How much mortgage can you qualify for when buying a home? Buying a home is a huge decision. While the process is exciting, it is crucial to be aware of the realities of home buying. With the crowded housing market, being prepared and knowing your budget for a home ensures a more seamless process.

Understanding How Much Home You Can Afford

It’s important to search for homes that are in your qualified price range so you do not fall in love with a home you simply cannot afford. When it comes to qualifying for a loan, there are an array of factors that play into the decision. Your loan officer will work directly with you on this. Proactively, you can use Direct Mortgage Loans our Home Affordability Calculator, on our website or by downloading our app, to get an estimate of how much you could afford based on your financial portfolio.

Use Our Home Affordability Calculator

Using Direct Mortgage Loans’ home affordability calculator is simple. Start by entering your income, debts, and other relevant financial information. Then, the calculator will provide you with an estimated mortgage amount and monthly payments. Here are several insights a home affordability calculator can provide you with:

- How much you can afford to borrow for a mortgage

- Your estimated monthly mortgage payments

- Your estimated down payment requirement

- Your estimated debt-to-income ratio

- Your estimated housing ratio

This information could help you understand how much you could afford to spend on a home, and what your monthly payments could be. Using the calculator could also help you identify any potential financial constraints that could impact your ability to obtain a mortgage.

29/41 Home Mortgage Rule of Thumb to Calculating Your Home Affordability

The 29/41 home mortgage rule of thumb is a straightforward guideline that can help you estimate the mortgage you can comfortably afford. It’s a useful tool for gauging your financial capacity when considering a home purchase. Here’s a breakdown of how it works:

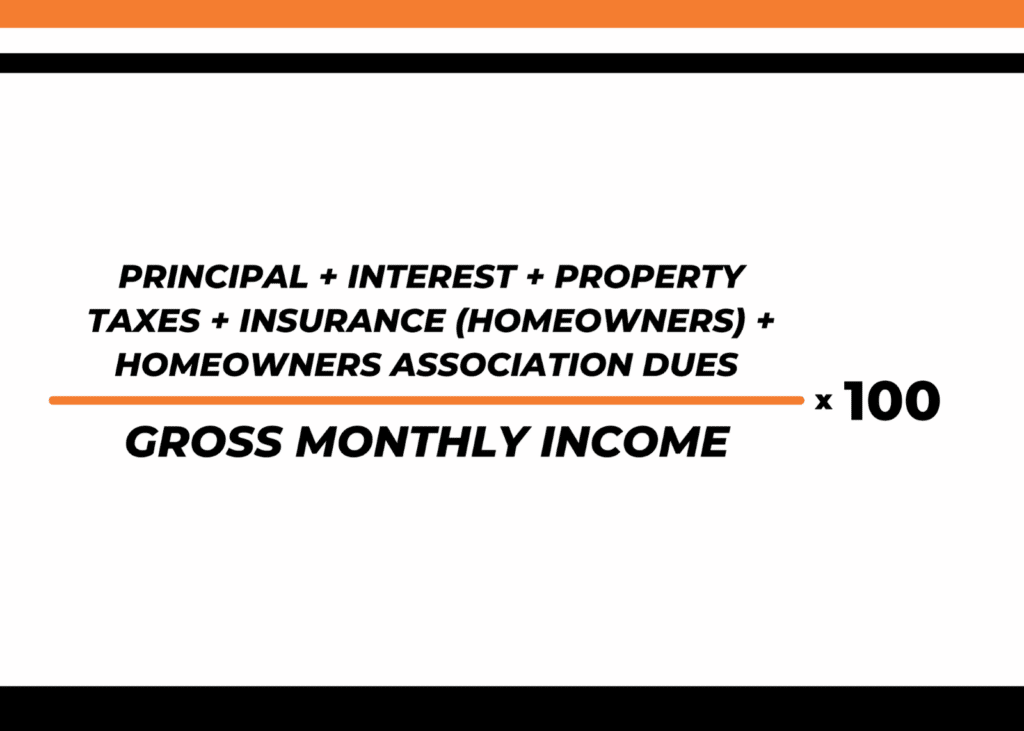

29% for Housing Expenses

This portion of the rule suggests that your monthly housing expenses, which includes principal, interest, property taxes, insurance, and housing dues, shouldn’t surpass 29% of your gross monthly income.

41% for Total Debt-to-Income (DTI)

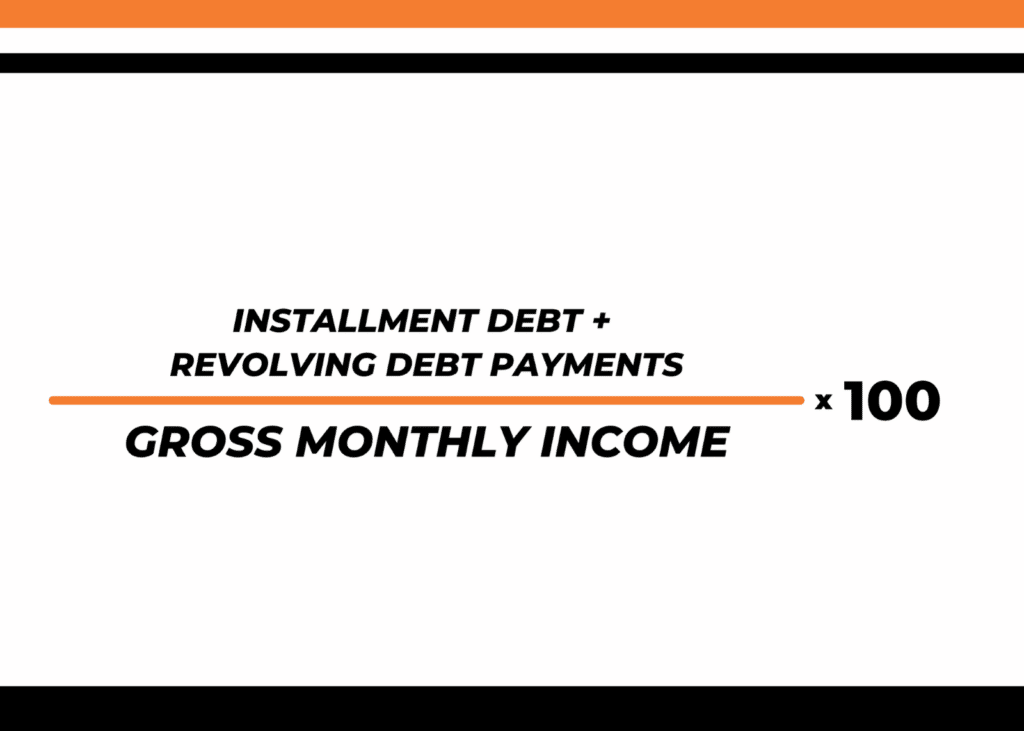

The 41% represents your total debt-to-income ratio (DTI), which includes your housing expenses as well as all other debts you may have.

By following the 29/41 rule, you show lenders that you could repay the loan and handle your mortgage payments while meeting other financial obligations. This rule serves as a useful tool to ensure that your homeownership goals align with your financial well-being, making the home buying process smoother and more informed.

How To Calculate Your DTI Ratio

Your debt-to-income (DTI) is the percentage of your gross income used to cover your mortgage and other debt payments. This ratio, and your credit score, are two key factors used to determine if you qualify for a loan. The lower your ratio, the easier it is for you to pay your bills each month. To calculate your debt-to-income (DTI) ratio, follow these steps:

- Add up your monthly debt payments. This includes your mortgage payment, rent payment, car payment, student loan payments, and credit card minimum payments.

- Divide your total monthly debt payments by your gross monthly income. This is your income before taxes and other deductions.

- Multiply the result by 100 to get your DTI ratio as a percentage.

Calculate your Debt-to-Income Ratio using our mortgage calculators!

Factors That Determine How Much Mortgage You Can Afford

The 29/41 rule and DTI are very important in determining how much home you can afford. However, there are many other factors that play into how much you can qualify for. Here are some common factors that play a key role in your affordability:

Buyer Information

- Monthly Income: Lenders want to see that you have a stable source of income that is sufficient to cover your monthly mortgage payments and other expenses. They will consider your income from all sources, including wages, investments, and rental properties.

- Debt expenses: Lenders also want to see that your debt payments are not too high compared to your income. They will consider all of your monthly debt payments, including credit card payments, student loan payments, and car payments.

- Credit score: Your credit score is a measure of your creditworthiness. It shows lenders how well you have managed your debt in the past. A higher credit score could qualify you for a lower interest rate on your mortgage loan.

Loan Information

- Loan Term: This is the time you must repay the loan, usually 15 or 30 years. Typically, shorter terms mean higher monthly payments but less overall interest. Longer terms offer lower monthly payments but more long-term interest costs.

- Interest rate: The interest rate is the percentage of the loan amount that you will pay each year. A lower interest rate will result in lower monthly payments.

- Down payment: The upfront amount you pay when buying a home. A larger down payment could reduce monthly payments and long-term interest costs.

- Property taxes: These are annual payments to the local government. The amount of property taxes you pay is determined by the assessed value of your home and the local property tax rate.

- Homeowners insurance: Homeowners insurance protects you from financial loss if your home is damaged or destroyed. The cost varies depending on the type of coverage you choose and the value of your home.

Lending Ratios

- Loan-to-value ratio (LTV): The percentage of the loan amount relative to the value of the home. The lower your LTV, the more equity there is in your home, which makes you less risky to the lender.

- Housing Expense Ratio: The percentage of your monthly income that goes towards housing expenses, including your mortgage payment, property taxes, and homeowner’s insurance. Lenders typically prefer a housing ratio of 28% or less.

- Debt-to-income ratio (DTI): The percentage of your monthly income that goes towards debt payments, including your mortgage payment, credit card payments, and student loan payments.

Bottom Line

Nonetheless, buying a home is an exciting adventure, but it’s important to be prepared. Before you start house hunting, take some time to understand your finances and what you can afford. Our free Homebuyer Guide could help you learn everything you need to know about purchasing a home, from getting pre-approved for a mortgage to finding the right home for your needs!

Housing Affordability FAQ’s

Can I afford a house on a single income?

Yes, it is possible to afford a house on a single income. However, it’s crucial to assess your financial situation carefully and ensure you can manage monthly expenses before taking the plunge. It’s best to consult a loan officer to better understand your borrowing capacity and monthly payments in advance.

Here are a few tips for making single-income homeownership more achievable:

- Consider Starter Homes or Condos: These tend to be smaller and more affordable.

- Explore Lower-Cost Areas: Rural or smaller city homes could cost less. (Learn more about a USDA Loan)

- Consider Fixer-Uppers: Willingness to renovate can save money.

- Share Costs: Getting a roommate or renting part of your home can offset mortgage expenses.

While challenges exist, thoughtful financial planning could make homeownership more attainable for buyers on a single income.

Should I wait for lower interest rates?

Waiting for lower interest rates is like trying to peer into a crystal ball. The truth is, none of us possesses the ability to foresee these changes, as financial markets are subject to a number of variables that can shift rapidly. Even if interest rates improve after you secure a mortgage, we’ve got you covered. Our no-lender cost refinance offers a refinancing option with no closing costs, up to two years after closing.* Plus, we’ll keep a close eye on the market and reach out to you when the time is right.

How can I save for a down payment?

Saving for a down payment is a critical step toward owning your own home. Here are some effective strategies to make it happen:

- Set Up a Savings Budget: Start by creating a budget that outlines your income, expenses, and savings goals. This will help you allocate funds specifically for your down payment and identify areas where you could reduce unnecessary spending.

- Increase Your Income: Look for opportunities to boost your earnings, like taking on a part-time job, freelancing, or selling items you no longer need. This extra income could go directly toward your down payment fund.

- Cut Unnecessary Expenses: Review your spending habits and find ways to reduce costs without compromising your quality of life. This might mean eating out less, canceling unused subscriptions, or finding more affordable alternatives for your regular expenses.

- Pay off Debts: It’s a good idea to tackle high-interest debts before diving into homeownership. Pay down credit card balances and loans with the highest interest rates first. This not only improves your financial health but also frees up more money for your down payment savings.

- Explore Down Payment Assistance Programs: Explore Down Payment Assistance Programs (DPA) that help first-time homebuyers. These programs often provide grants, low-interest loans, or down payment matching, making it easier to afford your dream home.

- Gift Fund: If you have the support of your loved ones, consider asking for a gift fund to assist with your down payment. They might be open to helping you achieve your homeownership goals.

What’s the maximum mortgage amount I can be eligible for?

The maximum mortgage amount you are eligible for depends on a number of factors, including the type of loan, your income, existing debts, credit score, and down payment size. This amount isn’t fixed and can vary based on these variables. In certain situations, borrowers might even be able to push their back-end DTI to 50% or higher.

Am I obligated to borrow the complete amount I’m approved for?

No, you are not obligated to borrow the complete amount you are approved for. In fact, it is generally not advisable to borrow more money than you need. The more money you borrow, the higher your monthly payments will be. If you are not sure how much money you should borrow, it is a good idea to speak with a qualified loan officer. They can help you assess your financial situation and determine the best mortgage amount for you.

What if I need assistance buying a new home?

Direct Mortgage Loans offers down payment assistance programs designed to support creditworthy individuals with low to moderate incomes in the United States. These programs offer financial aid to assist homebuyers in managing the upfront costs associated with buying a home. While the details can vary depending on the program, down payment assistance typically includes grants, loans, or a combination of both to help make homeownership more accessible. Contact us today to learn more about our DPA programs!

Is my income the sole factor affecting my ability to afford a home?

Your income is not the sole factor determining your ability to afford a home. Lenders assess multiple aspects when approving a mortgage, such as your credit score, debt-to-income ratio, down payment, property taxes, and prevailing market conditions. These factors collectively impact your eligibility and affordability for a home purchase.

*By refinancing your existing loan, total finance charges may be higher over the life of your loan. Eligibility and approval is subject to completion of an application and verification of home ownership, occupancy, title, income, employment, credit, home value, collateral and underwriting requirements. Direct Mortgage Loans, LLC NMLS ID# is 832799 (www.nmlsconsumeraccess.org). Direct Mortgage Loans, LLC office is located at 11011 McCormick Rd Suite 400 Hunt Valley, MD 21031. Equal housing lender.

Leave A Comment

You must be logged in to post a comment.