Start this year off by taking control of your finances and getting on the road to financial wellness! Try this Free 30 Day Financial Wellness Challenge, with tips for budgeting, earning more money, paying down debt, and more.

Establish a Budget

Establishing a budget is one of the most important steps you can take to become financially secure. Identify your income and expenses, keeping in mind any long-term goals, such as saving for retirement or paying for your education. This will help you determine how much money to set aside for essentials like your mortgage payment and utilities, how much you should save each month, and how much you can afford to spend on non-essential items. Be sure to leave room in your budget for emergency funds, too!

Automate Savings and Reminders

Automating your savings is an effective way to ensure you are always setting aside money for your future. Set up an automated transfer from your checking account to a savings account each month. Doing this on payday will help you quickly build healthy reserves as well as get in the habit of regularly saving and eventually putting that money towards reaching goals such as buying a home. Additionally, set up reminders for yourself when bills need to be paid. This can help make sure you never forget a payment and never incur late fees due to missed deadlines.

Track Spending Habits & Goals

One of the most important steps you can take in your financial wellness journey is to track and monitor your spending. Tracking your spending allows you to identify areas where you can cut back and maximize savings, so it’s important to be mindful of how you’re using your money each day. Set up a budget to track all incoming and outgoing expenses so you can stay on top of your finances. Additionally, keep an eye out for any big-ticket items that may come up throughout the month so you can start planning. Finally, set goals for yourself and make sure to document any progress towards them! Doing so will help keep you motivated while also allowing you to measure success – both financially and mentally.

Review Credit Reports and Scores

You should make sure to review your credit reports and scores. This can be an intimidating step, but it’s important to ensure all your information is accurate. When you receive and review your credit reports, keep an eye out for any incorrect information or signs of identity theft. Aside from ensuring accuracy, this gives you a better understanding of where you stand financially and what actions can help further improve your score in the long-term. Good credit is essential for future financing and loan qualifications – so make sure to be mindful about how lenders view you!

Develop Strategies to Pay Down Debt

It is time to come up with a timeline and goals for paying down your outstanding debt. Begin by gathering all your existing debts into one place, along with their interest rates and minimum payment amounts. Once you have the full picture of your financial situation, it’s time to formulate a repayment strategy. Start by paying off high-interest debt first and make sure to keep up regularly with monthly payments that are on time or as early as possible.

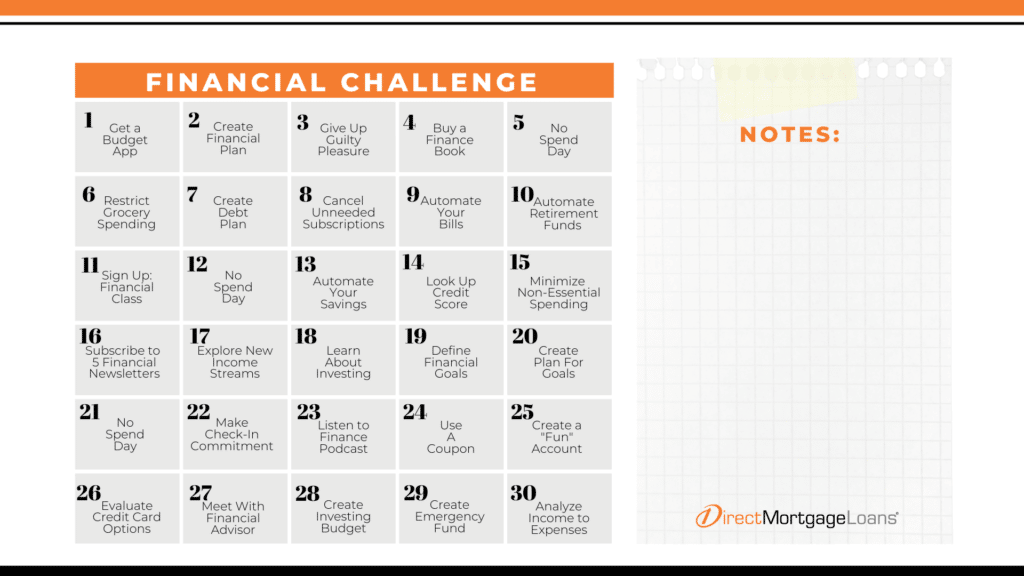

How do you create financial wellness?

Saving money is not always the easiest thing to do. One way to create financial wellness is by taking it day by day. To help you take control of your finances this year, we developed an ultimate 30 day financial wellness challenge just for you. Download the printable calendar to check off each day you have completed the challenge.

Day 1

Download a budget app to track all your expenses. Use this app to record expenses and budget properly from this day forward!

Day 2

Create a financial plan for the month and stick with it. Split your income into three categories- necessities, savings, and wants. Determine a percentage to go to each area. Consider a highly effective and popular budget, the 50/30/20 budget.

Day 3

Choose one guilty pleasure and give it up. At the end of the month, see how much money this saved you.

Day 4

Buy a financial wellness book and begin reading at least one page a day. Do not forget to take notes!

Day 5

Make today a no spending day. Get creative in your meals and be smart about your whereabouts.

Day 6

Write down your groceries and meals for the week and find a way to restrict your grocery spending.

Day 7

Formulate a plan to attack your debt and pay it off. The less debt the better you will feel!

Day 8

Review and cancel subscriptions you do not use.

Day 9

Automate your bills so they are never missed and always paid on time.

Day 10

Automate your retirement savings. Work with your employer to set up your plan for retirement and start contributing. Retirement may seem far off, but it is important to begin contributing as soon as you are able.

Day 11

Sign up for a financial literacy class. There are many free classes you can sign up for. Become familiar with financial terms.

Day 12

Today is another no spending day. Leave the wallet at home!

Day 13

Automate your savings. Therefore, funds will go directly to your savings on a consistent basis. Start building that savings.

Day 14

Look up your credit score. Then, research some ways to increase your credit score. Apps like Credit Karma will give you tips to increase your score. This is a big consideration in home buying.

Day 15

Find ways to minimize things you purchase that are not essential.

Day 16

Find three to five credible financial literacy websites and subscribe to their newsletter. Now, you will have tips, tricks, and knowledge coming your way often.

Day 17

Explore ways to make some more income. Many apps like Door Dash, Wags, and Instacart allow you to make money in your own schedule.

Day 18

Learn about investing. Start reading about investing and begin thinking about it for you.

Day 19

Create and define your financial goals. Create monthly, quarterly, bi-yearly, and yearly goals.

Day 20

Looking at your financial goals, create a plan to get to each one and put it on your calendar.

Day 21

Today is another no spending day.

Day 22

Make a commitment to check in with your spendings and statements at least once a month (yes, even when the challenge ends). Put the day you will check in each month on your calendar now, so you do not forget.

Day 23

Find a finance podcast you like and listen to it.

Day 24

Before shopping today, look to see if there are any coupons and use one on your purchase.

Day 25

Create a “fun” account or money jar. Put a consistent amount of money each month in this account. This is used for the random fun outings you go on. This way, you feel okay to spend the money and not overspend.

Day 26

Evaluate your credit card options. Do you have the best ones for you? Do some research and shop around…the goal is to maximize your benefits.

Day 27

Consider meeting with a financial advisor to set yourself up for success.

Day 28

Since you researched investing, create an investing budget. Determine what amount you can contribute to investments.

Day 29

Create an emergency fund! Determine a consistent monthly amount or percentage of income that can be put towards this.

Day 30

For the past month, analyze your total monthly spending in terms of your total income. How much of your income is being spent?

There you have it! That is your 30 day guide to financial success.

For more challenges like these, stick along. Follow us on social media to be alerted of a new challenge. When the challenge is complete, and you are ready to be a home buyer, contact a team member today!

Leave A Comment

You must be logged in to post a comment.