If you’re thinking about buying a home in North Carolina, you’re in luck! North Carolina is an excellent choice for first time homebuyers because of its affordability and diverse housing options. In this comprehensive guide, we’ll provide you with detailed information about the available first time home buyer NC down payment assistance programs. Let’s dive in to explore the program details, requirements, and how to apply.

Subscribe to our blog to receive notifications of posts that interest you!

What should I know about buying a home in North Carolina?

North Carolina is an attractive location for first-time homebuyers due to its affordability and diverse housing options. For first-time homebuyers in North Carolina, there are a variety of programs available to assist with the purchase of a home. These programs could provide down payment assistance, closing cost assistance, and other forms of support.

Is there a first time home buyer program in NC?

North Carolina offers a variety of programs tailored for first time home buyers. These options include the NC Home Advantage Mortgage program, the NC 1st Home Advantage Down Payment program, several community homebuying initiatives, and the NC Home Advantage Tax Credit. Furthermore, those looking to purchase a home in North Carolina can also explore DML’s Go Direct 100% FHA financing program.

First Time Home Buyer NC Assistance Programs

In North Carolina, there are several programs to aid first time home buyers. These programs provide down payment assistance, closing cost assistance, and other forms of support to eligible borrowers. Here’s a rundown of the top programs, how they function, and who’s eligible.

NC Home Advantage Mortgage

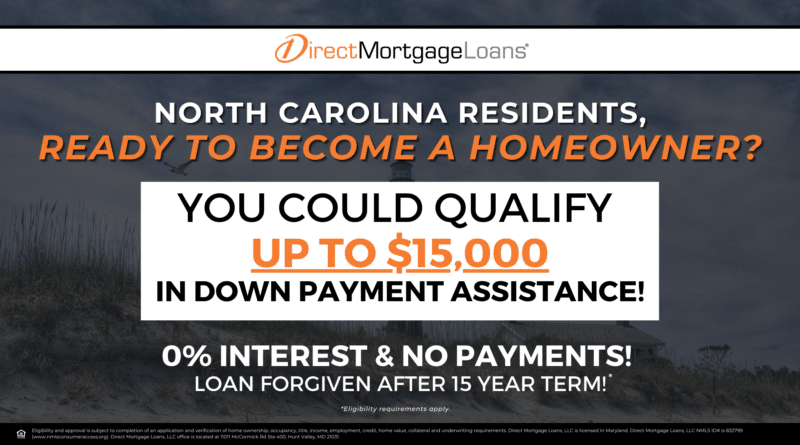

The NC Home Advantage Mortgage program offers stable, fixed-rate mortgages and up to 3% in down payment assistance for eligible first-time and move-up home buyers. It also offers a special $15,000 down payment assistance option exclusively for first-time buyers and military veterans who meet additional criteria.

NC Home Advantage Mortgage Requirements

To be eligible for the NC Home Advantage Mortgage program, you must:

- Purchase a home in North Carolina

- Make the purchased home your primary residence within 60 days of closing

- Have an annual income below $134,000

- Have a credit score above 640

- Be a legal resident of the United States

NC Home Advantage Mortgage Down Payment Assistance NC Requirements

The NC Home Advantage Mortgage program offers two types of down payment assistance:

- Standard down payment assistance: Up to 3% of the purchase price of the home, with a maximum of $10,000.

- Special down payment assistance: $15,000, available to first-time buyers and military veterans who meet additional criteria.

Down payment assistance received through the NC Home Advantage Mortgage program is forgivable, but there are repayment requirements if you sell, refinance, or transfer the home before year 15. The down payment assistance is forgiven at a rate of 20% per year between years 11 and 15, with complete forgiveness at the end of year 15.

NC Home Advantage Mortgage Pros and Cons

The NC Home Advantage Mortgage offers many advantages for first-time homebuyers looking to purchase eligible properties. However, like any program, it comes with its own set of considerations.

NC Home Advantage Mortgage Pros

- Support for First-Time Homebuyers: This program is tailored to assist first-time homebuyers, providing valuable resources and financial assistance to help them enter the homebuyer market.

- Down Payment Assistance: The program offers down payment assistance of up to 3% of the loan amount, making homeownership more attainable for those with limited funds.

- Stable, Fixed-Rate Mortgages: Borrowers benefit from stable, fixed-rate mortgages, providing predictability in their monthly payments.

NC Home Advantage Mortgage Cons

- Primary Residence Requirement: To qualify for this program, you must live in the purchased home as your primary residence. This means it may not be suitable if you plan to rent the property out.

- Price Limits: The program prioritizes assisting individuals or families with more modest means and may not be the best fit for those looking to purchase expensive homes.

Understanding these pros and cons can help you determine whether the NC Home Advantage Mortgage aligns with your homeownership goals and circumstances.

NC 1st Home Advantage Down Payment

The NC 1st Home Advantage Down Payment program grants eligible first-time homebuyers and military veterans $15,000 in down payment aid. It operates like other NC Home Advantage Mortgage™ down payment assistance options, with a 0% deferred second mortgage. This assistance forgives 20% annually from years 11-15, ultimately reaching full forgiveness by year 15. It’s funded through tax-exempt mortgage revenue bonds.

NC 1st Home Advantage Requirements

To qualify for the NC 1st Home Advantage Down Payment program, you must:

- Be a first-time homebuyer (or a military veteran) or be purchasing a home in a targeted census tract

- Have an income and property sales price within program limits

- Purchase a home in North Carolina

- Plan to make the home your primary residence within 60 days of closing

- Have a credit score of 640 or higher

- Be a permanent legal resident of the United States

Eligible property types for this program include single-family homes, townhouses, condominiums, and new manufactured homes (with a minimum credit score requirement of 660).

NC 1st Home Advantage Pros and Cons

The NC 1st Home Advantage Down Payment offers several benefits for first-time homebuyers and military veterans struggling to come up with the funds for a down payment. However, it is important to be aware of the program’s requirements and potential drawbacks as well.

NC 1st Home Advantage Pros

- Down Payment Assistance: The program offers a substantial $15,000 in down payment assistance, making homeownership more accessible.

- Zero Percent Interest: This assistance comes with no interest, reducing the overall cost of your home purchase.

- Deferred Second Mortgage: You don’t have to start making payments on the down payment assistance until year 11, providing financial flexibility in the early years of homeownership.

- Forgiveness Feature: From years 11 to 15, 20% of the down payment assistance is forgiven annually, and the entire balance is forgiven at the end of year 15 if you stay in your home.

NC 1st Home Advantage Cons

- Primary Residence Requirement: You must occupy the home as your primary residence within 60 days of closing, limiting rental opportunities.

- Potential Repayment: If you sell the home or refinance the mortgage before the year 15, you may have to repay some or all the down payment assistance, which can complicate the selling or refinancing process.

If you’re considering this program, weigh the benefits and drawbacks carefully before deciding whether it’s right for you.

NC Community Home Buying Programs

The North Carolina Housing Finance Agency (NCHFA) offers a number of Community Home Buying Programs to assist low- and moderate-income buyers who are looking to purchase a home. The two most popular community home buying programs are:

Community Partners Loan Pool (CPLP)

The CPLP is a down payment assistance program for eligible low- and moderate-income homebuyers. Borrowers can receive up to 25% of the sales price or a maximum loan of $50,000, whichever is less. This assistance is provided as a zero-interest, subordinate loan, and it must be used alongside an NC Home Advantage Mortgage™ or a USDA Section 502 Direct loan.

Self-Help Loan Pool (SHLP)

Collaboration between NCHFA and Habitat for Humanity affiliates (SHLP Members) that offers zero-interest, shared mortgage financing for eligible low- and moderate-income buyers purchasing Habitat homes. Shared mortgage financing means that both the borrower and NCHFA own a portion of the mortgage.

NC Community Home Buying Program Requirements

To qualify for either of these Community Home Buying Programs you must meet the following requirements for the corresponding program:

Community Partners Loan Pool (CPLP) Requirements

- Have an income below 80% of their county’s area median income

- Meet the credit score and other requirements of the NC Home Advantage Mortgage™ or the USDA Section 502 Direct loan program

- Purchase a North Carolina home

- Occupy the home as their primary residence

- Complete six hours of homebuyer education and two hours of one-on-one pre-purchase counseling provided by a HUD-approved housing counseling agency.

Self-Help Loan Pool (SHLP) Requirements

- Have an income below 80% of their county’s area median income

- Meet program underwriting requirements, including household income limits

- Purchase a Habitat for Humanity home

- Participate in the construction or rehab of the home they are purchasing.

NC Community Home Buying Program Pros and Cons

Community Home Buying Programs offer valuable benefits to eligible low- and moderate-income homebuyers, but it’s crucial to understand the eligibility criteria and program limitations.

NC Community Home Buying Program Pros

- Down payment assistance: The CPLP provides down payment assistance of up to 25% of the sales price or a maximum loan of $50,000, whichever is less. This could help borrowers overcome one of the biggest barriers to homeownership: the down payment.

- Shared mortgage financing: The SHLP offers shared mortgage financing for eligible low- and moderate-income buyers purchasing Habitat homes. This means that borrowers and NCHFA each own a portion of the mortgage, which can make monthly payments more affordable.

- Zero-interest loans: Both the CPLP and the SHLP offer zero-interest loans, which can save borrowers money over the life of the loan.

- Help for those who need it most: The Community Home Buying Programs are specifically designed to help low- and moderate-income North Carolinians, who are often the most underserved in the housing market.

NC Community Home Buying Program Cons

- Eligibility requirements: The Community Home Buying Programs have specific eligibility requirements that borrowers must meet to qualify. These requirements include income limits, credit score requirements, and other factors.

- Program restrictions: The Community Home Buying Programs have certain restrictions, such as the requirement that borrowers must use the down payment assistance from the CPLP in conjunction with an NC Home Advantage Mortgage or a USDA Section 502 Direct loan.

- Limited availability: The Community Home Buying Programs are limited to a certain amount of funding, so they may not be available to all eligible borrowers.

Understanding these pros and cons can help you decide whether these programs align with your homeownership goals and circumstances. For further questions, speak with a North Carolina Direct Mortgage Loans representative.

Go Direct FHA 100% Financing

Direct Mortgage Loans is proud to offer the Go Direct FHA 100% financing, a powerful solution for eligible home buyers looking to purchase a home with no down payment required.

This program pairs an FHA loan with a second mortgage of up to 3.5% (based on the lesser of the sales price or appraised value) to cover the required down payment. The second mortgage features a 10-year term, making homeownership more accessible than ever.

Want to learn more or see if you qualify? Contact one of our expert Loan Officers today!

Go Direct FHA 100% Financing Key Benefits

The Go Direct 100% Financing Program offers a powerful path to homeownership by eliminating the need for a down payment, making it accessible to buyers across a wide range of income levels. Unlike many other programs, it is not limited to first-time home buyers; anyone who meets the eligibility requirements can apply. The program is also credit-friendly, welcoming individuals with less-than-perfect credit, and it imposes no maximum debt-to-income ratio, allowing for more flexible qualification.

A key feature is the second mortgage component, which provides up to 3.5% of the home’s value (based on the lesser of the sales price or appraised value) to cover the down payment. This second lien comes with a competitive 10-year term and offers both amortized and forgivable repayment options, giving borrowers added flexibility. Additionally, non-occupant co-borrowers are allowed without restrictions, making it easier for buyers to qualify with support from family or others.

Go Direct FHA 100% Financing Requirements

To be eligible for Go Direct FHA 100% financing you must meet the following requirements:

- Have a minimum credit score of 620.

- Maximum Debt-to-Income (DTI) ratio of 45%.

- Must complete a Homebuyer Education course.

- No First-Time Homebuyer Requirements.

- Borrowers must follow FHA loan limit guidelines and adhere to maximum HUD county limits.

- There are no restrictions on non-occupant co-borrowers.

Applying for the Go Direct FHA 100% Financing No Down Payment Home Loans

To apply for our Go Direct FHA 100% financing loan program, complete the following steps:

- Apply Directly with Us: Start your application with Direct Mortgage Loans and let our expert team guide you every step of the way.

- Verify Eligibility & Obtain Pre-Approval: We can assist you in verifying eligibility and obtaining pre-approval if you qualify for the program.

- Complete Homebuyer Education Course: At least one borrower must complete a Home Buyer Education Course.

- Close on Your New Home: Once you have been approved and completed the required Homebuyer Education course, you are set you close on your new home.

NC Home Advantage Tax Credit

The NC Home Advantage Tax Credit is a federal tax credit that can help eligible first-time homebuyers and military veterans save up to $2,000 annually on their federal taxes. The tax credit is based on the amount of mortgage interest you pay each year, and it can be claimed for up to 15 years.

NC Home Advantage Tax Credit Requirements

To be eligible for the NC Home Advantage Tax Credit, you must:

- Be a first-time homebuyer, military veteran, or purchase a home in a targeted census tract.

- Meet income and sales price limits.

- Purchase a home in North Carolina.

- Apply for and receive Mortgage Credit Certificate (MCC) approval before the home purchase.

- Occupy the home as your primary residence within 60 days of closing.

- Be a legal resident of the United States.

NC Home Advantage Tax Credit Pros and Cons

The NC Home Advantage Tax Credit is a valuable program for eligible homebuyers, offering substantial financial benefits. However, it’s essential to understand the eligibility criteria and potential drawbacks before applying.

NC Home Advantage Tax Credit Pros

- Tax Savings: This program allows you to reduce your federal taxes by up to $2,000 annually, resulting in significant long-term savings, especially when dealing with high interest rates.

- Extra Funds for Mortgage: The tax credit provides additional funds that can be directed towards your monthly mortgage payments, potentially accelerating your loan repayment.

- Combining with NC Mortgage: If you qualify for both the NC Home Advantage Tax Credit and the NC Home Advantage Mortgage, you could maximize your savings when purchasing your home by combining these programs.

NC Home Advantage Tax Credit Cons

- Pre-Purchase Approval: To benefit from the tax credit, you must obtain MCC (Mortgage Credit Certificate) approval before buying a home; post-purchase applications are not accepted.

- Primary Residence Requirement: To qualify for the tax credit, you must reside in the purchased home as your primary residence within 60 days of closing, limiting rental opportunities.

- Legal U.S. Residency: Eligibility for the tax credit requires legal residency in the United States.

Carefully considering these pros and cons will help you determine whether the NC Home Advantage Tax Credit aligns with your homebuying goals and situation.

How To Apply For First Time Home buyer NC Down Payment Assistance

To apply for the NC Down Payment Assistance, complete the following steps.

- Visit the program website to check your eligibility.

- If you are eligible, submit an application.

- Find a participating mortgage lender in your area. Direct Mortgage Loans is an approved lender for Down Payment Assistance Programs in North Carolina.

Please note that the application process may vary depending on the mortgage lender you choose.

Be sure to contact one of our local lenders directly for more information.

First Time Home Buyer NC Down Payment Assistance FAQ’s

How do I qualify for a first time home buyer program in NC?

The qualifications and requirements for first-time home buyer programs in North Carolina vary depending on the program. However, most programs will have some general requirements, such as:

- Income limits: First-time home buyer programs are typically designed for low- and moderate-income borrowers.

- Credit score requirements: Most programs will require borrowers to have a minimum credit score.

- Occupancy requirements: Borrowers must typically intend to occupy the home as their primary residence.

In addition to these general requirements, some programs may have additional requirements, such as:

- Home purchase price limits: Some programs may limit the purchase price of the home that is eligible for assistance.

- Program-specific requirements: Some programs may have additional requirements, such as completing home buyer education or volunteering in the community.

To learn more about the specific qualifications and requirements for a particular first time home buyer program in North Carolina, find a participating lender near you.

What is the minimum down payment in North Carolina?

The minimum down payment for a conventional mortgage in North Carolina is 3.5% of the home’s value. However, some first time home buyer programs and government-backed loans may allow for lower down payments. Here is a summary of the minimum down payment requirements for different types of loans in North Carolina:

- Conventional loan: A conventional loan meets Fannie Mae or Freddie Mac requirements but isn’t government-backed. Typically, a conventional loan requires a minimum down payment of 3.5% of the home’s value.

- FHA Loan: This loan type is a government-insured mortgage with reduced down payment and credit score requirements to facilitate homeownership. FHA loans typically require a minimum down payment of 3.5% of the home’s value.

- USDA Loan: USDA loans are government-insured mortgages specifically designed to assist low- and moderate-income home buyers in designated rural areas to purchase homes. (0% down payment for eligible borrowers).

- VA Loan: This loan type is a government-backed mortgage program for eligible veterans, active-duty service members, and certain members of the National Guard and Reserves. (0% down payment for eligible borrowers).

Please note that these are just the minimum down payment requirements. Borrowers may choose to make a larger down payment to reduce their monthly mortgage payments and interest costs. If you are considering buying a home in North Carolina, we encourage you to talk to a mortgage lender to learn more about your financing options and to get pre-approved for a loan.

Can I combine multiple assistance programs to purchase my first home?

Yes, you can combine multiple down payment assistance programs to purchase your first home, but it depends on the specific programs you are considering. Some programs have restrictions on whether they can be combined with other programs. For example, in North Carolina, you can combine the NC 1st Home Advantage Down Payment program with the NC Home Advantage Mortgage program. However, you cannot combine the NC 1st Home Advantage Down Payment program with the NC Home Advantage Tax Credit.

Down payment programs subject to additional eligibility requirements that may vary. Eligibility and approval is subject to completion of an application and verification of home ownership, occupancy, title, income, employment, credit, home value, collateral and underwriting requirements. Loan products described here may not be available at the time of application. All products are subject to eligibility and availability.Reach out to your lender to learn more. Direct Mortgage Loans, LLC NMLS ID# is 832799 (www.nmlsconsumeraccess.org). Direct Mortgage Loans, LLC office is located at 11011 McCormick Rd Suite 400 Hunt Valley, MD 21031. Equal housing lender.

Leave A Comment

You must be logged in to post a comment.