Feel like homeownership is out of your reach? Think again. The The rate of homeownership increased, making the dream of homeownership alive and well. Learn why many are choosing to buy a home despite the increase in home prices.

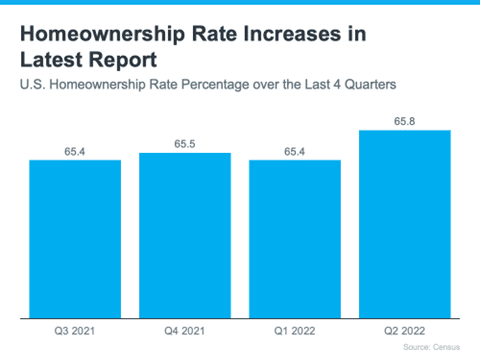

Based on recent data provided by the U.S Census Bureau, the rate of homeownership has increased overall in the last year. A significant factor contributing to this increase is the high inflation and rising rent costs. Specifically, Chief Economist at the NAR explains: “In the 1970s when inflation was running around 10%, home prices were rising at the same rate. Renters have a harder time in inflationary periods because rents tend to rise along with inflation, whereas mortgage payments stay the same for homeowners with fixed-rate mortgages.”

Why are More People Becoming Homeowners?

Purchasing a home can help protect you from rising costs that will not only benefit you in the short term, but in the long term as well. A fixed-rate mortgage provides predictable monthly payments for the duration of your loan. Learn more about this loan option to see if a fixed-rate mortgage is right for you, by contacting a mortgage professional.

Furthermore, homeowners will gain equity over time as your home appreciates when you make your monthly mortgage payments. Learn more about how homeowners have gained equity in the past year in our blog.

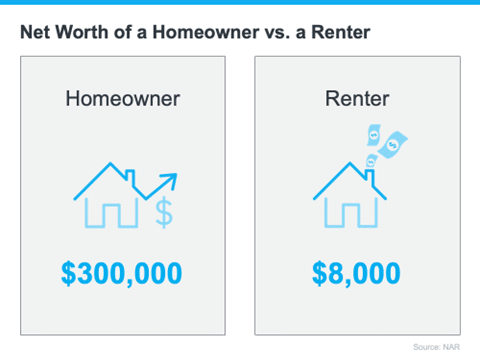

Growing equity also increases your net worth. Based on the latest data from NAR, the median net worth of a homeowner is $300,000, while the median net worth of a renter is only about $8,000. Therefore, that means a homeowner’s net worth is 40 times that of a renter!

Should I rent or buy a home?

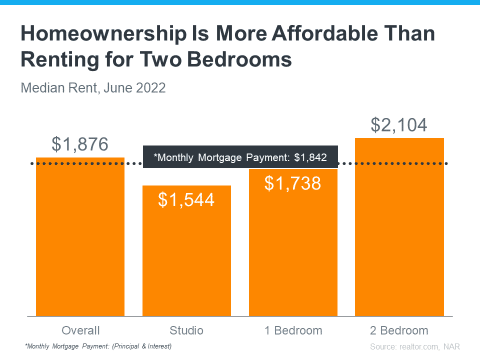

Although there has been an increase in home prices in recent years, rental prices have skyrocketed to new records. According to a recent article from Realtor.com: “The median rent across the 50 largest US metropolitan areas reached $1,876 in June, a new record level.” Moreover, in many cases, buying a home may be more affordable than renting depending on the amount of space you need.

Based on data provided by the NAR and Realtor.com, the graph above determines that if you need two or more bedrooms, it may be more affordable to buy a home than to rent. Homeownership is a great option if space is one of your motivating factors to move.

Reasons to Buy a Home in Today’s Market

- Fewer Multiple-Offer Scenarios: As buyer demand moderates, you may see the intensity of bidding wars ease. Bidding wars occur when two or more parties repeatedly outbid each other to purchase the same property.

- Not as Many Homes Selling Above Asking Price: Fewer buyers are bidding over the asking price, but it is still a competitive market. Review our article on Homebuying Strategies in a Competitive Market to make sure you’re prepared to make an offer.

- Supply of Homes for Sale is Growing: Housing inventory is increasing, which means more options for your home search. If you have had trouble finding the ‘one,’ this could be your next chance at finding your dream home.

Overall, homeownership is more attainable than many people think, and in some cases homeownership can be more affordable than renting. If you’re thinking about purchasing a home, don’t wait, contacting a mortgage professional.

Leave A Comment

You must be logged in to post a comment.