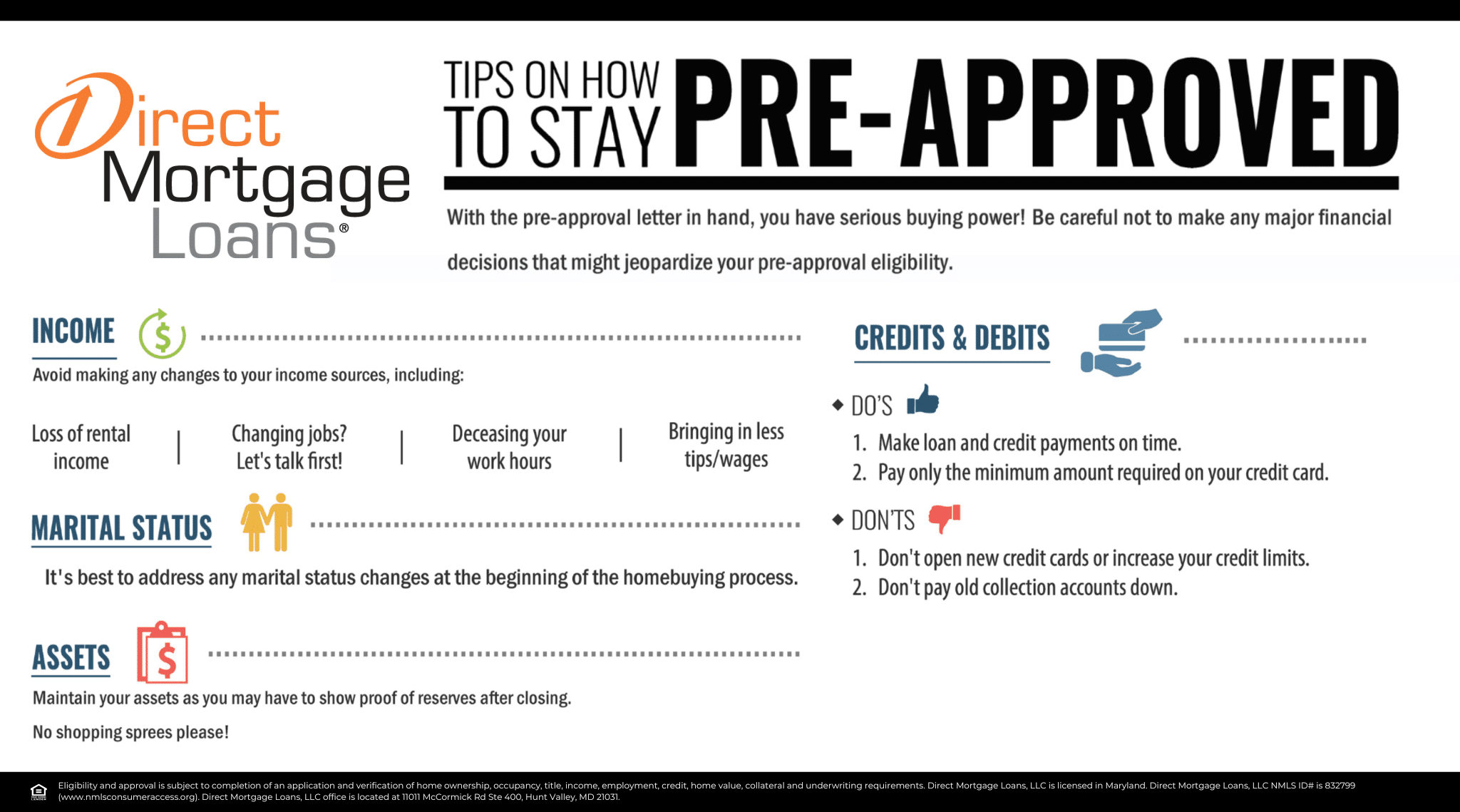

Yes, even with a preapproval, your mortgage could still be denied during the final underwriting process. Preapproval is based on the financial information provided at the time, but lenders perform a more thorough review before officially approving the loan. If your financial circumstances change—such as taking on new debt, losing your job, or a decrease in credit score—it could affect your ability to qualify. To avoid this, maintain financial stability during the home-buying process and keep your lender informed of any significant changes.

Does mortgage preapproval affect credit score?

Getting preapproved for a mortgage involves a hard inquiry on your credit report, which could temporarily lower your credit score by a few points. However, the impact is typically minor and short-lived. If you’re shopping for a mortgage and multiple lenders check your credit within a short period (usually 14-45 days, depending on the scoring model), these inquiries are generally counted as one. Remember, maintaining healthy financial habits during this time will help offset any minor dip caused by the inquiry.

What is stronger than a preapproval letter?

A loan commitment letter is stronger than a preapproval letter. While preapproval confirms your eligibility based on a preliminary financial review, a loan commitment indicates the lender has fully reviewed your financial profile and approved you for a specific loan amount. This commitment typically comes after underwriting and is only contingent on the property meeting certain conditions, such as appraisal value. For sellers, a loan commitment offers greater assurance that the transaction will close, making your offer even more competitive.

Leave A Comment

You must be logged in to post a comment.