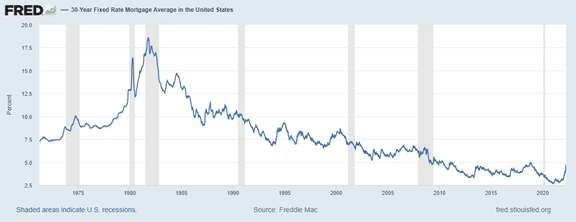

It’s no secret that mortgage interest rates have risen significantly in the last couple of weeks, but that doesn’t mean you need to abandon your plans to refinance or purchase a home. Interest rates can change at any time and are driven by market forces such as economic news and inflation. Moreover, although rates are on the rise it’s important to compare interest rates from a long-term point of view. The chart below, from Freddie Mac, compares mortgage interest rates throughout history. Based on this data, mortgage rates are still considerably low compared to decades in the past!

Interest rates are not the only thing to consider according to Pulsenomics founder Terry Lobes, who states home price growth in 2022 is projected to increase by 9% in addition to rising rates. With rising home prices and interest rates, many people may feel discouraged about their homeownership dreams. Luckily, if you purchase a home the value of the property appreciates over time. According to Keeping Current Matters, home appreciation relates to an increase in value over time. When considering appreciation and how it applies to real estate, today’s market is experiencing higher buyer demand. For sellers, this is significant. While you may pay a higher price and mortgage rate than you would have last year, purchasing a home allows you to build equity with the escalation of home prices.

Consider a Cash-Out-Refinance

With current home prices rising, your home may be worth more than you realize! Consider a cash-out refinance to tap into your home’s equity. A cash-out refinance allows you to pull cash from your home’s equity. The new loan amount will be greater than the amount you owe on your house, so the difference is paid out after closing. Here are a few reasons to consider a cash-out refinance.

- Home Improvement Projects: Many clients are using a cash-out refinance to make improvements to their home.

- Debt Consolidation: Pay off your high-interest debt to get ahead of your finances and to consolidate your bills to one monthly payment.

- New Vehicle/Boat: Need a new vehicle? Have you always dreamed of owning a new boat? You could use your cash-out refinance to make your purchase.

- Tuition: If you or your child are thinking about higher education, consider using your cash-out refinance to manage the expense.

- Pad Your Savings: Want a larger emergency fund? Use your cash-out to buffer your savings account.

- Investments: Use the funds you’ve earned to make financial investments toward your future.

Learn if this option is right for you by reading our blog Questions to Ask Your Lender Before You Refinance!

Don’t let rising interest rates and higher home prices get you down. It’s best to act now if you are planning to purchase or refinance, or it could end up costing you more overall. Learn more about the variety of loans available by connecting with one of Direct Mortgage Loans’ Loan Officers today!

Leave A Comment

You must be logged in to post a comment.