Your Guide To Buying A Beach House

Have you always dreamed of buying a beach house? A beach house can be a great investment. In this article, we will guide you through the steps to buy a vacation home.

Benefits of Owning a Beach House

Home Away from Home

A beach house offers a peaceful sanctuary for weekend getaways or extended vacations. It’s also a great way to get away from the hustle and bustle of daily life and create memories with family and friends.

Investment Potential

Beyond the undeniable emotional appeal, beachfront properties often appreciate over time due to their scarcity and increasing desirability, making a beach house a smart financial investment.

Rental Income

If you don’t plan to use your beach house year-round, think about renting it out as a vacation property. By listing your beach house on platforms like Airbnb and Vrbo, you could earn passive income during the times you’re not using it, turning it into a profitable asset.

Steps to Buying a Beach House

Step 1- Decide What You Can Afford

Before buying a beach house, assess your budget to determine how much you can comfortably afford. Consider additional monthly expenses like insurance, interest rates, property taxes, and maintenance costs.

Step 2- Analyze Financing Options

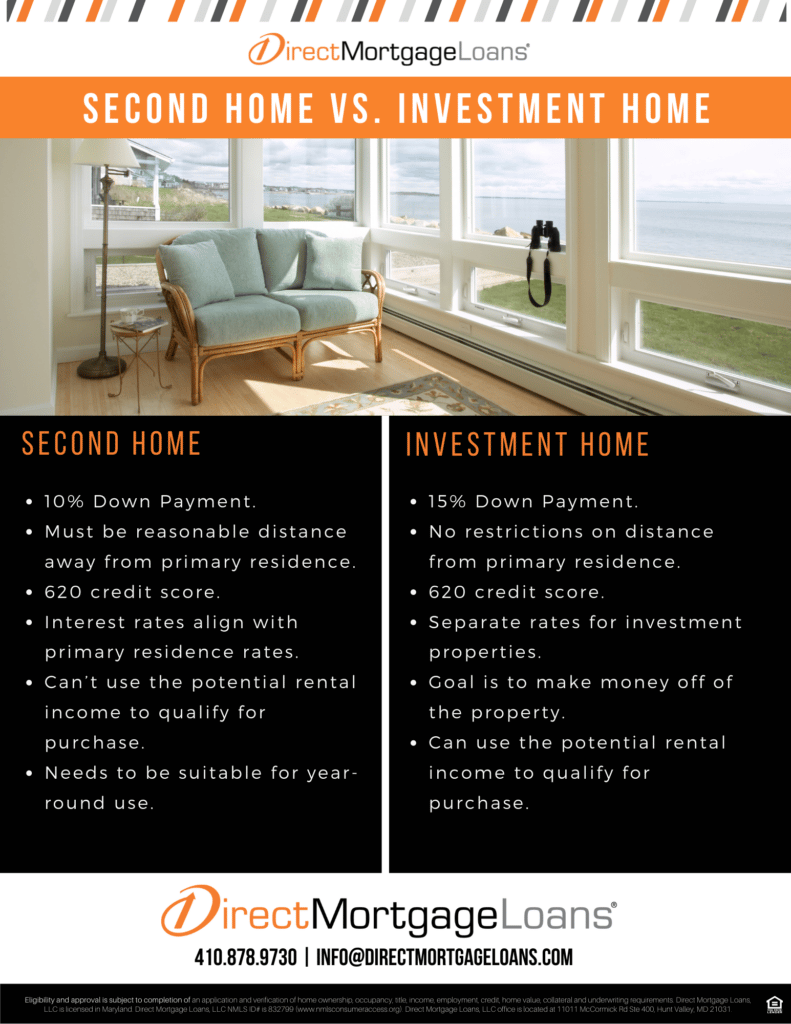

If you don’t currently own a home, you can use the vacation property as your primary residence and qualify for a conventional home loan, provided the purchase price falls within the conforming loan limit.

Alternatively, you have the option to utilize the property as a second home or an investment property. However, be aware that these loan options may come with higher interest rates and a larger down payment. For personalized advice on the best financing option to buy a beach house, reach out to a Loan Officer today.

Step 3- Deciding Where to Buy a Beach House

Choosing the ideal location for your beach house is a crucial decision that demands thorough research and thoughtful consideration. Take into account the scenic beauty, potential for future profit, rental restrictions, and ease of access. A well-chosen location ensures a rewarding beach house experience for you and offers promising investment prospects for the future.

Step 4- Save for Down Payment and Closing Costs

Plan and save for the down payment and closing costs before house hunting to avoid stress during the process. Use our free interactive mortgage calculators to stay prepared and avoid surprises later.

Step 5- Obtain a Pre-Approval Letter from Your Lender

Before you begin your search for the perfect beach home, obtaining a pre-approval is of utmost importance. This makes your offer more competitive to sellers and simplifies the buying process. Start the pre-approval process today by downloading our DML app!

Step 6- Find a Knowledgeable Real Estate Agent

Connect with a reliable real estate agent who knows the area. They’ll guide you through potential issues and offer valuable support after the purchase. If you need help finding a reputable realtor, we’re here to connect you with our trusted partners!

Step 7- Submit an Offer

Once you’ve found a beach house you want to buy, submit your offer with guidance from your real estate agent. Your agent can help provide insight into what attracts sellers in that area and will guide you in crafting a competitive offer.

Second & Investment Home Premier Mortgage Program

Unlock opportunities with our Second & Investment Home Premier mortgage program – tailored solutions for your property investment goals.

- Conforming underwriting without the pricing hits

- Up to 3 points, and/or 1.5% rate better than conventional pricing on second & investment homes

- No to low LLPAs

- Eligibility with down payments less than 25%

- Better pricing for condos

Connect with a loan officer near you to learn more.

Things To Consider When Buying a Beach House

Owning a beach house offers various benefits, but before you dive headfirst into this exciting venture, it’s crucial to take essential to take certain factors into consideration to ensure that your investment is a financially stable decision.

FAQ’s About Buying a Beach House

Should I buy a beach house as a vacation home or a permanent residence?

Deciding between buying a beach house as a vacation home or a permanent residence is a personal choice, and the right decision will depend on your individual circumstances. Interestingly, a growing number of homebuyers in urban areas are choosing to invest in a “second home” even before purchasing their primary residence. The reason behind this trend is that these second homes are often situated in regions where property prices have not yet experienced exorbitant increases.

Is buying a beach house a good investment?

Buying a beach house can be a good investment, but it depends on several factors. The location is key, as properties in popular coastal areas often appreciate over time. Analyzing local real estate trends and potential rental income is vital. Other considerations include additional costs, tax implications, and the long-term commitment required. Owning a beach house can bring emotional rewards and diversify your investment portfolio, but thorough research and financial planning are necessary. Consulting with experts can offer valuable guidance in making an informed decision.

Should I consider a fixer-upper or a move-in ready beach house?

Choosing between a fixer-upper and a move-in ready beach house depends on your preferences and circumstances. Consider your budget, time constraints, and renovation skills to make the best choice for your beach property.

Fixer-Upper

- Pros: Lower cost, personalization opportunities, potential for increased property value.

- Cons: Time and effort needed for renovations, possible unexpected costs, temporary inconvenience.

Move-In Ready Beach House

- Pros: Immediate use, predictable costs, convenience.

- Cons: Higher price, limited personalization, and potential competition from other buyers.

Leave A Comment

You must be logged in to post a comment.