Your credit score is one of the most important factors in the home-buying process. It influences not only your ability to qualify for a mortgage but also the interest rate you’ll receive. Understanding what credit score is needed to buy a house, how mortgage lenders evaluate scores, and how to improve your credit score could help you secure better loan terms and move closer to achieving your dream of homeownership.

Subscribe to our blog to receive notifications of posts that interest you!

What credit score do mortgage lenders use for home loans?

Mortgage lenders rely on credit scores to assess your financial reliability and risk level. Most lenders use FICO Scores, which are calculated using your financial history, and are provided by three major credit bureaus: Equifax, Experian, and TransUnion.

FICO Scores

FICO Scores are the industry standard for mortgage lending. These scores reflect your financial habits, ranging from 300 (poor) to 850 (excellent). A higher FICO Score indicates a lower risk to lenders, potentially qualifying you for better interest rates and loan terms.

- Borrowers with scores above 740 are considered excellent candidates and often receive the most favorable rates.

- Scores between 620 and 740 are acceptable for many home loan types, though interest rates and terms may vary.

- Scores below 620 may limit your loan options, though government-backed loans like FHA and VA loans often cater to borrowers with lower scores.

The three main credit bureaus—Equifax, Experian, and TransUnion—compile the data used to calculate your FICO Score. Each bureau collects slightly different information, so your score may vary slightly depending on the bureau.

Equifax

Equifax provides detailed credit reports focusing on your payment history and account balances. This information helps lenders evaluate your consistency in managing debt and making on-time payments.

Experian

Experian includes a broader mix of financial data, such as credit utilization trends and account types, offering lenders insights into your overall credit behavior.

Transunion

TransUnion monitors recent credit activity, including inquiries and changes to account statuses. This allows lenders to understand how you’ve been managing your credit in the short term.

Together, these bureaus provide lenders with a comprehensive view of your financial habits and reliability, helping them make informed decisions about your mortgage application.

What does your credit score tell lenders about you?

Your credit score tells lenders how financially responsible you’ve been in the past, helping them determine whether you’re likely to repay a loan. A high credit score signals:

- Reliability: On-time payments and low debt levels demonstrate you are a dependable mortgage borrower.

- Financial Management: Lower credit utilization ratios (using less than 30% of your available credit) indicate you manage credit responsibly.

- Experience: A long credit history with diverse account types shows you have experience handling various financial obligations.

Conversely, a low score may indicate missed payments, high debt levels, or financial instability, all of which increase a lender’s perception of risk. This could result in higher interest rates, stricter terms, or even loan denial.

How do lenders use credit scores?

Lenders take many aspects of your financial portfolio into consideration when deciding if they should provide you with a loan. One of these many factors is your credit score. Lenders use your credit score in combination with other factors to determine your eligibility and loan terms.

- Risk Assessment: Higher scores are associated with lower default risk, often leading to more favorable loan terms.

- Interest Rates: Borrowers with higher scores typically qualify for lower interest rates, reducing the overall cost of the loan.

- Loan Options: Certain loan programs have minimum score requirements. For example:

- Conventional loans generally require a minimum score of 620.

- FHA loans may accept scores as low as 580 with a small down payment (as low as 3.5%).

By combining your credit score with factors like income, employment history, and debt-to-income (DTI) ratio, lenders create a comprehensive picture of your financial situation. Getting a second opinion about your financial capability from a loan expert at Direct Mortgage Loans could help you find your dream home faster.

What credit score do you need to buy a house?

When buying a home, the credit score required depends on the loan type you’re applying for and your financial profile. Mortgage lenders use credit scores to evaluate risk, and while higher scores generally result in better loan terms, borrowers with lower scores may still qualify for certain government-backed loans. Understanding the general credit score benchmarks for homeownership could help you determine where you stand and whether you need to improve your score before applying for a loan.

Credit Score Needed To Buy A House By Loan Types

Conventional Loans

Most conventional loans require a minimum credit score of 620. Borrowers with higher scores (740 or above) are likely to qualify for the best interest rates and terms. A 20% down payment could also help you avoid private mortgage insurance (PMI), reducing your overall costs.

FHA Loans

FHA loans are backed by the Federal Housing Administration and are designed to help borrowers with lower credit scores or smaller down payments. A credit score of 580 allows you to qualify with a 3.5% down payment, while scores between 500 and 579 require a 10% down payment. These loans also include mortgage insurance premiums (MIP) regardless of your down payment amount.

VA Loans

Available to eligible veterans and active-duty service members, VA loans don’t have a strict minimum credit score requirement set by the Department of Veterans Affairs. However, most lenders prefer a score of at least 620. These loans offer benefits like no down payment and no PMI, making them an attractive option for qualified borrowers.

USDA Loans

USDA loans, which are intended for rural and suburban homebuyers, typically require a credit score of at least 640. These loans often feature no down payment requirements, making them a great choice for qualified buyers in eligible areas.

By understanding the credit score requirements for different loan types, you can identify the best mortgage option for your financial situation. If your credit score falls below the minimum requirements, there are steps you could take to improve it and enhance your chances of approval. Contacting a loan officer at DML could provide you with a better understanding of what loan type is best for you.

Ways To Improve Your Credit Score To Buy A House

Improving your credit score could open the door to better loan terms and lower monthly payments. Here are actionable steps you could take:

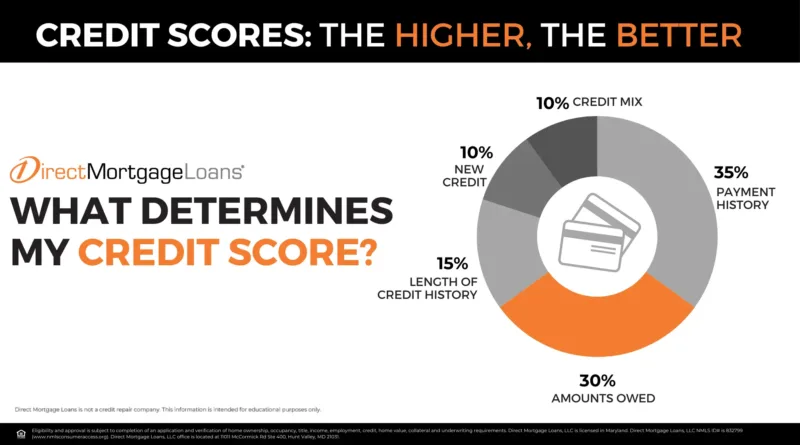

- Pay Bills on Time: Payment history accounts for 35% of your FICO Score, making timely payments essential.

- Lower Credit Utilization: Aim to use less than 30% of your available credit to boost your score.

- Avoid New Credit Accounts: Opening new accounts could temporarily lower your score due to hard inquiries.

- Dispute Credit Report Errors: Regularly review your credit reports and correct any inaccuracies to ensure they reflect your true financial standing.

Exploring more tips to improve your credit score will allow you to be better prepared before taking the next steps in the home buying process.

What Mortgage Lenders Look For Beyond Your Credit Scores

While your credit score is a vital part of the mortgage approval process, it’s not the only factor lenders consider. Mortgage lenders take a holistic approach to assess your financial health and ability to repay the loan. This includes evaluating aspects like your income, employment history, savings, and overall debt management. These additional factors provide lenders with a comprehensive view of your financial situation, helping them determine the level of risk involved in approving your loan application.

Employment History And Stability

Lenders value a stable work history because it demonstrates consistent income and financial reliability. They typically look for:

- Length of Employment: A steady job with the same employer for at least two years is ideal, although some lenders may consider shorter durations if you’ve stayed within the same industry.

- Employment Type: Full-time positions are generally viewed more favorably than part-time or freelance work, though lenders may consider alternative income sources with proper documentation.

- Job Changes: Frequent job changes may raise concerns unless they show career progression or increased earning potential.

Income And Earning Potential

Your income is a critical factor in determining how much house you could afford. Lenders analyze your income to ensure its sufficient to cover your mortgage payments alongside other expenses. They’ll evaluate:

- Gross Monthly Income: Lenders calculate your gross income (what you make before taxes) to assess affordability.

- Income Sources: Regular income from employment is prioritized, but additional sources such as rental income, alimony, or investments may also be considered.

- Future Earning Potential: If you’re in a stable industry or position with room for growth, lenders may view your financial outlook positively.

Assets And Savings

Assets and savings indicate financial preparedness, especially for covering upfront costs and emergencies. Lenders look for:

- Down Payment Funds: Having a significant down payment demonstrates financial discipline and reduces the lender’s risk.

- Emergency Savings: Maintaining reserves for three to six months of expenses could strengthen your application.

- Other Assets: Investments, retirement accounts, or secondary properties provide additional security for lenders.

Debt-To-Income Ratio

The DTI ratio compares your total monthly debt payments to your gross monthly income. This ratio helps lenders determine if you can handle additional debt. Two key calculations are:

- Front-End Ratio: This includes housing costs (mortgage principal, interest, taxes, and insurance). Lenders typically prefer this to be below 28% of your gross income.

- Back-End Ratio: This includes all monthly debt obligations, such as credit cards, car loans, and student loans, ideally kept below 36%. Government-backed loans may allow higher DTIs in certain cases.

Loan-To-Value Ratio

The LTV ratio measures the size of the loan compared to the appraised value of the property. A lower LTV ratio is favorable because it reduces the lender’s risk. Here’s how it works:

- High Down Payment: A larger down payment lowers the LTV ratio, which could lead to better loan terms, and eliminate the need for private mortgage insurance (PMI).

- Low LTV Ratio Benefits: Borrowers with a lower LTV ratio are often viewed as more financially stable and responsible.

Working with a trusted lender like Direct Mortgage Loans, allows you to be viewed as and taken care of as an individual with multiple factors affecting your financial makeup.

Credit Score And Mortgage FAQ’s

What is a good credit score to buy a house?

A good credit score for buying a house typically falls between 620 and 740, depending on the loan type. Here’s how lenders interpret different score ranges:

- 740 and above: Excellent credit. Borrowers in this range are more likely to qualify for the best interest rates and loan terms.

- 700–739: Good credit. This range still provides access to competitive rates and favorable terms.

- 620–699: Fair credit. Borrowers may qualify for standard loans, but rates may be higher.

- Below 620: Poor credit. While some government-backed loans like FHA loans may still be available, terms are less favorable, and additional financial documentation may be required.

Can I buy a house with no credit score?

Yes, it’s possible to buy a house even if you don’t have a credit score. Lenders may use non-traditional credit evaluations, which involve assessing payment histories for:

- Rent payments

- Utility bills

- Insurance premiums

- Other recurring monthly obligations

These alternative methods help establish your creditworthiness. However, not all lenders offer these options, so it’s important to work with a lender experienced in alternative credit evaluations.

What credit score is needed to buy a $300k house?

The required credit score depends on the type of home loan you pursue for a $300,000 home:

- Conventional loans: A minimum credit score of 620 is usually required, but higher scores improve your chances of securing better terms.

- FHA loans: A score of 580 allows for a 3.5% down payment, while scores between 500 and 579 require a 10% down payment.

- VA and USDA loans: Generally, a score of 620 or higher is recommended for better approval chances.

Example: For a $300,000 home, with a 10% down payment, would require a mortgage of $270,000. A higher credit score could significantly lower your interest rate on the loan, reducing the monthly mortgage payment, and saving you money over the life of the loan.

How can I check my credit score for free?

There are several ways to access your credit score without incurring fees:

- Annual Credit Report: Annualcreditreport.com allows you to request free credit reports from Equifax, Experian, and TransUnion (note: these may not include your FICO Score).

- Credit Card Providers: Many credit card issuers provide free access to your FICO or VantageScore through their online portals or mobile apps.

- Bank Accounts: Some banks offer free credit score monitoring as part of their account services.

- Credit Monitoring Platforms: Services like Credit Karma or Experian Boost provide free access to credit scores and helpful tools to monitor your financial health.

Do married couples need both credit scores to qualify for a mortgage?

Yes, when married couples apply for a mortgage together, lenders consider both credit scores. However, the lower credit score is typically used to determine:

- Loan eligibility

- Interest rates

- Terms and conditions

If one spouse has a significantly higher score, it may be advantageous for only the higher-scoring spouse to apply. However, this approach limits the total household income considered for the loan, which could reduce the amount you qualify to borrow.

Leave A Comment

You must be logged in to post a comment.