Buying your first home is an exciting milestone, but navigating the wide array of loan options and programs could feel overwhelming. Understanding these options is key to making informed decisions and finding the best fit for your financial goals. This guide breaks down the loan types, state-specific programs, and benefits available to first time buyers, helping you take confident steps toward homeownership.

Subscribe to our blog to receive notifications of posts that interest you!

What is a first time home buyer loan?

A first time home buyer loan is a mortgage specifically designed to make homeownership more accessible for those purchasing their first property. These loans often feature unique benefits, such as reduced down payment requirements, lower interest rates, and flexible credit score criteria. Many of these loans also allow buyers to pair with state and local assistance programs to further ease the financial burden of a home purchase. Whether you’re looking for zero-down-payment options or targeted grants, first time home buyer loans are tailored to meet the needs of new buyers.

These loans are not limited to traditional mortgages, but can include programs that address common hurdles, such as upfront costs and long-term affordability. By exploring these options, you could identify the programs that best align with your goals.

First Time Home Buyer Benefits

First time buyers enjoy several advantages making the home-buying process more manageable:

- Lower Down Payments: Programs like FHA loans allow buyers to put down as little as 3.5%, while USDA and VA loans offer eligible borrowers the option to pay no down payments.

- Flexible Credit Requirements: Many programs are designed to accommodate buyers with lower credit scores, offering a pathway to homeownership for those with less-than-perfect credit histories.

- Financial Assistance: State and federal programs often provide grants, forgivable loans, or tax credits, to help cover down payment and closing costs.

- Tax Benefits: Buyers may qualify for deductions on mortgage interest and property taxes, reducing the overall cost of owning a home.

- Affordable Loan Terms: Programs typically include competitive interest rates* and manageable monthly payments, ensuring long-term affordability.

These benefits work together to reduce the financial challenges that many first time buyers face, making it easier to achieve your dream of homeownership.

*Rates are subject to change. Eligibility and approval are subject to completion of an application and verification of home ownership, occupancy, title, income, employment, credit, home value, collateral, and underwriting requirements. Direct Mortgage Loans, LLC NMLS ID# is 832799 (www.nmlsconsumeraccess.org). Direct Mortgage Loans, LLC office is located at 11011 McCormick Rd Suite 400 Hunt Valley, MD 21031. This is a paid endorsement. Equal housing lender.

First Time Home Buyer Loan Options

There are several loan options tailored to meet the needs of first time buyers. Each program offers unique benefits, so understanding their features could help you choose the best fit.

FHA Loans

FHA loans, insured by the Federal Housing Administration, are a popular choice for first time buyers due to their flexible requirements.

- Down Payment: FHA loans require as little as 3.5% down for qualified borrowers.

- Credit Score: A minimum credit score of 580 for most borrowers is required; however, some lenders may accept scores as low as 500 with a larger down payment.

- Benefits: FHA loans offer more lenient credit and income guidelines, making homeownership possible for those with financial challenges.

VA Loans

VA loans are exclusively available to veterans, active-duty service members, and eligible spouses.

- Down Payment: There is no down payment required for this type of loan.

- Credit Score: VA loans typically require a score of 620 or higher.

- Benefits: These loans include no private mortgage insurance (PMI), competitive interest rates, and additional protections for military families.

USDA Loans

USDA loans help buyers in rural and eligible suburban areas.

- Down Payment: There is no down payment required for USDA loans.

- Credit Score: These loans typically require a score of 640 or higher.

- Benefits: USDA loans provide affordable loan terms and eliminate the need for a down payment.

Conventional 97 Loans

Designed for buyers with strong credit, Conventional 97 loans offer an affordable entry point to homeownership.

- Down Payment: These loans require the borrower to provide a down payment of 3%.

- Credit Score: Conventional 97 loans require a minimum credit score of 620.

- Benefits: These loans include reduced PMI costs and are ideal for those who meet higher credit requirements.

Good Neighbor Next Door

This HUD-sponsored program offers significant savings for teachers, police officers, and emergency responders.

- Discount: Those qualified could receive up to 50% off the home’s list price in eligible revitalization areas.

- Eligibility: To be considered for these loans, the borrower must meet employment and residency requirements.

HomeReady

Fannie Mae’s HomeReady program is designed for low-income buyers.

- Down Payment: The HomeReady program requires a minimum down payment of 3%.

- Benefits: This program features reduced mortgage insurance costs and flexible income guidelines, allowing additional household income to qualify.

Home Possible

Freddie Mac’s Home Possible program supports low to moderate income buyers.

- Down Payment: The Home Possible program requires a 3% down payment.

- Benefits: This program includes reduced PMI and allows for co-borrowers who don’t live in the home.

State Specific First Home Loans For First Time Home Buyers

States often offer programs to complement federal options, providing additional support tailored to local buyers.

First Time Home Buyer Down Payment Assistance Programs

Saving for a down payment is often one of the biggest challenges for first time home buyers. Down payment assistance programs provide financial support to help buyers cover this initial cost, making homeownership more attainable. These programs, which may include grants or low-interest loans, are designed to ease the financial burden and encourage more individuals to purchase their first home.

How They Work For First Time Home Buyers

These programs provide grants or loans to help cover upfront costs like down payments and closing fees. Assistance may come as forgivable loans or deferred payment options.

How To Qualify For DPA As A First Time Home Buyer

Eligibility for these down payment assistance programs depends heavily on income, credit score, and the purchase price of the property. Direct Mortgage Loans offers the answers to any of your questions regarding down payment assistance. Reach out to a loan officer to learn more about your options.

First Time Home Buyer Grants

First time home buyer grants are a valuable resource for reducing upfront costs like down payments and closing fees. Unlike loans, grants provide financial assistance that does not need to be repaid, making them an attractive option for buyers seeking additional support. These programs are often income-based and aim to make homeownership more accessible for qualifying individuals and families.

How They Work For First Time Home Buyers

Down payment assistance programs and first-time homebuyer grants are designed to reduce upfront costs like down payments and closing fees, making homeownership more accessible. These programs typically come in the form of grants, forgivable loans, or deferred-payment loans.

Grants provide funds that do not need to be repaid, while forgivable loans are canceled after a set period if the homeowner meets certain conditions, such as living in the home for a specified time. Deferred-payment loans require no immediate repayment, with the amount due only when the home is sold or refinanced.

Each program has its own eligibility requirements, which often include income limits, property location, and purchase price caps. Many programs also require buyers to complete a homebuyer education course to prepare for the financial responsibilities of owning a home. These resources allow first-time buyers to move forward confidently without the burden of large upfront costs.

How To Qualify For Grants As A First Time Home Buyer

To qualify for first-time homebuyer grants, buyers typically need to meet certain criteria:

- First-Time Buyer Status: Generally, you must not have owned a home in the past three years.

- Income Limits: Grants are often income-based, requiring your household income to fall below specific thresholds tied to the area median income (AMI).

- Credit Score: While grants themselves may not have strict credit requirements, the mortgage you pair with the grant, such as an FHA loan, may require a credit score of at least 580.

- Primary Residence: The home must be your primary residence and meet purchase price limits set by the program.

Most programs also require completing a homebuyer education course to ensure you are prepared for the financial and practical aspects of owning a home. By working with an approved lender, you can navigate these requirements and identify grants that align with your needs.

Tax Benefits For First Time Home Buyers

Tax benefits, like mortgage interest deductions and credits, could lower the overall cost of homeownership. Talking to a qualified mortgage professional at Direct Mortgage Loans will allow you to gain a better understanding of how you can take advantage of these benefits.

First Time Home Buyer Requirements

To qualify for any first time home buyer program, you generally need to not have owned a home in the past three years, meet specific income and credit score requirements tailored to each program, and complete a home buyer education course, where applicable.

How do I get a first time home buyer loan?

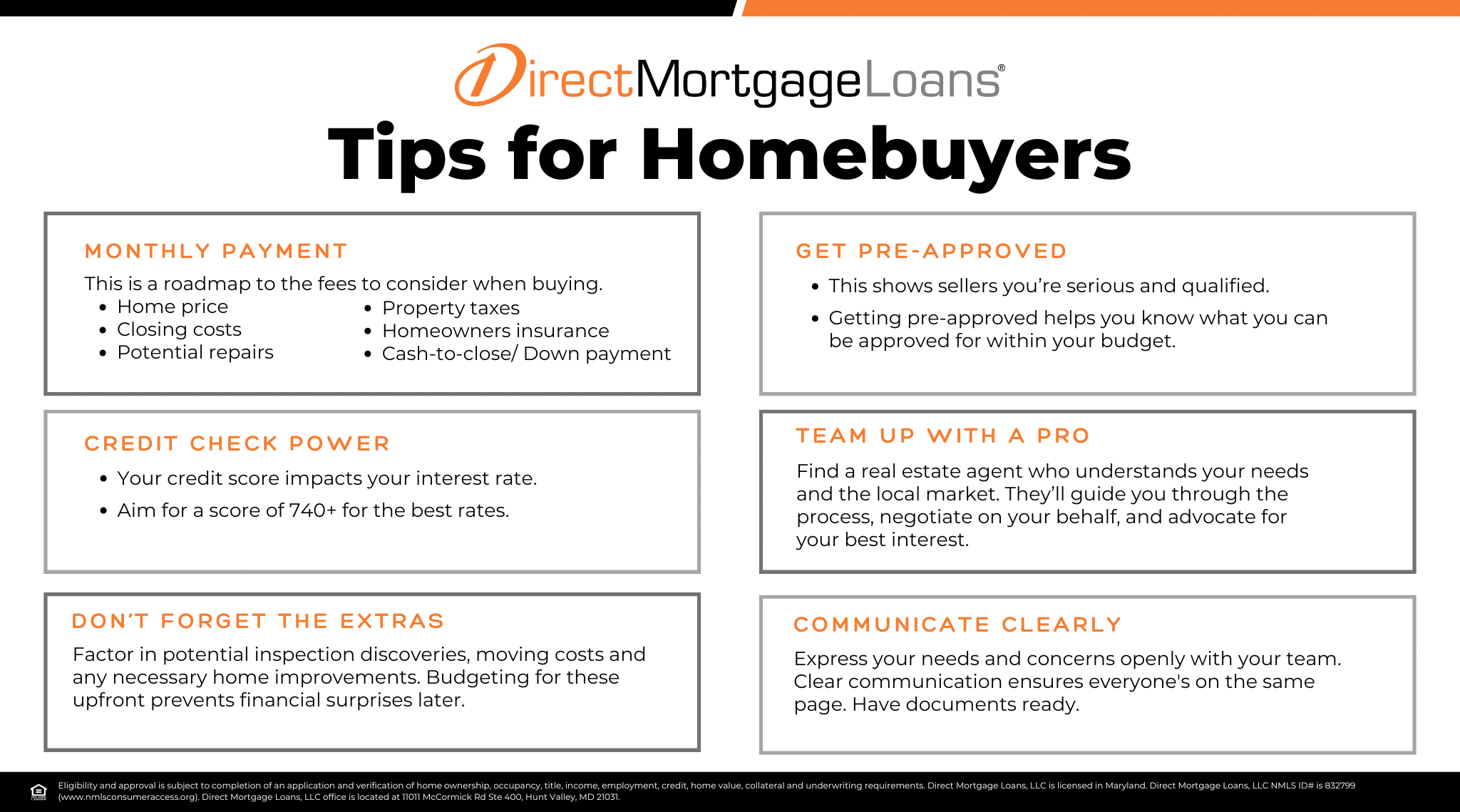

Securing a first time home buyer loan involves these key steps:

- Assess Your Finances: Review your credit score, income, and debt-to-income ratio to ensure you are up-to-par with the requirements.

- Research Loan Options: Explore programs that fit your financial profile and homeownership goals.

- Get Pre-approved: Work with a lender like Direct Mortgage Loans to determine how much you could afford, and to be better educated on what loans you qualify for.

- Find Your Dream Home: Begin your home search within your preapproved budget and with a trusted realtor by your side.

How To Apply For A First Time Home Buyer Loan

Applying for a first time home buyer loan involves several steps to ensure a smooth process:

- Review Eligibility: Understand the requirements of the loan or assistance program you’re interested in, such as income limits, credit score thresholds, or first-time buyer status.

- Gather Financial Documents: Prepare essential paperwork, including tax returns, pay stubs, bank statements, and proof of employment.

- Complete Required Education: Many programs, such as FHA loans and down payment assistance programs, require completion of a homebuyer education course.

- Work with a Trusted Lender: Contact a reputable lender like Direct Mortgage Loans to guide you through the application process and ensure you meet all requirements.

- Submit Your Application: Provide all necessary documents and complete your application with your chosen lender.

How To Find First Time Home Buyer Lenders Near You

Finding the right lender is critical to securing a loan that fits your needs. Here’s how to locate a reliable first time home buyer lender:

- Find a Specialized Mortgage Lender: Look for lenders experienced in working with first time buyers, like Direct Mortgage Loans, who understand the unique challenges you may face.

- Utilize State Resources: Many state programs list approved lenders who offer assistance programs and first time buyer loans. As an approved lender of many state programs, Direct Mortgage Loans has knowledgeable loan officers available to help first time home buyers with these state resources. Find a loan officer near you today.

- Compare Options: Evaluate lenders based on interest rates, fees, and customer reviews to find the best fit.

- Schedule Consultations: Meet with potential lenders to discuss your options and determine who can offer the most competitive and tailored solution.

Direct Mortgage Loans specializes in working with first time buyers, offering personalized support and guidance throughout the process. Talking to a loan officer could start your home buyer journey today.

FAQ’s About First Time Home Buyer Loans

Do first time home buyers need a down payment?

Not all first time home buyer programs require a down payment. For instance, with VA loans, veterans and active-duty service members could access loans with no down payment required. USDA loans also offer zero-down-payment options. In contrast, FHA loans require as little as 3.5% down, making them more accessible for buyers with limited savings.

If you’re concerned about affording a down payment, explore state-specific assistance programs, which could provide grants or loans to cover this expense.

Are there any zero down home loans for first time buyers?

Yes, zero-down-payment loans are available for first time home buyers through VA and USDA programs. VA loans are specifically designed for veterans and military members, while USDA loans cater to those purchasing homes in rural or suburban areas. These programs eliminate the need for a down payment, making homeownership achievable for those with limited savings. However, it’s important to account for other costs, such as closing fees, which may not be covered by these programs.

How do first time buyer programs work?

First time home buyer programs are designed to reduce the financial barriers to homeownership. These programs may offer grants, forgivable loans, or deferred loans to help cover expenses such as down payments and closing costs. Many also include tax benefits, such as the Mortgage Credit Certificate (MCC), which could allows buyers to claim a portion of their mortgage interest as a federal tax credit. To qualify, buyers typically need to meet specific income, credit score, and purchase price requirements. Partnering with an approved lender ensures you understand the eligibility criteria and can access the right programs.

Leave A Comment

You must be logged in to post a comment.