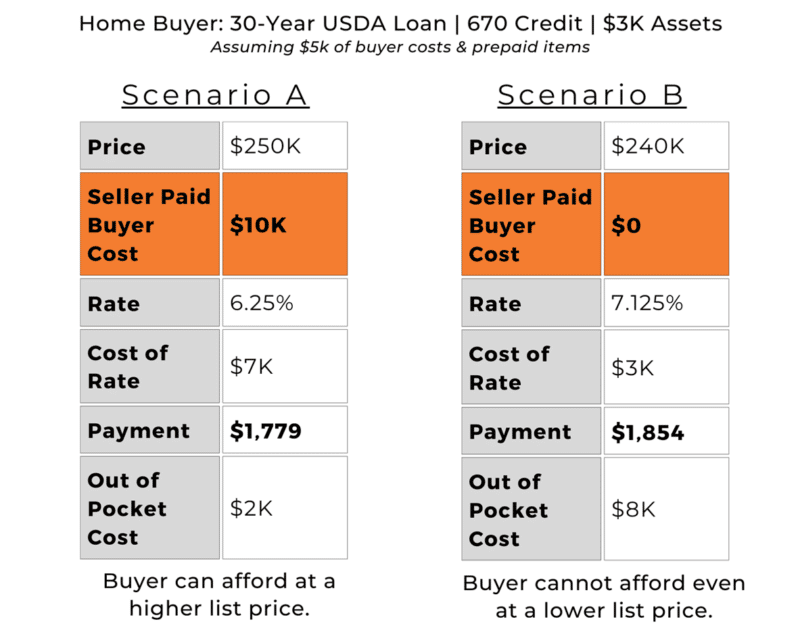

Seller concessions are a great way to reduce the amount of cash paid upfront when closing on a home. Whether you’re buying or selling your home, learn how seller concessions can benefit you! Seller concessions are closing costs the seller agrees to pay to help the buyer reduce the amount of cash needed to close. Below is a scenario to help breakdown how seller concessions can help both parties!

Benefits of Seller Concessions

The buyer benefits by being able to finance the closing costs into the mortgage to offset some of the upfront costs that come with purchasing a home. Moreover, seller concessions increase the number of properties available to buyers with limited funds.

Depending on the neighborhood, it may be difficult to sell your home if the market is overcrowded. Seller concessions can attract interested buyers and better offers. Additionally, by offering concessions, you can help sell your property faster, which is ideal if you want to avoid overlapping mortgages.

What can seller concessions cover?

Appraisal Fee

An appraiser will be sent to the property to determine the true value of the home. The buyer will have to pay for this at closing.

Discount Point(s)

Money paid to a lender at closing in exchange for lower interest rates. Each point is equal to 1 percent of the loan amount.

Inspection fees

Cost for home inspector to determine the condition of the home, if it is safe, and its current state

Loan Origination fees

A percentage fee of the loan amount is charged by a lender as compensation for processing a loan application. (e.g., for commitment, underwriting, or loan applications).

Property Taxes

A government tax based on the market value of a property.

Recording Fees

Small cost to record the home purchase with the local government.

Title Insurance

Insurance that protects the lender (lender’s policy) or buyer (owner’s policy) against loss due to disputes over property ownership.

Negotiating Seller Contributions

Determine the market

Is it a buyer or sellers’ market? It’s important to get a sense of the current housing market before forming your strategy to negotiate. Typically, sellers are more likely to agree to concessions when homes aren’t moving as quickly in the market.

Consult with a real estate agent

Most likely your real estate agent will be the one doing the negotiating. Depending on the conditions of the market your real estate agent will guide you in the right direction if negotiating for a seller concession is a wise move. Learn more about the experts involved in the mortgage process!

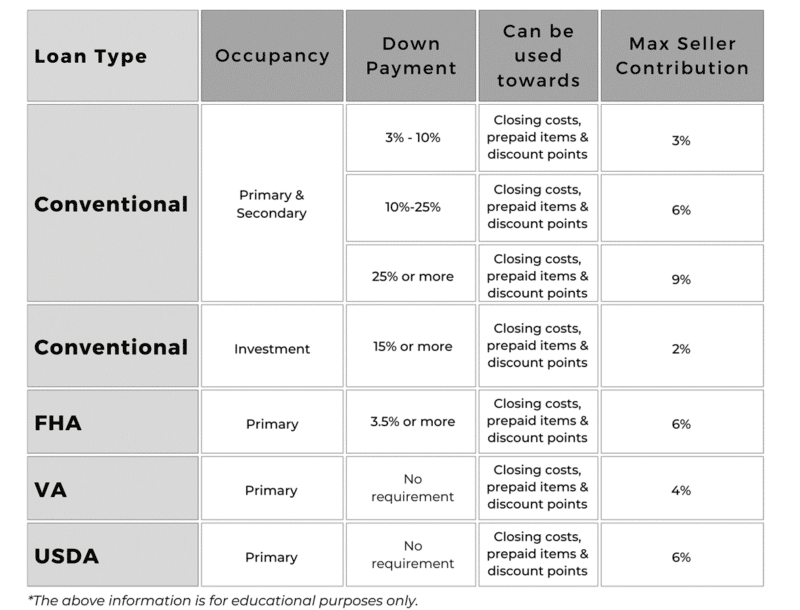

Types of Loans with Max Seller Contributions

This is just one of the solutions we offer to make homeownership more affordable. Contact Direct Mortgage Loans today to learn more about seller concessions and our personalized mortgage solutions!

Leave A Comment

You must be logged in to post a comment.