Do you have equity in your home? Consider taking out a HELOC or a Home Equity Loan to gain access to funds. Read more to learn about the different types of Home Equity Loans available and if this option could be right for you!

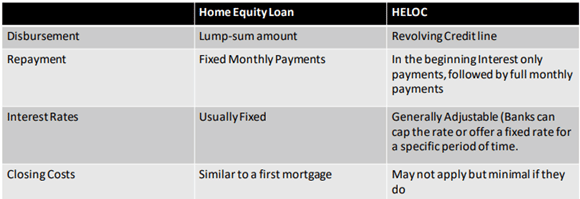

According to Investopedia, home equity loans give the borrower a lump sum upfront to spend, and in return, they must make fixed payments over the life of the loan. Although, both HELOC and Home Equity Loans allow consumers to gain access to funds there are distinct differences between the two.

What is a Home Equity Line of Credit (HELOC)?

A home equity line of credit (HELOC) is a line of credit secured by the equity of your house. This provides the borrower with a revolving line of credit. Additionally, to qualify for a HELOC, the amount you owe for you home must be less than the value of your home. Typically, you can borrow up to 85% of the value of your home minus what you owe. As you repay the outstanding balance, the amount of credit is reestablished.

Advantages

-

Typically, no closing costs.

-

Borrower only pays the interest on the portion you are using (not the total amount qualified for).

-

Borrowers may be able to deduct interest payments from their taxes.

-

Flexibility allows the borrower to access funds at different times during the draw period.

Disadvantages

-

HELOCs typically have a higher interest rate than a Home Equity Loan.

-

Can lead to debt if used like a credit card or other revolving charge accounts.

-

Can have a variable rate, which can mean a variable payment where the payment could increase during the Repayment period.

What is a Home Equity Loan?

With a Home Equity Loan, a specific amount is borrowed and paid back with fixed monthly payments over a fixed period. This type of loan is ideal for one-time needs where you know exactly how much cash you need on hand.

Advantages

-

Fixed, predictable payments.

-

Interest rates are closer to rates for first mortgage.

-

Can be refinanced if the rates become more favorable.

Disadvantages

-

Borrowers pay closing cost (usually 2%-5% of the loan value).

-

Must have substantial equity in your home in order to qualify.

Furthermore, if you’re thinking about taking out a Home Equity Loan, or HELOC contact one of our expert Loan Officers to discuss which option is best for your financial goals.

Leave A Comment

You must be logged in to post a comment.