What are bank statements?

Bank statements are monthly or periodic documents provided by your bank that summarize the financial activities and transactions within your account. They offer a detailed record of your deposits, withdrawals, transfers, and other financial movements during a specific time period. When it comes to bank statement mortgages, these statements serve as the primary proof of income, enabling borrowers, especially those with non-traditional income sources, to qualify for a home loan without relying on typical tax documents or pay stubs. For lenders, this means evaluating an applicant’s financial behavior over time through these statements to ensure the borrower’s ability to repay the loan.

Subscribe to our blog to receive notifications of posts that interest you!

What is a bank statement loan?

A bank statement mortgage is a non-QM loan program that utilizes bank statements for calculating a borrower’s income. Unlike traditional mortgages that rely on tax returns and W-2 forms, bank statement loans offer alternative documentation options. Primarily designed for self-employed individuals who often face challenges in proving their ability to repay due to significant tax write-offs, bank statement mortgage programs evaluate applicants using personal or business bank statements.

How do bank statement loans work?

In a bank statement mortgage, the borrower’s income verification does not rely on employment verification forms. Instead, the lender assesses personal, or business bank statements provided by the borrower.

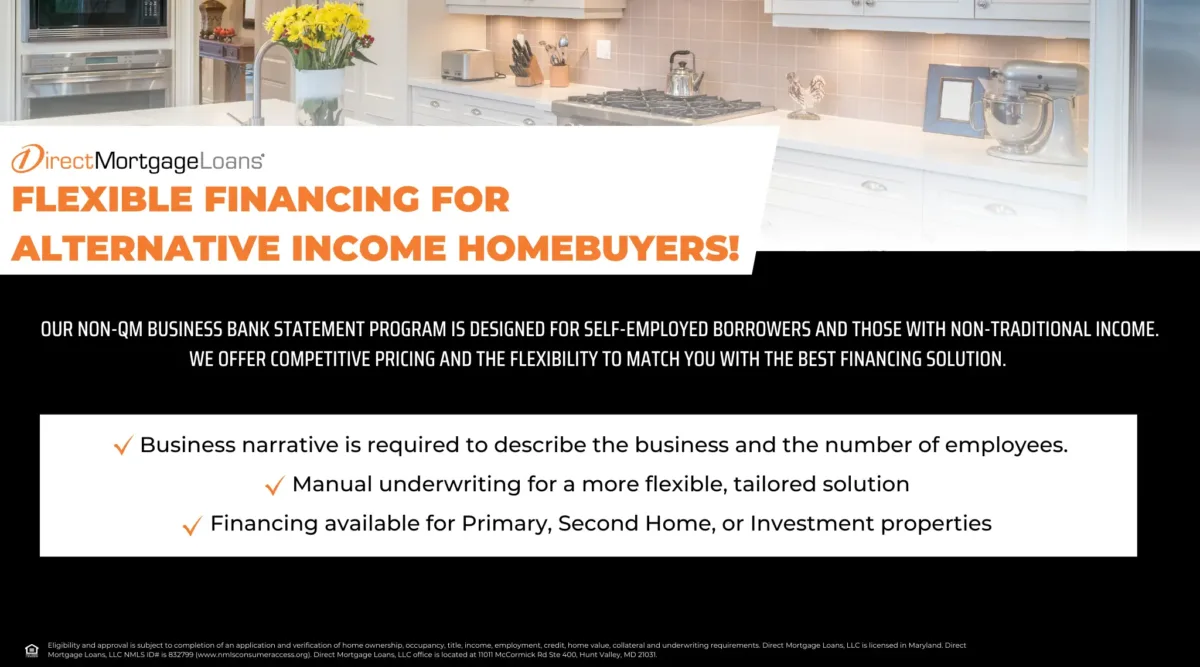

Who can benefit from a bank statement mortgage?

Bank statement mortgages benefit self-employed individuals, those with non-traditional income, seasonal workers, individuals with inconsistent cash flow, and borrowers with lower credit scores. These mortgages allow them to qualify based on their bank statements, providing a flexible alternative to traditional mortgages.

Pros and Cons of Bank Statement Loans

Before deciding if this option is right for you, thoroughly assess the benefits and drawbacks of a bank statement mortgage. By carefully considering these factors, you can determine if this loan option aligns with your specific needs and circumstances.

Pros of Bank Statement Loans

- Flexibility in Income Verification: Bank statement mortgages allow borrowers to qualify without relying on W-2s, pay stubs, or tax returns. This is particularly beneficial for self-employed individuals and those with non-traditional income sources.

- Eligibility for Second Homes and Investment Properties: Bank statement mortgages often extend financing options to borrowers looking to purchase second homes or investment properties.

- No Requirement for Private Mortgage Insurance (PMI): With a 20% down payment, bank statement mortgage borrowers can avoid the additional cost of private mortgage insurance.

- Potential for Higher Loan Limits: Bank statement mortgages may offer higher loan limits compared to traditional mortgages, allowing borrowers to access larger amounts of funding.

Cons of Bank Statement Loans

- Higher Down Payment Requirement: May require a higher down payment compared to other types of home loans, making it necessary for borrowers to have more funds available upfront.

- Potentially Higher Interest Rates: In some cases, bank statement mortgages may come with higher interest rates than traditional mortgages.

- Limited Availability: Not all lenders offer bank statement mortgages, limiting the options available to borrowers. It is important to research and find lenders who specialize in this type of loan product.

- Business History Requirement: To qualify for a bank statement mortgage, some lenders may require borrowers to have an established business history, which could pose challenges for individuals with newer businesses or self-employment ventures.

Bank Statement Loan Requirements

Minimum Credit Score

While specific requirements may vary, most lenders will require a minimum credit score for bank statement loans. This score is typically higher compared to conventional loans, often ranging from 640 to 680 or higher.

Stable Income

Lenders will typically look for a history of stable income. This can be demonstrated through consistent deposits into your bank account over a specified period, usually around 12 to 24 months.

Bank Statements

As the primary documentation for income verification, you’ll need to provide bank statements covering a specified period, typically ranging from 12 to 24 months. These statements should reflect regular deposits that can be attributed to your income.

Self-Employment or Business Ownership

Bank statement loans are often favored by self-employed individuals or business owners who may have irregular income streams. You’ll need to provide evidence of your business ownership or self-employment status, such as business licenses, tax filings, or other relevant documentation.

Down Payment

The required down payment for a bank statement loan can vary, but it’s often higher than conventional loans. Expect to put down at least 10% to 20% of the home’s purchase price, although some lenders may require more.

Cash Reserves

Lenders may require you to have reserves, which are additional funds set aside in savings or other liquid accounts. This is to ensure you have enough money to cover mortgage payments and other expenses in case of unforeseen circumstances.

Debt-to-Income Ratio

While bank statement loans are more flexible than traditional loans, lenders will still evaluate your debt-to-income (DTI) ratio. This ratio compares your monthly debt obligations to your gross monthly income. Typically, lenders prefer a DTI ratio below 43%, but some may accept higher ratios depending on other factors.

Proof of Assets

In addition to bank statements, you may need to provide documentation of other assets, such as retirement accounts, stocks, or other investments.

How do I qualify for a bank statement loan?

When applying for a bank statement mortgage, it is typically necessary to provide specific documentation to support your application. Although the exact requirements can vary among lenders, here are the general steps for qualification:

- Meet with a Loan Officer: Schedule a meeting with a Loan Officer from Direct Mortgage Loans to explore your mortgage options and receive personalized guidance.

- Gather Supporting Documentation: Collect the necessary supporting documentation for your mortgage pre-approval. This may include bank statements, tax returns, pay stubs, identification documents, proof of address, and any other documents requested by the lender.

- Complete and Submit the Pre-Approval Application: Fill out and submit the pre-approval application. Utilize the secure DML app to conveniently upload your documents from your mobile device or desktop.

- Review and Determine Loan Amount: Once you have completed the pre-approval application and provided the required documentation, your mortgage lender will review your application, assess your financial situation, and determine your loan amount.

- Pre-Approval Letter: If you meet the necessary requirements and qualify for the bank statement mortgage, your mortgage lender will issue a pre-approval letter, which outlines the approved loan amount and serves as confirmation of your eligibility.

How Does the Bank Statement Mortgage Program Compare to Traditional Mortgages?

Bank statement mortgages differ from traditional mortgages in terms of their requirements for documentation, credit score, and debt-to-income ratio. While traditional mortgages typically require extensive documentation and a high credit score, bank statement mortgages offer greater flexibility in these areas. Nonetheless, they may come with higher interest rates and fees and may require a larger down payment.

Is a bank statement mortgage right for you?

Deciding if a bank statement mortgage is right for you depends on your unique financial situation and goals. This type of home loan is especially suited for self-employed individuals, freelancers, or anyone with non-traditional income sources who may have difficulty meeting the documentation requirements of a traditional mortgage. If your income is steady but unconventional, such as through business ownership or freelance work, a bank statement mortgage could be a flexible and viable option. By relying on personal or business bank statements instead of W-2s and tax returns, this loan type evaluates your financial health holistically.

However, it’s important to be aware of potential downsides, like larger down payment requirements, compared to conventional mortgages. To find out if this option aligns with your homeownership or refinancing goals, consider speaking with one of our loan officers who can walk you through the specifics and assess your eligibility.

How do I find a loan officer that offers bank statement mortgages?

Bank statement mortgages are just one of the loan options Direct Mortgage Loans has to offer. Specifically, here are some other common non-QM mortgage loan programs we have to offer.

- Stated Income Loans: These loans allow borrowers to qualify based on their stated income, rather than their verifiable income.

- Alternative Documentation Loans: These loans allow borrowers to provide alternative forms of documentation, such as bank statements or tax returns, in order to qualify for a loan.

- Investor Cash Flow: These loans allow borrowers to use the cash flow on a home to qualify for an investment property.

FAQ’s About Bank Statement Loans

Are bank statement loans hard to get?

Bank statement loans cater to those who may not meet the typical standards for income verification, such as self-employed individuals, independent contractors, or those with variable cash flow. While these loans offer greater flexibility by using bank statements instead of traditional documents like pay stubs and tax returns, qualifying could still present challenges. Applicants generally need to show a solid credit history, stable deposits, and available cash reserves to demonstrate financial reliability.

Lending standards could vary, but compared to conventional loans, bank statement loans may require a larger down payment and could have stricter interest rate terms. This added scrutiny ensures borrowers could handle the responsibilities of a mortgage. Despite these hurdles, for individuals who have difficulty fitting into the mold of traditional mortgage qualification, bank statement loans offer a worthwhile and viable alternative.

How quickly can you close with a bank statement mortgage?

The time it takes to close a bank statement mortgage varies, often depending on the lender’s processes, the completeness of your documentation, and the complexity of your financial profile. Generally, the timeline can be similar to conventional mortgages, typically ranging from 30 to 45 days, though it may take longer due to the detailed analysis required of bank statements. Having well-prepared documentation and promptly responding to any lender requests could expedite this process.

A smooth and efficient closing process is achievable if you work with a knowledgeable lender experienced in bank statement loans, like Direct Mortgage Loans. The knowledge lender could provide guidance on potential challenges, help streamline document submission, and offer a clearer expectation for your unique case, potentially leading to a faster closing. Make sure to see if you are pre-approved before you go through the process of acquiring one of these loans.

What credit score is needed for a bank statement mortgage?

The required credit score for a bank statement mortgage can vary depending on the lender and loan program you select. However, in general, borrowers usually need a minimum credit score of 640 to qualify for this type of mortgage.

How many months of bank statements will I need for the mortgage?

Typically, you’ll be required to submit personal and/or business bank statements covering the last 12 to 24 months, as per the lender’s requirements. These statements must display your consistent income deposits and account transactions.

How much can I borrow with a bank statement mortgage?

With a bank statement mortgage, you have the potential to borrow between $150,000 and $3 million, depending on your eligibility. Meeting the minimum requirement of $150,000 is essential, and the specific loan amount within this range will be determined by factors such as your creditworthiness, income stability, debt-to-income ratio, and other relevant considerations assessed by the bank. Your income and financial profile will play a significant role in determining the loan amount you qualify for.

What kind of documentation do I need to provide for a bank statement mortgage?

- Bank statements: You will generally need to provide personal and/or business bank statements for the past 12 to 24 months, depending on the lender’s specifications. These statements should show your regular income deposits and account activity.

- Proof of identity: You will need to provide a valid form of identification, such as a driver’s license, passport, or government-issued ID, to verify your identity.

- Proof of address: Lenders typically require proof of your current address, which can be demonstrated through documents like utility bills, lease agreements, or bank statements that show your name and address.

- Income documentation: While a bank statement mortgage is designed for individuals with non-traditional income, you may still be required to provide some income-related documents. This can include tax returns, profit and loss statements, 1099 forms, or other relevant documents that support your income claims.

- Business documentation (if applicable): If you are self-employed or own a business, you may need to provide additional documentation such as business licenses, articles of incorporation, or partnership agreements to verify your business existence and ownership.

- Asset documentation: Lenders may require documentation related to your assets, including bank account statements, investment account statements, or property ownership documents. This helps demonstrate your financial stability and ability to handle mortgage payments.

- Credit information: While a bank statement mortgage may be more flexible regarding credit requirements, you may still be asked to provide your credit report or authorize the lender to obtain it to assess your creditworthiness.

Can I use bank statement mortgages for a home purchase or a refinance?

Bank statement home loans can be used to purchase your next home or refinance your current mortgage. There are two types of refinancing options to be aware of. A refinance-rate is often used by homeowners to get a lower interest rate and more affordable monthly mortgage payments, or you can get a cash-out to refinance, which allows you to pull equity out of your home and convert it into cash. In the latter case, the lender will pay off your existing mortgage, disperse cash to you and grant you a new loan that includes the amount you pull out.

Can I get a bank statement loan if I am not self-employed?

While bank statement loans are often associated with self-employed individuals, it is possible for borrowers with traditional employment to obtain this type of loan as well. However, it’s important to note that eligibility criteria and requirements can vary among lenders.

Bank statement loans for non-self-employed borrowers are specifically designed to cater to individuals with income sources that are challenging to document using conventional methods. For instance, if you receive income from rental properties, investments, or freelance work, and can demonstrate a consistent and stable income through your bank statements, you may be eligible for a bank statement loan.

Eligibility and approval is subject to completion of an application and verification of home ownership, occupancy, title, income, employment, credit, home value, collateral and underwriting requirements. Direct Mortgage Loans, LLC NMLS ID# is 832799 (www.nmlsconsumeraccess.org). Direct Mortgage Loans, LLC office is located at 11011 McCormick Rd Suite 400 Hunt Valley, MD 21031. Equal housing lender.

Leave A Comment

You must be logged in to post a comment.