What is a mortgage buydown?

A mortgage buydown is a strategic financial arrangement in the realm of home financing that involves the manipulation of mortgage interest rates. This process typically occurs through the collaboration of a mortgage lender and the borrower. The objective of a mortgage buydown is to secure a lower interest rate on the loan, thereby reducing the monthly mortgage payments during the initial years of homeownership.

Subscribe to our blog to receive notifications of posts that interest you!

To implement a mortgage buydown, borrowers may opt to pay discount points upfront to their mortgage lender. These discount points, also known as mortgage points, act as a form of prepaid interest. Each point usually costs 1% of the total mortgage amount.

By paying these points at closing, the borrower can “buy down” the mortgage interest rate for the life of the loan. This leads to a decrease in the monthly mortgage payments, offering financial relief during the early stages of homeownership.

A mortgage buydown can be particularly beneficial for those who anticipate future financial changes or plan to sell the property before the interest rate adjusts. It allows borrowers to enjoy more manageable monthly payments during the initial years, offering greater flexibility and potential savings.

However, it is essential for potential buyers to assess their long-term financial goals and evaluate whether a mortgage buydown aligns with their overall homeownership plans. Consulting with a mortgage professional can help borrowers better understand the implications and potential advantages of utilizing a mortgage buydown strategy. Find one of our loan officers near you!

Who benefits from a mortgage buydown?

Both the buyer and seller can benefit from a mortgage buy down. Concessions offered by the seller paid buydown might help the seller achieve a higher sale price. Furthermore, the buyer benefits by receiving a lower rate and monthly payment for the first two years of the loan without having to pay any points up front. It is even possible for the buyer to offer more for the property (as long as the appraisal supports the price) in order to receive a concession from the seller.

How do mortgage buydowns work?

During the home loan application process, you could buy down your interest rate. Buying down your mortgage interest rate requires out-of-pocket fee for mortgage discount points at closing. In essence, these points reduce your interest rate as they are prepaid interest.

Nevertheless, there are several different types of buydown options you can choose from to obtain a lower interest rate. The process to buy down your interest rate will vary depending on if you choose to opt for a temporary or permanent mortgage rate buydown.

What is temporary buydown vs permanent?

Temporary Mortgage Rate Buydown

A temporary mortgage rate buydown is a lump sum that you pay to your lender to reduce your interest temporarily for the first year(s) of the loan. This allows you to ease into the full mortgage payment at the beginning of the loan term. For example, generally, here is how a temporary mortgage buydown works:

- Both you and your lender will review investor pricing sheets and select the best option that fits your needs.

- You and your lender will select an interest rate that is typically lower than your current rate.

- You pay a lump sum (the buydown) to your lender at closing in addition to your closing costs.

- As a result, the monthly payments are lower than they would be without a temporary mortgage buydown because you secure a lower interest rate while for the first few years, you are paying it down.

Permanent Mortgage Rate Buydown

A permanent mortgage rate buydown can be used to help a buyer lower the interest rate on his or her mortgage. The lump sum amount is paid at closing, and the buyer takes possession of the home with an interest rate that is lower than that shown on the note. However, they will have to make more principal payments over time, to pay off the mortgage at its original terms.

- Discount points are paid to the lender in exchange for a lower rate. The more mortgage points you pay, the lower the rate will be.

- The interest rate will not change for the duration of the loan term unless you get an adjustable-rate mortgage (ARM).

- The buydown fee is paid at closing and is paid in addition to closing costs.

Are mortgage buydowns worth it?

The decision to buy down your mortgage rate requires you to evaluate your plans and financial situation for the future. Here are some scenarios in which a borrower would benefit from a buy-down mortgage:

- If you anticipate your income will increase in the future.

- If you can afford the higher payment but want to line your savings during the lower rate period years.

- If you anticipate selling your home or refinancing your home, soon.

Mortgage Buydown Pros

- Interest Savings: Can temporarily reduce your interest rate by lowering your monthly payment during the initial loan term.

- Price Reduction: This may allow the buyer to pay less from home than the listing price if a seller is offering to pay something toward the buydown.

- Ease into higher payment: Option for homebuyers whose incomes will or are expected to increase in the years to come.

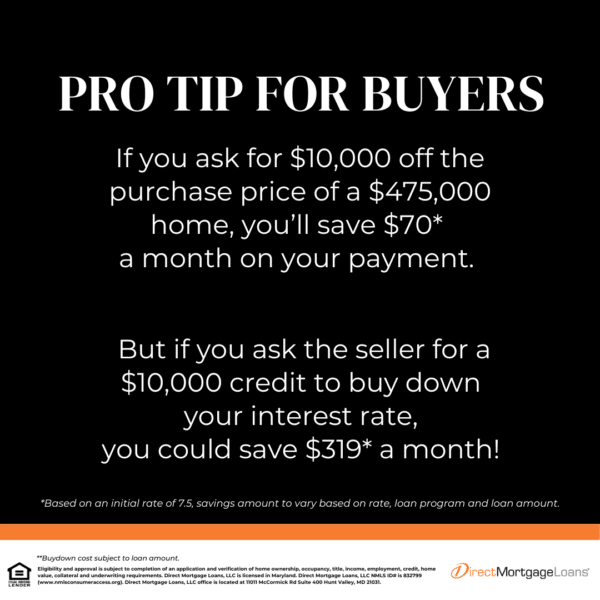

Tip for Homebuyers: Mortgage Rate Buy Down vs Price Reduction

If you ask for $10,000 off the purchase price of a $475,000 home, you’ll save $70* a month on your payment. But if you ask the seller for a $10,000 credit to buy down your interest rate, you could save $319* a month.

Contact Direct Mortgage Loans to learn more.

Mortgage Buydown Cons

- Ongoing affordability: If your income has dropped since purchasing your home, then you may struggle to meet your monthly payments once the initial rate period ends.

- Availability: Depending on the type of property, or the type of mortgage you are applying for, the ability to take advantage of a mortgage buydown may be limited.

- Default Risk: Greater risk of foreclosure if challenges arise to make higher mortgage payments after the initial buydown period.

Lender-Funded Buydown Programs

Looking for an alternative program with a low initial interest rate, with the rate protection of a fixed-rate mortgage? Our lender-funded buydown programs allow the cost of the buydown to be built into the pricing and therefore no buydown funds are required at closing!

Connect With A Direct Mortgage Lender To Learn More Today!

How much does it cost to do a 2-1 buydown?

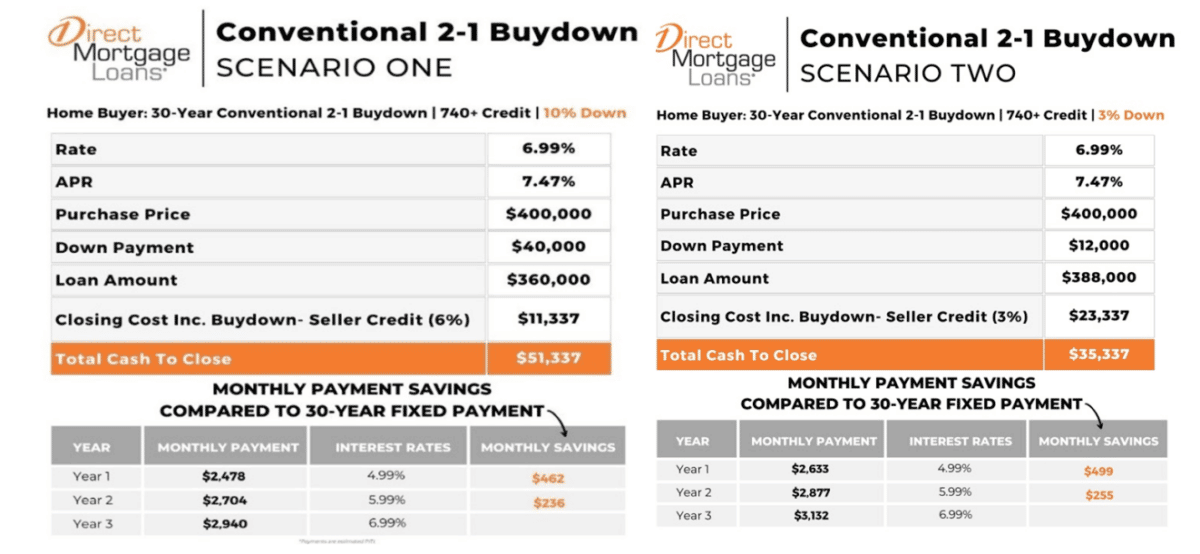

In a 2-1 buydown, a borrower temporarily lowers their interest rate during the first two years of the loan term in exchange for an upfront additional charge.

- 1st Year: The interest rate starts 2% below the locked interest rate. (Two percentage points)

- 2nd Year: The interest rate is 1% below the locked interest rate.

- 3rd Year: The loan converts to the locked interest rate.

*Seller-funded and lender funded options available*

Is a 2-1 buydown worth it?

With climbing interest rates and a shifting house market, a 2-1 buydown mortgage has become an increasingly popular option for both sellers and buyers. Here are some scenarios in which a 2-1 buydown could benefit you!

- Those whose income will increase significantly in the next two years.

- Looking for a lower initial payment without an adjustable-rate loan.

- Have a spouse returning to the workforce in the next 1-2 years.

- First-time home buyers looking for a lower payment in their first years of homeownership.

- Those looking to make it faster and easier to sell their home.

How much does it cost to do a 1 ½ – ¾ buydown?

- In the first year the rate is brought down 1.5%* below the note rate. *(one and one-half percentage points)

- The second year the rate increases 0.75% of 1%. *(three-fourths)

- The third year begins the borrowers’ repayment responsibility for the principal and interest as required by the note.

What is an adjustable-rate mortgage?

An adjustable-rate mortgage (ARM) is a home loan with an interest rate that can adjust over time. Monthly mortgage payments can increase or decrease throughout the life of the loan. Generally, the initial payment is lower than a comparable fixed-rate mortgage.

How does an adjustable-rate mortgage work?

Initial Rate and Payment: One part of an ARM is the initial rate and payment. Upon closing on your home, you will be given an initial interest rate and monthly mortgage payment. With an adjustable-rate mortgage, this initial rate and payment will remain for only a short amount of time; typically, this time frame is between 1 month to 5 or more years.

Remember, with this mortgage loan, the rate and payment can change greatly, or not so much, and may not be related to interest changes in the collective market. Consider asking your lender for the annual percentage rate (APR) to get a better estimate of the amount of change you will see in your rate.

If the APR is greatly higher than your initial rate, then there may be a greater chance that your rate will be much higher when it adjusts. However, this is just an estimate from experience and cannot be factually proven.

Adjustment Period: The adjustment period is the period between your rate changes with an adjustable-rate mortgage. This can vary from loan to loan; for some people, the interest rate and monthly mortgage payment can change monthly, quarterly, yearly, or even longer. For example, if you have a 3-year ARM, your interest rate and monthly payment can change once in three years as you have a 3-year adjustment period.

Interest-Rate Caps: Interest-rate caps are another important concept when you talk about ARMs. An interest rate cap limits the amount your interest rate can change (typically it is an increase). The two types of caps are:

- Periodic adjustment cap: limits the amount of change in interest rate for each adjustment period.

- Lifetime cap: limits the amount of change in interest rate over the entire life of the loan.

Advantages of an Adjustable-Rate Mortgage (ARM)

- Low Initial Payments: Before your rate adjusts (this could be months to years depending on your mortgage agreement), you will get the benefit of lower payments and a lower interest rate.

- Flexibility: If you are expecting life changes soon, you could greatly benefit from an ARM. If you have a 5-year ARM and decide to move before those five years are up, then you can sell the house before having to pay the higher, adjusted interest rate.

Disadvantages of an Adjustable-Rate Mortgage (ARM)

- Payments may increase: When the adjusted rate sets in, the rate may be higher than the initial rate you secured. The adjustment of the rate is uncontrollable and may not correlate with changes in the current market.

What is the difference between buydown and ARM?

The main difference between the two types of loans is the interest rate. An ARM’s interest rate and monthly payment are subject to periodic change throughout the loan term. However, with a buydown, the seller, or sometimes the lender, pays part of the borrower’s interest payment for the year(s) of the loan, but the underlying note rate remains the same. In other words, unlike an ARM, the interest rate does not fluctuate with market conditions with a buydown mortgage.

What makes a mortgage buydown different from paying points?

Both mortgage buydowns and paying points are methods for reducing the interest rate on a mortgage, but they work in different ways.

A mortgage buydown involves paying an upfront fee to reduce the interest rate on a mortgage for a certain period of time, typically for the first few years of the loan. This can make the initial mortgage payments more affordable and may be a good option for homebuyers who expect their income to increase in the future.

For example, in a 2-1 buydown, the interest rate is reduced by 2% in the first year, and by 1% in the second year, after which the interest rate will revert to the original rate for the remainder of the loan term.

Paying points, on the other hand, involved paying an upfront fee to lower the interest rate over the entire term of the loan. Each point typically costs 1% of the loan amount and can lower the interest rate by a certain amount, such as 0.25%. Paying points can be a good option for borrowers who plan to keep the loan for a long period of time and want to lower their total interest costs over the life of the loan.

The main difference between a mortgage buydown and paying points is the duration of the interest rate reduction. A mortgage buydown only reduces the interest rate for a certain period, while paying points can reduce the interest rate over the entire term of the loan. It’s important to carefully consider your options and speak with a lender to determine which option may be best for your situation.

How are mortgage points calculated?

A mortgage point can be used to lower your home’s interest rate, with each point equaling 1% of your total loan. For example, on a $500,000 mortgage 1 point would cost you $5,000 at closing ($500,000 making the cost of your mortgage point $5,000).

Rates are subject to change. Eligibility and approval are subject to completion of an application and verification of home ownership, occupancy, title, income, employment, credit, home value, collateral, and underwriting requirements.

Direct Mortgage Loans, LLC is licensed in Maryland. Direct Mortgage Loans, LLC NMLS ID# is 832799 (www.nmlsconsumeraccess.org). Located at 11011 McCormick Rd Suite 400 Hunt Valley, MD 21031. This is a paid endorsement. Equal housing lender.

Leave A Comment

You must be logged in to post a comment.