First responders play a crucial role in safeguarding and serving our communities. To assist them, several specialized mortgage programs cater to police officers, firefighters, paramedics, and other first responders, helping this group to become homeowners. In this article, we will discuss who qualifies as a first responder, how these programs work, and the benefits they offer.

Subscribe to our blog to receive notifications of posts that interest you!

Who is considered a first responder?

First responders are individuals employed by state or local public agencies who provide emergency response services. Specifically, law enforcement officers, paramedics, emergency medical technicians (EMTs), and firefighters are all examples of those considered to be first responders.

How do first responder home loans work?

First responder home loans are mortgage programs specifically designed to help individuals such as police officers, firefighters, paramedics, and other qualifying first responders to finance a home. These programs could offer more favorable terms and benefits, depending on the type of home loan selected.

Direct Mortgage Loans Law Enforcement Home Buying Program Benefits

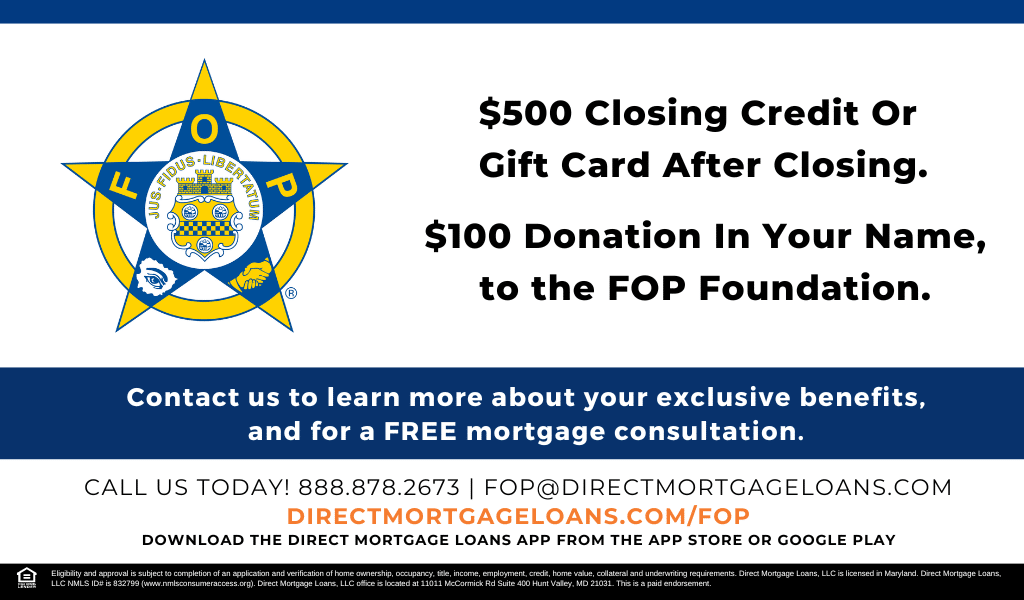

Direct Mortgage Loans is the Fraternal Order of Police’s (FOP) preferred lending partner, offering exclusive mortgage benefits to police officers and their families. As a Law Enforcement Officer, you could receive a $500 closing credit or gift card (after closing) to assist with your home financing needs. Furthermore, in your name, we will donate $100 to the FOP Foundation to support their causes.

Law Enforcement and First Responder Mortgage Programs

If you are a law enforcement officer or first responder, then there are several mortgage programs available. Here is a general overview of the types of programs:

Conventional Mortgage

A conventional mortgage is a type of loan that is not insured or guaranteed by the government. These loans are typically considered conforming loans as they adhere to the standards set by Fannie Mae and Freddie Mac. With conventional mortgages, borrowers have several down payment options that range from 3% to 20%.

FHA Loan

FHA loans are a type of mortgage regulated by the Department of Housing and Urban Development (HUD). These loans are designed to provide flexible guidelines for borrowers with limited down payment funds and a less-than-perfect credit history. They are particularly popular among first-time home buyers since they accept lower credit scores and a 3.5% down payment.

VA Loan

The Department of Veteran Affairs (VA) offers loan programs to help service members, veterans, and their families purchase homes. These loans could provide eligible borrowers with a competitive fixed VA mortgage rate, no down payment, and no monthly mortgage insurance premiums.

USDA Loan

These loans are designed to help low and moderate-income borrowers interested in purchasing a home in rural areas. These loans are government-insured and intended for use in designated rural areas.

Renovation Loan

If you’re thinking of buying a property and making some home improvements, then there are two government backed loans you could choose from. The first option is the FHA 203(k) Loan, which allows you to finance both the home purchase and necessary repairs as a single mortgage.

The second option is the Freddie Mac CHOICE Renovation Loan, which is a conventional loan offered by private lenders but backed by Freddie Mac, a mortgage giant. This loan combines purchase price and renovation costs, like the FHA 203(k) Loan. However, it may have stricter eligibility requirements compared to the FHA 203(k) Loan.

Good Neighbor Next Door Program

First Responders, which include Law Enforcement Officers, Teachers, Firefighters, and Emergency Medical Technicians can be eligible for HUD’s Good Neighbor Next Door Program. This program offers a 50% discount from the list price of a home that is in a revitalization area. In exchange, eligible buyers must commit to living in the property for 36 months as their primary residence.

Homes for Heroes

The Homes for Heroes program is a financial assistance program that supports first responders like firefighters, police officers, teachers, and military members in buying, selling, or refinancing their homes. It is the largest nationwide network with affiliate real estate agents, mortgage lenders, and local businesses. The program offers various benefits such as reduced real estate service fees, lending fees, and special hero discounts. Specifically, heroes could save an average of $3,000 through this program after closing on a house.

Eligibility Criteria for First Responder and Law Enforcement Home Loans

To determine your eligibility for First Responder and Law Enforcement Home Loans. Consider the type of loan, and ensure you’re working with a lender who will be transparent about your options. Below are the general requirements you should keep in mind:

- First-Responder Status: If you plan on using a program like Homes for Heroes, then you must be a first responder.

- Credit Score: The minimum credit score requirement varies depending on the loan, but it is recommended to have a score of at least 640 or higher.

- Income Requirements: The program you choose may have income limits that you must meet to qualify. These limits are typically based on the median income in your county.

- Loan Limits: The loan program usually has a maximum loan amount allowed. For example, DML can offer conforming loans up to $750,000.

Advantages of Home Loans for First Responders and Law Enforcement

If you’re a first responder or law enforcement officer, then there are several perks available to you. Many programs provide grants and down payment assistance tailored specifically for first responders. For example, Homes for Heroes and the Good Neighbor Next Door Program could offer substantial savings to eligible borrowers.

Additionally, law enforcement officers could benefit from exclusive mortgage benefits, including a $500 closing credit or gift card (after closing) to aid in home financing. As part of this program, we also donate $100 to the FOP Foundation in your name to support their initiative.

First Responder First Time Home Buyer Grant

A grant is like a gift, it’s an amount of funds provided to the borrower with no qualifications of repayment. As a first responder, you may qualify for a grant through programs such as the Good Neighbor Next Door Program or Homes for Heroes. While certain conditions and requirements apply, both programs offer grants that do not need to be repaid.

How can I find a lender that offers law enforcement and first responder loans?

Direct Mortgage Loans is the preferred lending partner of the Fraternal Order of Police and participates in the Homes for Heroes program. Speak with one of our expert Loan officers to discuss your options!

How to Apply for First Responder Home Loans

If you’re interested in applying for a First Responder Home Loan through Direct Mortgage Loans, then here is an overview of the steps in the process:

- Speak with a Mortgage Lender: Reach out to one of our expert Loan Officers to set up a no-obligation call to discuss your home buying goals and specific financial situation.

- Gather Documents & Submit Application: The next step includes gathering your financial documents like W-2’s paystubs and bank statements. Then using these documents to complete the pre approval application.

- Find a Home: Work with a trusted Real Estate Agent to find a place to call home and submit an offer.

- Closing: After the offer has been accepted, sign the necessary documents, transfer funds, and complete any remaining steps outlined by your real estate agent and lender.

FAQ’s About First Responders and Law Enforcement Home Buying Programs

Do first responders get better mortgage rates?

When it comes to mortgage rates, your eligibility depends on factors like your credit score, debt-to-income ratio, and down payment. Although first responders do not get lower rates, there are some incentives available that could help with the out-of-pocket expenses when purchasing a home.

What professions are considered first responders?

First responders include police, firefighters, EMTs, paramedics, 911 dispatchers, military personnel (active and veterans), healthcare professionals, and educators. Review the full list of eligible first responder professions and verify your first responder status.

Are there special home loans for police officers?

Police officers who are eligible can take advantage of special home loans and programs such as Homes for Heroes and The Good Neighbor Next Door Program. These programs offer special savings that are granted by real estate agents, lenders, and title/inspection specialists. Regardless of the type of loan, if you work with Direct Mortgage Loans, you and your family and friends will also be eligible for exclusive mortgage benefits.

Do police officers get a VA loan?

Police officers may be eligible for a VA loan under certain conditions. To qualify, a police officer must have served 90 consecutive days of active service during wartime, 181 consecutive days of active service (not during wartime), have 6 years of service in the National Guard or Reserves, or be the spouse of a service member who passed away during duty or due to a service-related disability.

What types of first responder down payment assistance programs are available?

There are several types of first responder down payment assistance programs available to help heroes such as firefighters, police officers, veterans, and others. Some of these programs include:

- Homes for Heroes: This program is offered by various nonprofit organizations and lenders and provides benefits like down payment assistance and closing cost assistance tailored to first responders.

- Good Neighbor Next Door: This program is run by the U.S. Department of Housing and Urban Development (HUD) and allows qualified first responders to purchase HUD homes in revitalization areas at a discounted price, often 50% of the appraised value.

- FOP Mortgage Benefits: Law enforcement officers are eligible for this program through DML. They can receive a $500 closing cost credit or gift card to aid in their home financing needs. Additionally, a $100 donation to the FOP Foundation is made in their name to support the Foundation’s causes.

Leave A Comment

You must be logged in to post a comment.