What is a mortgage commitment letter?

A mortgage commitment letter is a formal document issued by the lender to confirm the approval of a loan. It is given to the borrower after successfully completing the pre approval process and undergoing a thorough review by the underwriting team. This letter provides information to the borrower regarding the estimated mortgage amount that the lender is likely to approve. It serves as evidence of the borrower’s creditworthiness and demonstrates their commitment as a serious home buyer. This document can be presented to real estate agents and home sellers to showcase the borrower’s financial credibility and readiness to proceed with the home purchase.

Subscribe to our blog to receive notifications of posts that interest you!

Different Types of Mortgage Loan Commitment Letters

Conditional Commitment Letter

A conditional mortgage approval letter is the most frequently encountered form, which signifies that you have been conditionally approved. Moreover, it means that the conditions laid out by the underwriter must be met before a clear to close can be issued*. These conditions can vary depending on the lender’s policies and state laws. Here are a few common conditions that you can expect:

- Lender’s Name

- Borrower’s Name

- Preapproval Statement

- Loan Type

- Loan Amount

- List of Conditions for Final Approval

- Validity Period of Pre approval

Clear To Close

A final mortgage commitment (also known as clear to close) happens when all the loan conditions are fulfilled, and the lender assures to lend you the designated amount. This letter usually includes the following details:

- Lender’s name

- Borrower’s name

- Property address if an offer has already been made

- Statement of approval for loan

- Type of loan

- Loan amount

- Loan term

- Interest rate

- Date of commitment

- Rate lock expiration date

- Commitment expiration date

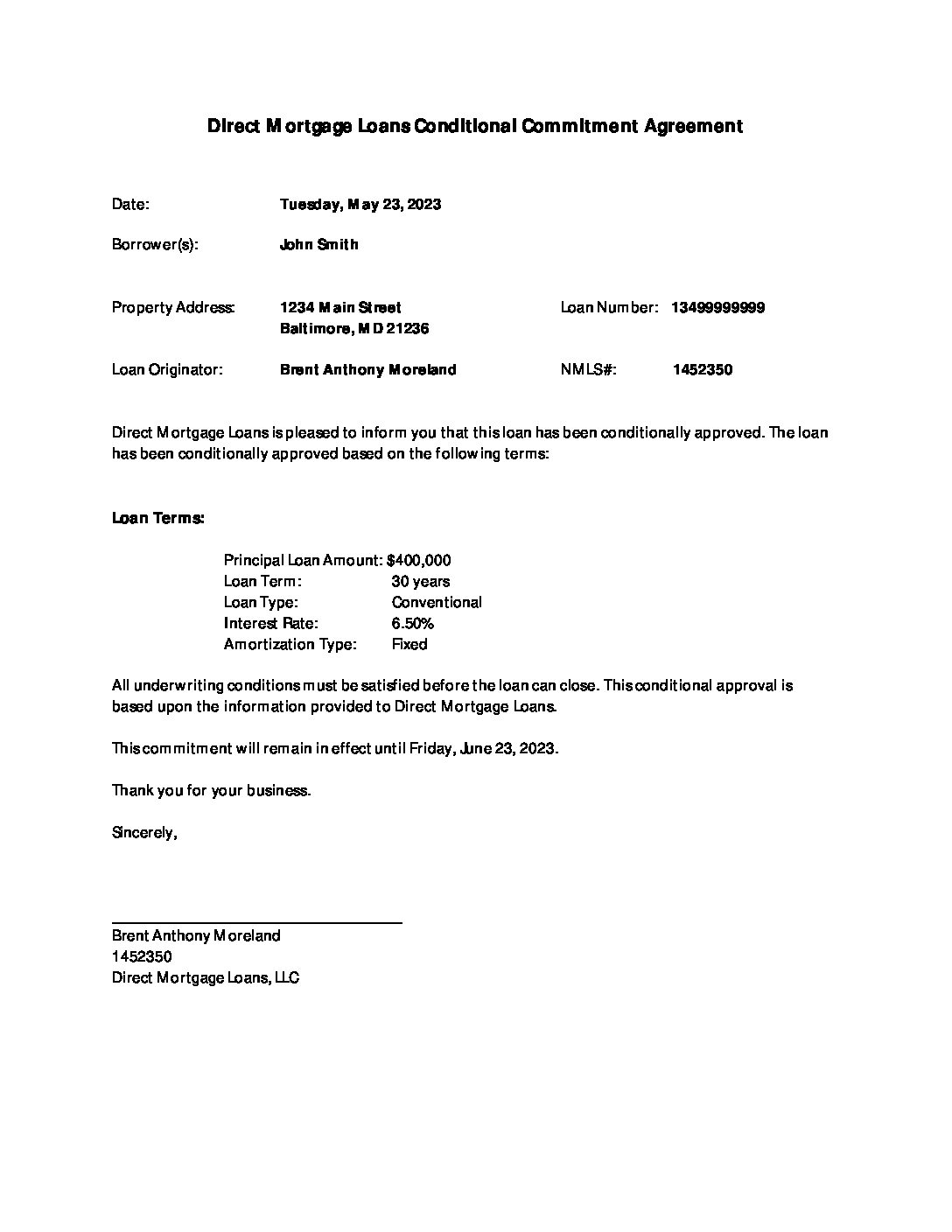

Commitment Letter Sample

Although mortgage commitment letters may differ slightly from lender to lender, they typically contain similar key information. A sample commitment letter is provided below.

How and when do you get a mortgage commitment letter?

To obtain a mortgage commitment letter, you must go through the mortgage application and approval process. This involves submitting an application, providing documentation, and thoroughly reviewing your financial situation and credit history. Once your application is approved, you will receive a commitment letter stating that the lender is willing to provide the specified loan amount, subject to certain conditions. The timeline for receiving the commitment letter can vary based on individual circumstances and the lender’s process.

Mortgage Commitment Letter VS. Pre-Approval

A mortgage pre approval is an initial assessment by the lender based on your financial information to determine the loan amount you may qualify for. It does not guarantee a mortgage. On the other hand, a mortgage commitment letter is a formal agreement from the lender after a thorough evaluation of your financial details and property. It states the lender’s commitment to providing a specific loan amount under defined terms and conditions. In summary, a pre approval is an early indication of loan eligibility, while a mortgage commitment letter is a more definitive agreement from the lender to provide the loan.

Do you need an appraisal for a conditional commitment letter?

An home appraisal is not typically required for a conditional commitment letter. Specifically, a conditional commitment letter is issued by a lender after they have reviewed the borrower’s financial information, reliability, and other relevant factors. It signifies the lender’s intention to provide the loan, subject to certain conditions being met.

One of the common conditions included in a conditional commitment letter is the satisfactory completion of an appraisal. This means that the lender will finalize the loan commitment once the property has been appraised and its value meets or exceeds the agreed-upon purchase price. The appraisal helps the lender assess the market value of the property and ensures that it provides sufficient collateral for the loan.

So, while an appraisal is not required before obtaining a conditional commitment letter, it is typically a condition that must be fulfilled for the loan to progress further. The specific terms and conditions of the commitment letter can vary depending on the lender’s policies and the details of the home buying transaction.

Does the letter of commitment come before or after appraisal?

Generally, the commitment letter is issued before the appraisal, and the appraisal is conducted as a condition to finalize the loan. The lender may include a deadline or a specified date by which the appraisal must be completed and meet the lender’s requirements. So, to clarify, the commitment letter can come before the appraisal, with the appraisal being a condition to be completed at a later or specified date.

Why is a mortgage commitment letter important?

A mortgage commitment letter is important because it confirms loan approval, increases buyer confidence, outlines loan terms, expedites the closing process, and provides protection against financing contingencies. Moreover, it means that the loan has gone through approval by the underwriting team.

Mortgage Letter of Commitment FAQ’s

How long does it take to get a mortgage commitment letter?

The time it takes to receive a mortgage commitment letter can vary depending on several factors, including the complexity of the loan application and the efficiency of the lender’s processes. Furthermore, when you work with Direct Mortgage Loans, you can expect a mortgage commitment letter on average of 24- 28 based on the initial review.

Apply Now

How long is a loan commitment letter valid for?

The validity period of a loan commitment can vary depending on the lender and the specific terms outlined in the commitment letter. In general, a loan commitment is typically valid for a specific period, such as 30, 60, or 90 days.

Is there a way to prevent the seller from knowing the exact amount that you have been pre approved for?

In most cases, when you are pre approved for a loan or financing, the seller does not have direct access to the specific amount you have been pre-approved for. Typically, this information is shared between you and the lender or financial institution. However, there are a few measures you can take to further ensure that the seller does not have access to your pre approved amount:

- Avoid disclosing the pre approved amount during negotiations.

- Obtain a letter of credit from your lender without specifying the figure.

- Involve a trusted third party, like a real estate agent or lawyer, as an intermediary.

What is the advantage of having a loan commitment letter?

A loan commitment offers advantages such as assurance of funds, better planning and budgeting, interest rate protection, a competitive advantage, time flexibility, and a streamlined loan process.

- Assurance of funds: When a lender provides a loan commitment, it means they have reviewed your application and are willing to lend you a specific amount of money. This assurance gives you confidence that the necessary funds will be available when you need them, which is particularly important for large purchases or investments.

- Planning and budgeting: Knowing that you have a loan commitment allows you to plan and budget more effectively. You can make financial decisions based on the confirmed borrowing capacity, such as purchasing a home or starting a business, without worrying about last-minute funding obstacles.

- Competitive advantage: In competitive markets, having a loan commitment can give you an edge when negotiating a home purchases or real estate transactions. Sellers are often more willing to negotiate with buyers who have secured financing, as it indicates a serious intent and reduces the risk of a deal falling through due to financing issues.

- Time flexibility: Loan commitments often come with a specified timeframe during which you can utilize the funds. This provides flexibility to choose when to initiate the loan and draw funds, allowing you to align it with your specific needs or project timelines.

- Streamlined loan process: By obtaining a loan commitment, you have already gone through the initial stages of the loan approval process. This can simplify and expedite the subsequent steps, such as finalizing documentation, underwriting, and disbursing the loan. It reduces the chances of unexpected delays or complications during the loan closing process.

Is a mortgage commitment letter the same as clear to close?

A commitment letter and “clear to close” are not the same. A commitment letter is an initial agreement indicating the lender’s intent to provide a loan, while “clear to close” signifies that all conditions have been met and the loan is ready for the final steps of closing. In short, the commitment letter precedes “clear to close,” which represents the final stage of loan approval and readiness for closing.

Is a commitment letter a final approval?

A commitment letter is typically not the final approval for a loan or financing. While a commitment letter indicates that a lender is willing to provide funding, it is usually contingent upon certain conditions being met. These conditions may include satisfactory property appraisal, verification of income and assets, and fulfillment of any other requirements specified by the lender.

The final approval usually occurs after all the conditions outlined in the commitment letter have been satisfied. At that point, the lender thoroughly reviews the documentation and confirms that all requirements have been met. Once the final approval is granted, the loan or financing is considered fully approved, and the process moves forward towards closing or disbursing the funds.

Direct Mortgage Loans Loan Commitment

The home financing process can be overwhelming. We want you to be excited about your home purchase. With a DML pre underwritten file, you’ll have peace of mind knowing there will be no surprises so you can focus on the fun part of home buying, not the financing aspect. Here are just a few reasons why you should consider a Loan Commitment with DML.

- 100% asset, credit, and income have been reviewed and approved by a DML Underwriter.

- Any questions related to assets, credit, and income were addressed, resulting in no surprises when under contract.

- Loans that receive Property Inspection Waivers could close within ten business days.

- The borrower is qualified at the maximum mortgage allowed, allowing for more flexibility in a challenging market.

Leave A Comment

You must be logged in to post a comment.