Establishing a good credit score and understanding the types of scores used to establish creditworthiness is essential to both the home-buying process and your financial health. Below is a breakdown of the different Vantage and FICO scores used.

What is a FICO Credit Score?

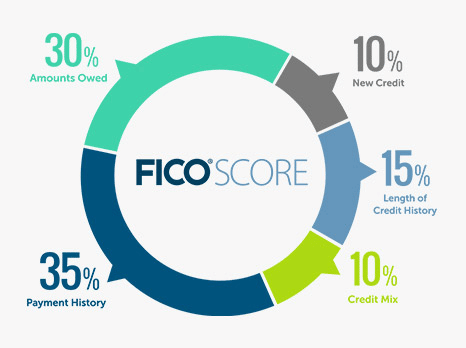

A FICO score demonstrates your creditworthiness to pay back a loan based on data in your credit history. Created by Fair Isaac Corporation, 90% of top lenders use FICO scores to make credit-related decisions. There are several types of FICO scores, each tailoring for a different purpose such as a credit card, personal, installment, auto, or mortgage loan. Specifically, your credit score is calculated using five categories:

- Payment History (35%): Whether you’ve paid past credit accounts on time.

- Amounts Owed (30%): The amount of credit and loans you are using.

- Length of Credit History (15%): How long you have had credit.

- New Credit (10%): Frequency of credit inquiries and new account openings

- Credit Mix (10%): The mix of your credit, retail accounts, installment loans, finance company accounts, and mortgage loans.

What are the different types of FICO scores?

- Used in Credit Card Decisioning: Credit card companies use a FICO 0 and a FICO 10. They are the most recent FICO scores but again they’re not used for mortgages. (Typically, these are 10 to 50 points higher than mortgage FICOs)

- Used in Auto Lending: Automobile companies run on a FICO 6. (Typically, 5 to 50 points higher than mortgage FICOs)

- Used in Mortgage Lending: Mortgage credit scores run on a FICO 2, FICO 5, and a FICO 4. This version of scoring is more direct and grades heavier on delinquency and utilization of revolving debt categories.

What is a Vantage Score?

A Vantage Score is another type of scoring model used to generate your credit score and demonstrate creditworthiness. Unlike a FICO score, your entire credit history is collected by Equifax, Experian, and TransUnion to create a score based on your creditworthiness.

- Credit Karma is a Vanta 3.0 score and not a FICO score. Typically, the Vanta 3.0 score can be anywhere from 50 to 100 points higher than a mortgage FICO score.

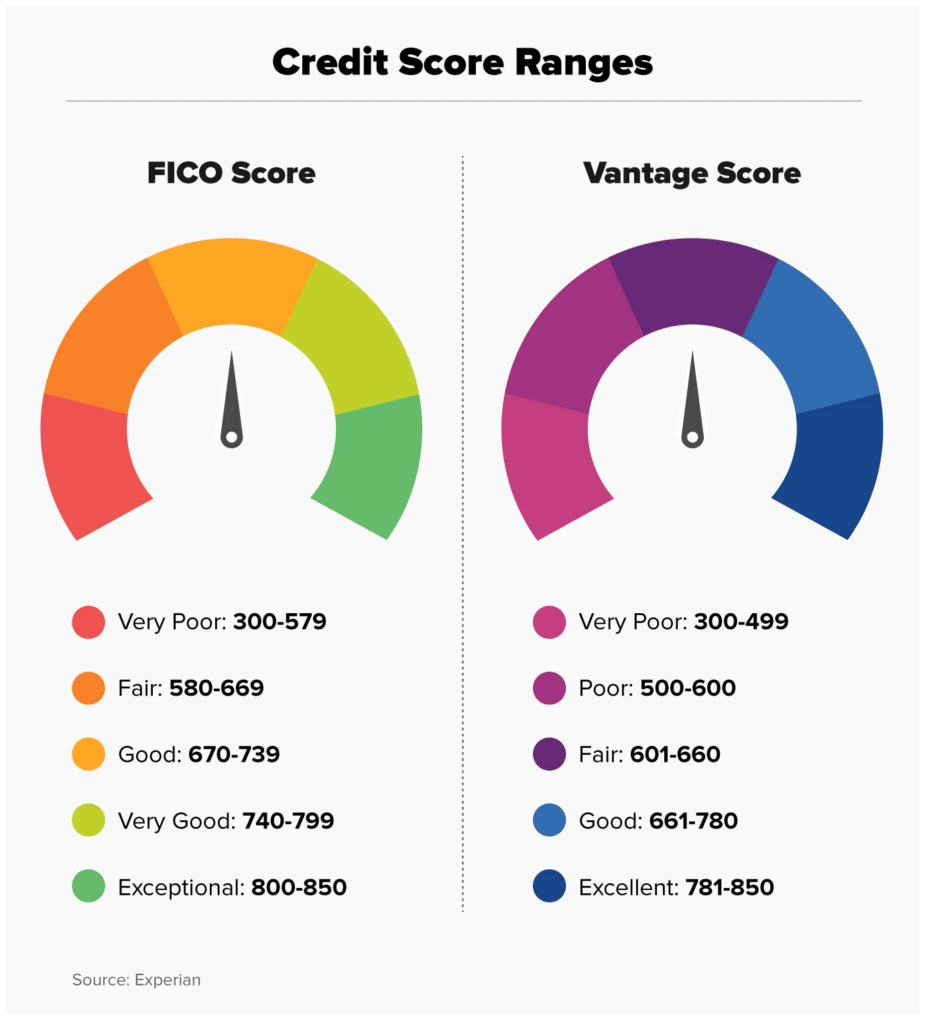

FICO & Vantage Score Ranges

The common range of scores runs from 300 up to 850. Scores vary by year and economic conditions, yet typically, approximately 60 percent of U.S. consumers fall between 650 and 799. Here is a breakdown of ranges according to Experian:

Tips to Maintaining a Good Credit Score

- Minimize your outstanding debt by keeping loan balances low, particularly on credit cards.

- Apply for new credit accounts only as needed. Don’t fall into a credit card trap by opening high-interest rate cards for “one-time discounts (e.g. department store cards).”

- Make a budget and outline your spending habits, savings objectives, and financial goals.

- Use your credit responsibly and manage it effectively. Make sure you and your spouse agree on mutual financial management goals.

- Know when your bills are due: pay on time, and to the appropriate agreed-upon amount.

Factors That Can Lower Your Credit Score

- Moving credit card debt around or consolidating credit card debt and then closing unused credit cards. Owing the same amount with fewer open accounts may lower your credit score.

- Lowering your ‘average account age. What does this mean? Imagine that you have good credit – but then new credit card companies offer you some unbelievably low teaser interest rates. You accept a couple of offers at the same time. These new accounts – mixed with your old accounts – lower your average account age.

- Making partial payments. If you pay off an amount that is less than the agreed amount, your partial payment may be viewed as an overdue payment.

Understanding the types of credit scores and what each is used for is a key element in the process if you’re looking to buy a home. The big takeaway: while you might know your credit score, you may be understanding your credit according to another industry, or credit score methodology. It’s important to speak with a mortgage professional for a full picture of your eligibility. Download our app to start the pre-approval process and contact Direct Mortgage Loans today to learn more about how your current credit score stacks up for your home buying needs.

*Direct Mortgage Loans is not a credit company. Information is provided for educational purposes only.

Leave A Comment

You must be logged in to post a comment.