Is it cheaper or more expensive to build or buy a house?

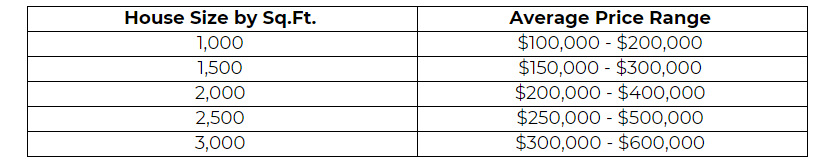

As of June 2023, the median sales price for new houses sold was $415,400, with an average sales price of $494,700. When building a house, the cost depends on factors like size and location. On average, constructing a new home cost around $150 per square foot. Here’s an approximate cost breakdown for different house sizes:

Discover your financing options with DML’s construction loans!

Cost Considerations: Building a House vs Buying

Before deciding whether to buy an existing home or build a new one, consider the cost factors for each option:

Cost of Building a New House

- Land Plot: Factor in the expense of acquiring the land for construction.

- Home Financing: Secure funding for the construction project.

- House Plans & Design Fees: Include expenses for developing house plans and architectural services.

- Permits & Inspection Fees: Account for costs associated with obtaining necessary permits and complying with local regulations.

- Labor: Allocate the price for hiring skilled professionals, including the general contractor and laborers.

- Site Work/Excavation: Budget for costs of preparing the construction site.

- Foundation & Framing: Consider expenses for building a stable foundation and structural framework.

- Utilities & Finishes: Include costs for essential utilities and finishing the house’s interior and exterior.

- General Maintenance & Unexpected Costs: Plan for miscellaneous expenses and general maintenance throughout the construction process.

Cost of Buying a House

- Home Inspection: A thorough inspection could identify potential issues before finalizing the purchase of the home.

- Maintenance & Repairs: Budget for higher maintenance and repair costs, especially for aging elements like roofs and gutters.

- Less-Efficient Major Appliances: Older homes may have less energy-efficient appliances, leading to higher utility bills.

- HOA Fees: If part of a homeowner’s association, there will be HOA fees for communal amenities and services.

Start your application to begin your homebuying journey!

Building A New Home: Pros and Cons

Having examined the expenses associated with purchasing and constructing a new home, it is time to delve into the advantages and disadvantages of each option.

Pros of Building a New House

- Personalization: You have full control over the design to match your preferences.

- Reduced Competition: Avoid bidding wars commonly experienced in the existing home market.

- Lower Maintenance: Newer homes can come with warranties for major systems and appliances.

- Modern, Safe Materials: No worries about hazardous substances found in older homes.

- Better Energy Efficiency: Building an energy-efficient home can cut down on your home’s energy usage and electricity bills.

Cons of Building a New House

- Can Be Stressful: The process of building a new home requires hands-on involvement and can be demanding and stressful at times.

- Unexpected Costs and Delays: Unforeseen expenses and construction delays are common in new home construction.

- Lengthy Build Time: Building a new home takes much longer than buying an existing home.

- Limited Negotiating Power: Unlike the resale market, new homes can offer limited flexibility with closing costs or purchase price.

Apply for a Construction Loan today!

Buying An Existing Home: Pros and Cons

If you’re considering buying an existing home, here are the advantages and disadvantages to review.

Pros of Buying an Existing Home

- Faster Move-In: Often quicker closing process allows you to move in sooner.

- Room to Negotiate: You can negotiate the price and discuss repairs with the seller.

- Less Risk: The overall process is usually easier, and home loans are less risky than land loans.

- Renovating over Time: Flexibility to renovate and improve the property gradually.

Cons of Buying an Existing Home

- Unforeseen Issues & Repairs: Aging homes may have hidden repair expenses.

- Compromise on Wants & Needs: Finding a perfect match may require compromising on certain features.

- Environmental Concerns: Older homes may have environmental issues, such as harmful substances like lead paint or asbestos.

- More Competition: In a competitive real estate market, desirable existing homes may face more competition, leading to bidding wars and higher prices.

How to Decide If Building or Buying a Home Is Right for You

When deciding between an existing home and a newly constructed one, consider the actual monthly cost of owning your home beyond the sales price. Newly built homes often result in lower energy bills and require less maintenance, potentially reducing your monthly expenses. Additionally, paying more in interest each month may offer an added tax benefit.

Leave A Comment

You must be logged in to post a comment.