Purchasing a home from a family member is no different than purchasing from any other individual. Nonetheless, there are many factors to consider before deciding to take this route. Keep reading to better understand how this process works!

Steps to Purchase a Home from a Family Member

1. Discuss your Expectations:

It is important to discuss any details, questions, or concerns with your family before starting the process. Discuss factors such as price, timeframe, and where your family will stay after buying the house. Balancing finances and family can be tricky so make sure you all are on the same page before making it official.

2. Get Pre-Approved:

Once you and your family have established expectations, the next step in the process is to get pre-approved. Pre-approval is a commitment by a lender to provide a mortgage loan to a specified borrower, prior to the identification of a specific property. Download our app to start your pre-approval process.

3. Determine the Purchase Price:

To accurately determine a fair purchase price, consider the following factors:

- Fair Market Value: The estimated selling price of a home between a willing buyer and seller on the open market. In a mortgage or a home equity loan, the fair market value is usually determined by an appraisal.

- The Appraised Value: A written estimate by a licensed residential appraiser of a property’s current market value, based on recent sales information for comparable properties, the current condition of the property and other neighborhood characteristics.

- The Assessed Value: The value used to determine property taxes, based on a tax accessor’s opinion. Additionally, the tax accessors will use the calculated assessed value taxes to see if you will generate any income from the property and qualify for any tax exemptions.

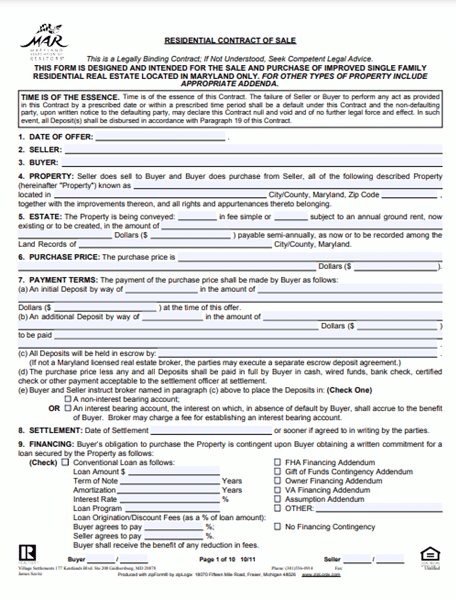

4. Draw Up a Purchase Agreement:

A purchase agreement is a contract signed by the buyer and seller stating the terms and conditions under which a property will be sold. Here is an example of the contract both parties must sign.

5. Complete a Title Search:

An examination of records used to determine the legal ownership of property, all liens, and encumbrances on it. Usually performed by a title company, or attorney.

6. Consult a Professional:

It can be helpful to bring in professionals to ensure the process runs efficiently for both parties involved. Consider hiring a lawyer to make sure all contracts are completed properly, and consult a tax expert to be aware of any tax implications.

7. Get a Home Inspection:

Although you may have either grew up in the home or visited frequently, we recommend not skipping the home inspection. Have a professional assess the home before you close to prevent any costly repairs you didn’t account for. Read more about what to keep in mind during a home inspection learn more!

8. Close on the Home:

On closing day, you and your family will meet, and the keys and funds transfer legally. Prepare yourself for closing day by learning about closing costs and how to pay them.

Gifts of Equity

One of the major benefits associated with this option is that your family member can contribute a Gift of Equity – a gift provided by the seller of a property to the buyer who is a family member.

The gift represents a portion of the seller’s equity in the property and transfers to the buyer as a credit in the transaction. This is permitted for principal residence and second home purchase transactions, and can be used to fund all or part of the down payment and closing costs (including prepaid items).

Gift Letter Required Documentation & Guidelines

FHA: Gift Letter Required Documentation

- Signed and dated by the Borrower and the Donor.

- Includes the Donor’s name, address, and telephone number.

- Includes the Donor’s relationship to the Borrower.

- Dollar amount of the Gift of Equity.

- Statement that they require no payment.

Acceptable Donors: Borrower Family Member: Child, Parent, Grandparent, Spouse, Domestic Partner, Foster Child, Brother, Sister, Uncle, Aunt, In-Laws.

Conventional: Gift Letter Required Documentation

- Signed and dated by the Borrower and the Donor.

- Includes the Donor’s name, address, and telephone number.

- Includes the Donor’s relationship to the Borrower.

- Dollar amount of the Gift of Equity.

- Statement that they require no payment.

Acceptable Donors: Relatives, defined as the borrower’s spouse, child, other dependent, or by any other individual who is related to the borrower by blood, marriage, adoption, or legal guardianship. Fiancé, Fiancée, Domestic Partner.

USDA: Gift Letter Required Documentation

- Signed and dated by the Borrower and the Donor.

- Includes the Donor’s name, address, and telephone number.

- Includes the Donor’s relationship to the Borrower.

- Dollar amount of the Gift of Equity.

- Statement that they require no payment.

Acceptable Donors: Borrower Family Member: Child, Parent, Grandparent, Spouse, Domestic Partner, Foster Child, Brother, Sister, Uncle, Aunt, In-Laws.

Please note that this process does not allow for transactions that are related to distressed properties. A distressed property is a home on the brink of foreclosure or the bank already owns the property.

Benefits of Buying from Family

- Relationship with Seller: Trusting the person you are doing business with can put your mind to ease. Additionally, working with family or friends offers more flexibility since you will be able to stay connected through the process, and coordinate times that work best.

- Low or No Down Payment: As previously mentioned, Gifts of Equity given by your family members can be used toward your down payment or closing costs. Review the guidelines above and download our Gift Fund Guide to learn more about the requirements and specifications.

- More Buying Power: When purchasing a home from family, you will not have to compete with other buyers for the home. Furthermore, you also will not have to worry about bidding wars or inflating home prices based on the market.

Drawbacks of Buying from Family

- Risk of Family Conflict: Balancing family relationships and finances can be tricky and can have the ability to cause conflict. Make sure both parties are willing to listen, compromise, and commit before choosing to purchase a home from a family member.

- More Restrictions: Non-Arm Length transactions require lenders to take extra precautions since there is more potential for mortgage fraud. Traditional financing may still be needed which can sometimes complicate things if the family member you are purchasing from still has a mortgage on their home.

- Possible Tax Implications: If your family members give you a gift of equity, they may have to pay taxes on it. If the gift fund is more than $15,000 or $30,000 for married buyers, the relative will need to report it to the IRS and can have to pay taxes on it.

The bottom line: if you’re thinking about purchasing a home from a family member, it’s crucial to consider and explore all the factors while effectively communicating with all parties to ensure a smooth and beneficial home buying process. Contact Direct Mortgage Loans today to learn more about our mortgage solutions!

*Eligibility and approval is subject to completion of an application and verification of home ownership, occupancy, title, income, employment, credit, home value, collateral and underwriting requirements. Direct Mortgage Loans, LLC NMLS ID# is 832799 (www.nmlsconsumeraccess.org). Direct Mortgage Loans, LLC office is located at 11011 McCormick Rd Suite 400 Hunt Valley, MD 21031. Equal housing lender.*

Leave A Comment

You must be logged in to post a comment.