Increasing home prices in today’s market have made 8/10/10 piggyback loans a popular option for borrowers who need to borrow more than the conforming loan limit and need a Jumbo Loan. Let’s delve into what a piggyback loan is, how it operates, and how to decide if it’s the right choice for you!

Subscribe to our blog to receive notifications of posts that interest you!

What is a piggyback loan?

A piggyback loan is a two-part financing strategy where you take out two mortgages simultaneously. First, you secure a primary mortgage, which typically covers around 80% of the home’s purchase price. Then, a smaller second mortgage “piggybacks” on top, functioning like an extra boost for your down payment.

This second mortgage, often a Home Equity Line of Credit (HELOC), helps you reach the 20% down payment threshold. By achieving this threshold, you avoid private mortgage insurance (PMI), which adds an extra cost to your monthly payment.

Subscribe to our blog to receive notifications of posts that interest you!

How does a piggyback loan work?

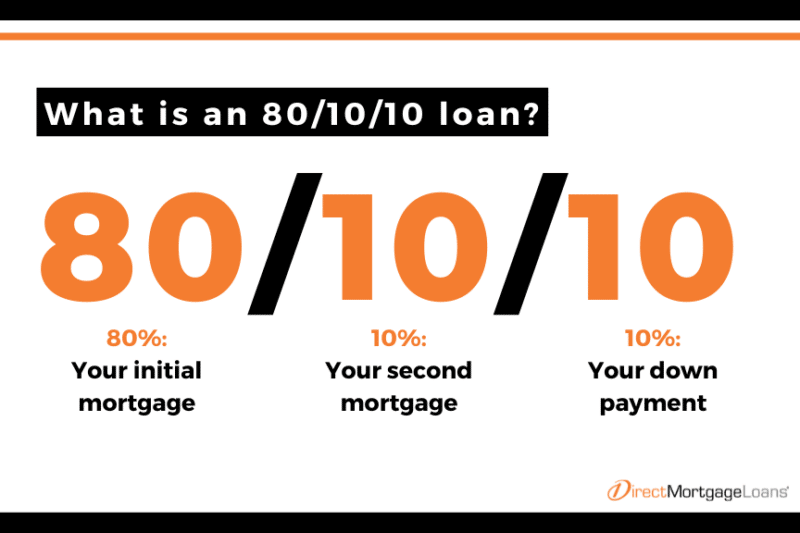

Piggyback loans, also known as 80/10/10 loans, offer a way to finance a home purchase using two separate mortgages. Let’s break down the three key components:

- Primary Mortgage: The first mortgage covers the majority of the home’s purchase price, typically around 80%.

- Smaller Second Mortgage: The second mortgage, often a home equity line of credit (HELOC), acts as a supplement to your down payment. This second loan usually covers around 10% of the home’s value.

- Down Payment Equivalent: By combining these two loans, you can achieve a 20% down payment on the house (10% down payment + 10% second mortgage) without needing large amounts of cash up front.

This structure allows you to avoid private mortgage insurance (PMI), which is typically required for traditional mortgages with a down payment of less than 20%.

Types of Piggyback Loans

The two most common types of piggyback loans are a Home Equity Line of Credit (HELOC) and a Down Payment Loan. Here is a brief overview of how these loans work:

Home Equity Line of Credit (HELOC) / Fixed Rate Closed End

A home equity line of credit (HELOC) allows you to open a credit line secured by the equity you’ve built up in your existing home. This functions like a second mortgage in the piggyback scenario. During the closing of your new home, you can access funds from the HELOC to contribute toward your down payment.

While HELOC’s generally have adjustable interest rates, there are also fixed-rate closed-end options available. With this option, you could convert some or all the money borrowed on the HELOC to a fixed interest rate and then repay the amount over a specified number of years.

Down Payment Loan

Down payment loans function somewhat similarly to piggyback mortgages. These programs are designed to help homebuyers who may struggle to come up with a 20% down payment. Typically offered through state financing agencies, these loans come with their own set of requirements. Direct Mortgage Loans offers a variety of down payment assistance programs. Speak to a Loan Officer to learn more!

How to Save on Your Mortgage With an 80/10/10 Piggyback Loan

The 80/10/10 piggyback loan has gained popularity due to increasing home prices. It is a good option for borrowers who would otherwise need a jumbo loan. This loan allows borrowers to surpass the conforming loan limit with a down payment of less than 20%. Depending on your financial situation, this could help you save on your mortgage since jumbo loans usually have higher interest rates.

80/10/10 Piggyback Loan Breakdown

The 80/10/10 piggyback loan is a popular strategy for financing a home purchase with a lower down payment than the traditional 20%. It works by combining two separate mortgages with a 10% down payment from your savings.

The figure above illustrates the breakdown of an 80/10/10 loan, where 80% represents the initial mortgage, 10% is for the second mortgage, and 10% accounts for the down payment.

Pros & Cons of a Piggyback Loan

While it is apparent that there are many advantages of this type of loan. It is important to weigh the pros and cons of any mortgage decision you make.

Pros of a Piggyback Loan:

- No PMI: This loan helps you avoid paying private mortgage insurance (PMI), possibly saving you money over the loan term.

- More Cash on Hand: Without PMI added to your monthly mortgage payment, you could hold onto more cash for emergencies or unexpected repairs.

- Avoid a Jumbo Loan: When you need a loan amount above the conforming loan limit, you typically need a jumbo loan, which requires a higher credit score and larger down payment. With a piggyback loan, you can avoid this by spreading the borrowed amount across two loans.

Cons of a Piggyback Loan:

- Stricter Qualifications: The requirements for a piggyback loan may be stricter because the lender is taking on more risk by approving two loans at the same time.

- Double Closing Costs: You’ll need to pay closing costs on both the first and second mortgage, which increases your upfront expenses.

- Could Cost More than PMI: Making two mortgage payments could end up being more expensive than paying private mortgage insurance (PMI), depending on the loan terms. It’s important to compare the total loan costs of both options carefully to determine which is more costly.

Piggyback Loan Requirements

To be eligible for an 80/10/10 piggyback loan, you must meet the requirements for both the first and second mortgage. The first mortgage, usually a conventional loan, requires a minimum credit score of 620, while the HELOC part of the piggyback loan may require an even higher credit score, typically around 680 or more.

Lenders also consider your debt-to-income ratio (DTI), which compares your monthly debt payments to your gross monthly income. For piggyback loans, the DTI requirement is generally stricter, with lenders requiring a ratio of around 43% or lower, compared to the 50% limit for conventional loans.

How To Get A Piggyback Loan

If you’re looking to get a piggyback loan, there are some general steps you can take.

- Connect with a Loan Officer: Start by speaking with an expert Loan Officer to discuss your financial situation and goals. They will be able to assess if a piggyback loan is the right fit for you.

- Gather your Documents: Before applying, gather your financial documents like pay stubs, tax returns, and bank statements. You’ll need these for both the first and second mortgage.

- Apply for the Primary Mortgage: Submit a pre-approval application for the initial home loan, typically a conventional loan.

- Apply for Second Mortgage: Once approved for the first mortgage, you will then submit a pre-approval application for your second mortgage, typically a home equity line of credit (HELOC).

- Prepare for Closing: Review loan documents, sign paperwork, and pay closing costs for both mortgages.

Piggyback Loan FAQ’s

Is it hard to get a piggyback loan?

Securing a piggyback loan could be more challenging than getting a traditional mortgage. This is because you essentially need to qualify for two loans at the same time. To make sure you can handle both monthly payments, lenders may require a higher credit score and a lower debt-to-income ratio than they would for a standard mortgage.

Why might a borrower take a piggyback loan?

There are several reasons why a borrower may choose to take out a piggyback loan. The most common reason is to avoid private mortgage insurance (PMI), which is an additional fee added to conventional loans when the down payment is less than 20%. Moreover, piggyback loans could help you reduce the amount of money needed upfront for a down payment or even qualify for a more expensive home by splitting the financing into two loans.

Can you refinance a piggyback loan?

You could refinance your piggyback loan with a new one if you qualify for a lower interest rate or more favorable terms. It’s best to speak with a loan officer about your specific situation to help you determine if refinancing your piggyback loan makes sense for your financial goals.

Does Direct Mortgage Loans offer piggyback loans?

Yes, Direct Mortgage Loans offers an 8/10/10 piggyback loan as well as a variety of other loan programs personalized to fit your specific needs. Speak with a Loan Officer to see if this option is right for you!

Leave A Comment

You must be logged in to post a comment.