The Federal Housing Finance Agency has recently made an announcement regarding significant changes to the fees charged by Fannie Mae and Freddie Mac on conventional and conforming mortgages, known as loan level pricing adjustments (LLPA). These changes are considerable, with some having a positive impact and others having a negative impact. Let’s take a closer look at these changes.

Subscribe to our blog to receive notifications of posts that interest you!

What is Loan Level Pricing Adjustments (LLPAs)?

Fannie Mae and Freddie Mac impose a loan-level pricing adjustment which is a fee that is charged to mortgage borrowers who use a conventional mortgage, and the fee is based on the borrower’s level of risk. The LLPA fee can vary depending on factors such as the borrower’s loan-to-value (LTV) ratio, credit score, type of occupancy, and the number of units in the property. Typically, borrowers pay LLPAs in the form of higher mortgage interest rates and or fees.

How does Loan Level Pricing Adjustments work?

Loan-level pricing adjustments have been in effect since April 2008 in conventional mortgage lending. They were introduced as a response to the financial crisis, as Fannie Mae and Freddie Mac needed to increase their capital and mitigate risk. Rather than making across-the-board fee changes, they introduced loan-level pricing adjustments to adjust the price of a loan based on its risk level. This way, riskier borrowers pay higher prices and higher mortgage rates without penalizing safer borrowers. LLPAs can result in a significant change in a borrower’s mortgage rate, often by 1.00% or more.

How is LLPA calculated?

LLPAs are calculated based on several factors, including a borrower’s credit score, loan-to-value ratio, and the type of mortgage. The higher the risk associated with a borrower’s mortgage loan, the higher the LLPAs will be.

Credit Score

Credit scores are a critical factor in determining LLPAs. Borrowers with lower credit scores are considered higher risk and may be charged higher LLPAs. On the other hand, borrowers with higher credit scores will be charged less LLPAs and in certain scenarios, may be able to avoid LLPAs all together.

Loan to Value Ratio

Loan-to-value (LTV) ratio is another critical factor in determining LLPAs. The LTV ratio is the amount of the mortgage loan divided by the appraised value of the property. The higher the LTV ratio, the higher the LLPAs will be.

Type of Mortgage

The type of mortgage also plays a role in determining LLPAs. Mortgages that are considered higher risk, such as adjustable-rate mortgages (ARMs) or mortgages with interest-only payments, may have higher LLPAs.

How LLPAs Impact Mortgage Borrowers

Starting May 1st, 2023, for loans that are guaranteed by Fannie Mae and Freddie Mac the fee for having a credit score below 680 will be reduced. Although having a lower score will still cost more, this reduction can help save on upfront fees and closing costs. For instance, if you have a score of 659 and are borrowing 75% of the home’s value, then you’ll pay a fee equal to 1.5% of the loan balances whereas you’d pay no fee if you had a 780+ credit score. But before these changes, you would have paid a whopping 2.75% fee. On a hypothetical $300k loan, that’s a difference of $3,750 in closing costs. Furthermore, they have also recently introduced new credit score thresholds for LLPA at 760 and 780, whereas previously they only went up to 740.

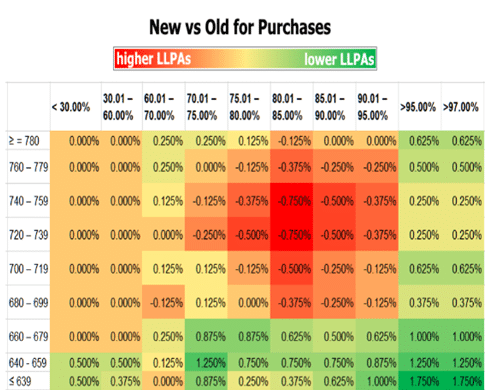

LLPAs Before and After Changes

The following charts show the differences in fees charged as an upfront fee as a percentage of the loan balance. Green and yellow cells indicate where fees have become more affordable, while orange and red cells indicate where they have become more expensive. These upfront fees may not necessarily come out of the borrower’s pocket immediately, as lenders can offer higher interest rates and pay these costs for the borrower. Nevertheless, the costs are still present and are technically being paid by the borrower over time in the form of higher interest rates.

In addition to the changes in fees that can be seen in the heatmap table, there are other changes that are not as easily displayed in a visual format. One of the most significant changes is the introduction of a new charge based on the borrower’s debt-to-income (DTI) ratio. This change is likely to be controversial in many cases. As income calculations can be subjective, and debt calculations can be adjusted with advanced planning or debt consolidation. However, every loan that is guaranteed by the agencies has a DTI attached to it. If a borrower’s DTI is over 40% and they are borrowing more than 60% of their home’s value, then they will be required to pay more fees.

Which lenders and loans are affected by LLPAs?

The loan-level pricing adjustments imposed by Fannie Mae and Freddie Mac affect MOST loans in the U.S., regardless of the lender. Mortgage loans that are not affected by this price adjustment include FHA, VA as well as certain jumbo and specialty products.

Myths About The Loan Level Price Adjustment Changes

Myth: The LLPA Changes Will Increase Mortgage Rates

One of the biggest myths surrounding the LLPA changes is that they will result in higher mortgage rates for borrowers. While it is true that some borrowers may see an increase in their fees, this is not the same as an increase in mortgage rates. Fees are a one-time charge that is added to your closing costs, while mortgage rates are the interest rate you pay on your loan over the life of the loan.

Myth: Low and High Credit Score Borrowers Receive the Same Interest Rate.

While it’s true that there are reduced fees for many borrowers with lower credit scores, it’s a misconception that they pay the same rate as borrowers with higher credit scores. The difference between what they pay is just smaller than it was previously. Fannie and Freddie made these adjustments to increase home affordability. However, having a higher credit score still has many benefits when applying for a home loan

Myth: The LLPA Changes Will Only Affect Borrowers with Low Credit Scores

Another common myth is that the LLPA changes will only impact borrowers with low credit scores. While credit score is one factor that will be considered in the new pricing structure, it is not the only one. Debt-to-income (DTI) ratio will also be factored into the pricing, meaning that borrowers with high levels of debt relative to their income may see an increase in their fees.

It’s important to note that the LLPA changes are not meant to punish borrowers with low credit scores or high DTIs. Rather, they are designed to ensure that lenders are pricing their loans accurately based on the risk associated with lending to a particular borrower.

Myth: LLPA Changes Suggest Now May Not Be an Ideal Time to Buy.

In fact, these changes have created reduced fees for first-time homebuyers and low-to-moderate income borrowers to help more people afford a home. Now is a great opportunity to purchase a home with these advantages.

Myth: The LLPA Changes Will Make It Harder to Qualify for a Mortgage

Another common misconception is that the LLPA changes will make it harder to qualify for a mortgage. While it is true that some borrowers may see an increase in their fees, this does not mean that they will be denied a loan. Lenders will still be required to follow underwriting guidelines that are set by Fannie Mae and Freddie Mac, and borrowers who meet these guidelines will still be able to qualify for a loan.

In fact, the LLPA changes may actually make it easier for some borrowers to qualify for a mortgage. By accurately pricing loans based on risk, lenders may be more willing to lend to borrowers who were previously deemed to be too high-risk.

The Bottom Line

It’s worth noting that the adjustments mentioned will not be the same for everyone. As they depend on individual financial circumstances and the type of property being financed. The aim of these changes is to create a more equitable pricing structure for borrowers with varying credit scores. These adjustments do not make home financing cheaper for those with worst credit and more expensive for those with higher credit. These are merely adjustments to the scale at which the loan level pricing is set. If you have any questions or require more information, then contact one of our expert loan officers for assistance.

Leave A Comment

You must be logged in to post a comment.