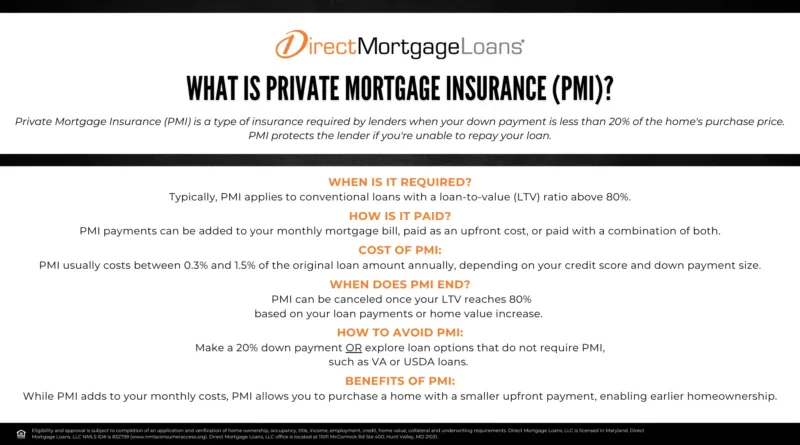

Private Mortgage Insurance (PMI)

When it comes to conventional loans with low down payments, Private Mortgage Insurance (PMI) often comes into play. This insurance serves as a safeguard for lenders, allowing them to provide financing for buyers with down payments below 20%.

What is PMI?

PMI functions as a risk-reducing tool, enabling lenders to offer financing even with down payments as low as 3%. If your down payment falls short of 20% for a home purchase, you’re required to pay the monthly PMI premium. This insurance helps lower the lender’s risk.

How does PMI work?

The cost of PMI premiums can fluctuate based on factors such as loan type, loan-to-value (LTV) ratio, credit score, and loan conditions. This premium protects the lender if the borrower defaults. You can organize payments as a lump sum at closing, or have the fee included in your monthly mortgage payments.

What are the pros and cons of PMI?

It’s essential to understand the advantages and drawbacks of PMI to make an informed decision. Let’s explore the pros and cons:

PMI Pros

- Lower Down Payments: One of the most significant benefits of PMI is that it allows you to purchase a home with less than a 20% down payment. This lower barrier to entry can be especially beneficial for first-time homebuyers or those who might not have a substantial amount of savings for a down payment.

- Financial Flexibility: PMI provides you with the financial flexibility to keep funds available for future needs. Instead of tying up a significant portion of your savings in a down payment, you can allocate those funds towards other investments, emergency funds, or other essential financial goals.

- Rate Lock: PMI can help secure your loan at the current interest rate. By locking in the current rate, you can have more predictable monthly payments, which can be especially valuable in a rising interest rate environment.

- Temporary PMI: As you pay off 20%, in order terms, when you have 20% equity in the home, and the loan-to-value (LTV) ratio drops below 80%, you can request to cancel the PMI.

PMI Cons

- Higher Monthly Costs: PMI increases your monthly mortgage payment. This additional cost can impact your budget and potentially make homeownership less affordable, especially if you’re already stretching your budget to afford the home.

- Lender Protection: It protects the lender, not the borrower. This means that you’re paying an additional cost to provide protection to the lender, without directly benefiting from the insurance coverage.

- Cancellation Complexity: Eliminating PMI might require an official request or appraisal and the overall process can be complex, involving specific requirements to be met.

Lender Paid Mortgage Insurance (LPMI)

Lender Paid Mortgage Insurance (LPMI) offers an alternative approach to handle mortgage insurance costs. Here’s a closer look at LPMI:

What is LPMI?

In LPMI, your mortgage lender covers the insurance cost, simplifying payments. Instead of separate premiums, the cost is integrated into your mortgage rate, slightly raising your interest rate.

How does LPMI work?

With LPMI, the lender pays for the mortgage insurance, but it’s not free by any means. This cost adjustment is typically reflected in a slightly higher interest rate. Nonetheless, it could lead to lower monthly payments and greater potential tax deductibility, making it an attractive option for some borrowers.

What are the pros and cons of LPMI?

Gaining insight into the benefits and potential drawbacks of LPMI is crucial for informed decision-making. Let’s delve into the pros and cons:

LPMI Pros

- Reduced Interest Expense: LPMI might charge less in extra mortgage interest compared to monthly PMI premiums. This can make a noticeable difference in the total cost of your mortgage over time, potentially saving you money, especially if you plan to stay in the home for an extended period.

- Tax Deductibility: If you itemize your tax returns, the increased interest cost from LPMI can sometimes be deducted. This deduction can provide a financial benefit, helping to offset some of the costs associated with LPMI.

- Enhanced Affordability: LPMI can contribute to making your monthly payments more affordable, as the insurance cost is spread over the entire loan term. This can be particularly beneficial if you’re looking to manage your monthly budget and need some flexibility in your cash flow.

LPMI Cons

- Higher Interest Rate: Typically comes with a higher interest rate. While this may initially lead to more manageable monthly payments, it can result in higher overall interest costs over the life of the loan.

- Potential Long-Term Costs: LPMI might lead to higher overall expenses, especially for homeowners who plan to sell relatively quickly or refinance. While the reduced monthly payments might seem appealing initially, the higher interest rate could result in greater total costs, especially if you move or refinance before you’ve had the opportunity to build substantial equity in the home.

- Limited Elimination Options: LPMI is non-refundable, and there are limited options for cancellation compared to traditional PMI. With LPMI, you might not have the same ability to cancel the insurance when you reach a certain level of equity or when your loan-to-value ratio drops below a specific threshold.

What is the difference between PMI and LPMI?

Private Mortgage Insurance (PMI) and Lender Paid Mortgage Insurance (LPMI) both address the risk of low-down payment loans, but their payment structures vary. With PMI, you pay a monthly premium, while LPMI involves the lender covering the insurance cost through a slightly higher interest rate.

How to Decide Between LPMI and PMI

As you consider your mortgage options, it’s crucial to weigh the advantages and drawbacks of PMI and LPMI. Evaluate your financial goals, current budget, and potential long-term costs to make an informed decision that aligns with your needs.

FAQs About PMI and LPMI

Can I choose between PMI and LPMI with any type of mortgage?

The ability to select between PMI and LPMI depends on the lender’s policies, available loan products, and current market conditions. It’s important to note that not all lenders offer LPMI, and its availability may vary over time. Connect with one of our expert Loan Officers to discuss your options!

How does LPMI affect my monthly mortgage payment?

Lender-Paid Mortgage Insurance (LPMI) doesn’t directly change how much you pay each month for your mortgage. Instead, with LPMI, your mortgage interest rate goes up a bit, but you don’t have to make separate monthly insurance payments.

Can I get a refund on LPMI if I refinance or sell my home?

LPMI does not offer refunds upon refinancing or selling your home. On the other hand, if you have borrower paid mortgage insurance (BPMI), there’s potential for a refundable rate. BPMI provides the flexibility to opt for either a refundable or non-refundable option.

Why might you have to pay private mortgage insurance?

Private Mortgage Insurance (PMI) may be required based on specific circumstances, primarily related to the type of mortgage you’re seeking. Here are the types of mortgage loans that typically involve mortgage insurance:

- Conventional loans with a down payment of less than 20 percent.

- FHA (Federal Housing Administration) loans, which mandates a Mortgage Insurance Premium, regardless of the down payment amount.

- VA (Veterans Affairs) loans, which require a Guarantee Fee, regardless of the down payment amount.

- USDA (United States Department of Agriculture) loans, also needs a Guarantee Fee, regardless of the down payment amount.

Is PMI tax-deductible?

Homeowners might have the opportunity to claim tax deductions for PMI. It’s advisable to seek guidance from a tax expert regarding the tax-deductibility of PMI.

How long do you have to pay PMI?

Lenders must cancel PMI when the loan-to-value (LTV) reaches 78% (or 22% equity is reached) based on the original appraised value of your home and the payment schedule at that time. You can request PMI cancellation if you have made additional payments on your mortgage, or if your home has appreciated at a rate where you have equity of at least 20% based on your home’s current market value.

Can I remove PMI after 2 years?

If you’ve owned the property for a minimum of two years, you can qualify for the removal of PMI if your remaining mortgage balance is no more than 75 percent of the current value of the property. However, it’s essential to request early PMI cancellation in writing, maintain on-time mortgage payments, have no second mortgages, and be willing to pay for a home appraisal.

Leave A Comment

You must be logged in to post a comment.