How to Buy a House in Oregon as a First Time Home Buyer

Buying your first home in Oregon is an exciting milestone, but it can feel overwhelming. Whether you’re eyeing a trendy Portland condo or a quiet home in Bend, this guide will help you navigate the process step by step.

Start by connecting with a licensed Oregon mortgage professional who can explain your options and help you find programs that fit your financial goals.

Speak with One of Our Licensed Oregon Mortgage Lenders

Gather Your Documents & Begin Pre-Approval

Pre-approval is key to understanding your budget. Collect essential documents like pay stubs, W-2s, and bank statements to speed up the process.

Go Under Contract

Once you’ve found your dream home, we’ll guide you through inspections, appraisals, and negotiations to keep everything on track.

Home Appraisal & Processing

Our team ensures a smooth appraisal and thorough review before underwriting, so you can move forward confidently.

Final Mortgage Approval & Closing

After final approval, you’ll receive your loan commitment and prepare for closing day—the last step before you get your keys.

First Time Home Buyer Oregon Loan Options

Oregon offers a wide range of mortgage options designed to fit the needs of different homebuyers. Whether you’re purchasing your first home, a veteran seeking benefits, or simply looking for programs with low down payment requirements, here’s an overview of the most common loan types available.

FHA Loans

FHA loans are a go-to option for many first-time buyers with limited savings or lower credit scores. Backed by the Federal Housing Administration, these loans make homeownership more accessible by allowing down payments as low as 3.5% for credit scores of 580 or higher. Even those with scores down to 500 may qualify with a 10% down payment. While FHA loans require mortgage insurance, they offer flexible credit and income guidelines, making them an excellent entry point into owning a home

VA Loans

VA loans provide one of the most valuable paths to homeownership for eligible veterans, active-duty service members, and surviving spouses. Backed by the Department of Veterans Affairs, these loans enable lenders to offer exceptional benefits, including zero down payment, no private mortgage insurance (PMI), and competitive interest rates. Designed to honor your service, VA loans make buying a home more affordable and accessible.

USDA Loans

If you’re planning to buy a home in Oregon’s rural or suburban areas, a USDA loan could be an excellent choice. This government-backed mortgage program is designed for buyers with low to moderate incomes in eligible locations. One of its biggest advantages is that USDA loans require no down payment and no private mortgage insurance (PMI), making them an attractive option for first-time buyers who meet the income and location requirements.

Conventional Loans

Conventional loans are a solid choice for first-time buyers with strong credit and some savings. Unlike government-backed programs, these loans aren’t insured by a federal agency but follow standards set by Fannie Mae and Freddie Mac. They offer flexible down payment options and greater control over mortgage insurance, making them ideal for buyers who can meet stricter credit and income requirements and want more say in their loan structure.

Conventional 97 Loans

The Conventional 97 loan is a great option for first time home buyers who want to minimize their upfront costs. With just a 3% down payment required, this loan allows you to borrow up to 97% of the home’s value. It’s a practical solution for buyers who have steady income and good credit but haven’t had time to save a large down payment.

Fannie Mae HomeReady

HomeReady, a Fannie Mae program, is designed to support low- to moderate-income buyers, particularly in high-cost areas. With a down payment as low as 3%, it’s an accessible option for many first-time buyers. Eligible borrowers may also receive a $2,500 credit to apply toward their down payment or closing costs. Plus, HomeReady offers flexibility by allowing income contributions from household members who aren’t listed on the loan.

Freddie Mac Home Possible

Freddie Mac’s Home Possible program is an excellent option for first-time buyers with moderate incomes. Similar to HomeReady, it requires only a 3% down payment and offers reduced private mortgage insurance (PMI) costs. Home Possible also provides flexibility in income calculations and allows co-borrowers who don’t plan to live in the home, making it easier for families to support each other during the buying process.

Piggyback Loans

A piggyback loan is a creative financing strategy that helps buyers avoid private mortgage insurance (PMI) and reduces upfront costs. This method involves taking out two loans at the same time; a primary mortgage and a smaller second mortgage. The second loan covers part of the down payment, keeping the primary loan below 80% of the home’s value. It’s an especially useful option for buyers purchasing higher-priced homes who want to sidestep the added expense of mortgage insurance.

Oregon Down Payment Assistance & Home Buying Programs Through Direct Mortgage Loans

Direct Mortgage Loans offers a range of homebuying solutions for eligible Oregon buyers, including the Go Direct FHA 100% Financing program, which provides a path to homeownership with no down payment required. We also proudly support those who serve our communities through our Law Enforcement Home Buying program, delivering exclusive mortgage benefits for police officers and first responders as a trusted lending partner of the Fraternal Order of Police.

Go Direct FHA 100% Financing for Oregon Home Buyers

This is achieved by combining a 1st and 2nd mortgage and is compatible with FHA loans. The 2nd mortgage can be up to 3.5%, based on the lesser of the sales price or appraised value, and has a 10-year term.

Go Direct FHA 100% Financing Benefits for Oregon Home Buyers

The Go Direct FHA 100 loan is designed to enhance homeownership opportunities by offering key benefits that boost both accessibility and affordability.

- 0% Down Payment

- Standard FHA Guidelines

- Second Lien Financing

These benefits make the Go Direct FHA 100 loan an exceptional choice for eligible buyers aiming to reduce upfront homebuying costs.

Go Direct FHA 100% Requirements for Oregon Home Buyers

To qualify for this program, applicants must meet the following criteria:

- Minimum FICO credit score of 620

- Completion of a Home Buyer Education course to better understand the home buying process

Eligible Property Types Include:

- Single-family homes

- Duplexes

- Manufactured homes

- Townhouses

- Condos

How do I apply for the Go Direct FHA 100% Financing Program as a first time home buyer in Oregon?

To apply for the Go Direct 100% FHA Financing Loan Program in Oregon, follow these steps:

Apply with Direct Mortgage Loans: Begin by submitting your application with Direct Mortgage Loans. Our experienced team will walk you through the process and help you understand your financing options.

Verify Eligibility and Get Pre-Approved: Once your mortgage application is submitted, the next step is to verify your eligibility for the program. If you qualify, Direct Mortgage Loans will assist you in obtaining a pre-approval, which helps determine your homebuying budget.

Complete a Homebuyer Education Course: At least one borrower must complete a Homebuyer Education Course. This course is designed to prepare you for the responsibilities of homeownership and is a required part of the program.

Close on Your New Home: After you’ve been approved and completed the education course, you’ll be ready to close on your new home. This final step brings you one step closer to becoming a homeowner.

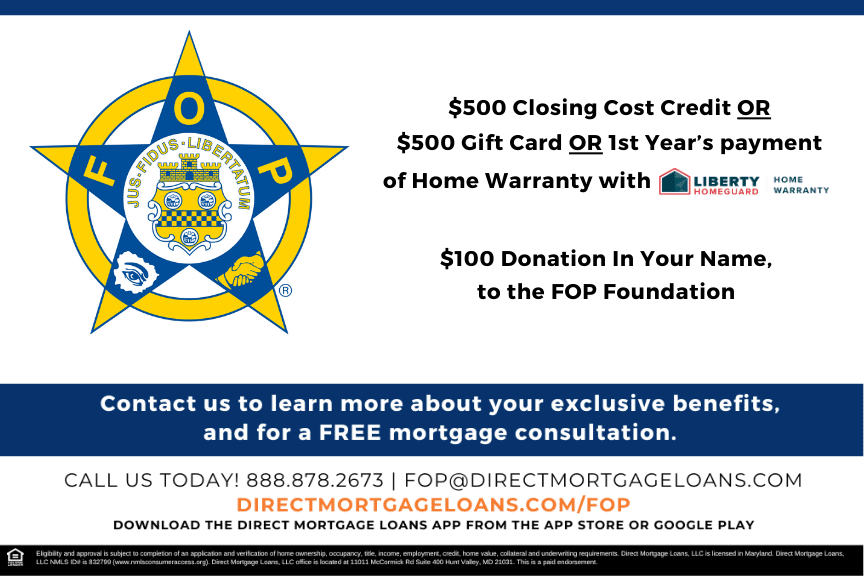

Direct Mortgage Loans Law Enforcement Home Buying Program

As a lending partner of the Fraternal Order of Police, Direct Mortgage Loans is proud to make homeownership possible for those in law enforcement. We offer exclusive mortgage benefits for cops through our specialized law enforcement home buying programs for FOP members. Protecting and serving the community is no easy job. Thankfully, for police officers and first responders, buying a home is a much less stressful process.

Direct Mortgage Loans Law Enforcement Home Buying Program Benefits

As a Law Enforcement Officer, you get to choose from one of the following benefits:

- $500 Closing Cost Credit

- $500 Gift Card

- First Year’s Payment of a Home Warranty through our partnership with Liberty Home Guard

Additionally, we will donate $100 to the FOP Foundation in the name of the FOP member, supporting the foundation’s important causes.

Other Ways to Buy a House as a First Time Home Buyer in Oregon

Buying your first home in Oregon is an exciting milestone, but saving for a down payment can feel like the biggest challenge. The good news is there are several creative and practical strategies to make homeownership more achievable; even if you don’t have a large amount set aside. From receiving financial help from family to leveraging retirement savings or investment accounts, these options can help bridge the gap and bring you closer to owning your first home. Let’s explore some of the most effective ways to fund your down payment and turn your homeownership dream into reality.

Gift Funds

If your family is willing to help with your home purchase, gift funds can be a valuable resource for covering your down payment. These monetary gifts from relatives can significantly reduce your upfront costs, but the rules vary depending on the mortgage program. Some loans allow the entire down payment to be gifted, while others require you to contribute a portion from your own funds. Be sure to discuss this with your loan officer early on so they can guide you toward the right mortgage option and ensure all documentation is properly handled.

Borrow From 401(k)

If you’ve been contributing to a 401(k), you might consider borrowing from it to help cover your down payment. This option lets you access your retirement savings without permanently withdrawing the funds. Essentially, you’re borrowing from yourself and repaying the loan over time, typically through payroll deductions. While this can be a convenient way to access cash, it’s important to understand the potential drawbacks. There may be tax implications, and if you leave your job before the loan is repaid, the remaining balance could become due immediately. Be sure to weigh the pros and cons carefully and consult a financial advisor before moving forward.

Savings

Saving for a down payment is one of the most straightforward and responsible ways to prepare for homeownership. Even small, consistent contributions each month can add up over time. Consider using a high-yield savings account to grow your funds faster and create a budget that prioritizes your homebuying goal. This approach not only builds financial discipline but also strengthens your mortgage application by showing lenders you’re financially prepared

Cash Out on Investments

If you’ve built an investment portfolio, you might consider cashing out a portion to use for your down payment. This can be a smart move if your investments have appreciated significantly, and you’re ready to convert those gains into a long-term asset like a home. However, selling investments can trigger tax consequences and may reduce future earning potential. It’s wise to consult a financial advisor before making any decisions to ensure the impact aligns with your overall financial plan and long-term goals.

First Time Home Buyer Oregon FAQs

Who qualifies as a first time home buyer in Oregon?

Anyone who hasn’t owned a primary residence in the last three years.

Can you buy a home in Oregon with no money down?

Yes! VA loans, USDA loans, and certain FHA programs make it possible to purchase a home without a down payment.

What credit score do I need?

Most loan programs require a credit score of at least 620, though some options are available for borrowers with scores as low as 580.

Leave A Comment

You must be logged in to post a comment.