The process of securing a mortgage, gathering the necessary paperwork, and understanding the various steps involved in the home buying process can feel overwhelming. To help simplify the process, we’ve created this comprehensive mortgage borrower to do checklist for first time home buyers. Follow these steps to stay organized and confident throughout the process.

Subscribe to our blog to receive notifications of posts that interest you!

Figure Out Your Budget

The first step in the home buying process is understanding your financial situation. This involves evaluating your income, debts, and determining a realistic budget for your home purchase.

Debt To Income Ratio

One crucial aspect is your debt-to-income ratio (DTI), which lenders use to assess your ability to manage mortgage payments. This ratio measures the percentage of your gross monthly income that goes toward paying your debts.

Review Your Credit Score

Another key factor is your credit score, which plays a significant role in your mortgage approval. This score represents your past borrowing history and ability to repay debts. A higher credit score often results in more favorable loan terms, such as a lower interest rate.

Monthly Mortgage Payment

It’s essential to understand what your monthly mortgage payment will look like. This payment includes the principal and interest on your loan, property taxes, and homeowners’ insurance.

Use A Mortgage Calculator

Using a mortgage calculator could help you estimate your monthly payment based on different loan amounts, interest rates, and loan terms. By doing this, you could better understand how much you can afford and plan your budget accordingly.

Save For A Down Payment and Closing Costs

When buying a home, you’ll need to save for both the down payment and closing costs. For down payments, depending on the type of loan, you may need anywhere from 3% to 20% of the home’s purchase price. Closing costs typically range from 3% to 4% of the purchase price, including fees for things like appraisals, title searches, and attorney services.

Explore Down Payment Assistance Programs

Many home buyers are unaware that there are down payment assistance programs available to help with the upfront costs of purchasing a home. These programs offer grants or loans to qualified buyers to help cover down payments and/or closing costs.

Get Pre-Qualified

Pre-qualification gives you a rough estimate of how much you may be able to borrow based on your financial information. While it’s not as detailed as a pre-approval, it’s a good first step to understanding your borrowing capacity.

Choose The Right Mortgage Loan Type

Once you’ve established your budget, it’s time to choose the best mortgage loan for your needs. There are several types of loans available, each with its own set of benefits.

Fixed Rate vs. Adjustable Rate Mortgages

A fixed rate mortgage offers an interest rate that remains unchanged throughout the life of the loan. This option is ideal for buyers who plan to stay in their home for an extended period, or for those who prefer the certainty of consistent, predictable payments.

On the other hand, an adjustable rate mortgage (ARM) begins with a lower interest rate for a set period, after which the rate adjusts based on current market conditions. ARMs are often a good choice for buyers who anticipate selling or refinancing before the adjustment period begins.

Conventional Loan

Conventional loans are mortgages that are not insured or backed by the government. Often categorized as conforming loans, they meet the down payment and income requirements set by Fannie Mae and Freddie Mac and adhere to the loan limits established by the Federal Housing Finance Administration (FHFA). These loans provide various down payment options, offer flexible mortgage insurance terms, and have less restrictive property guidelines.

Jumbo Loan

A jumbo loan is for buyers purchasing homes that exceed the conforming loan limits set by the Federal Housing Finance Agency (FHFA). These loans typically have stricter credit requirements and may come with higher interest rates, but they allow you to finance more expensive properties.

Government Backed Loans

Government backed loans include VA loans, FHA loans, and USDA loans, all of which are designed to make homeownership more accessible. These loans typically have more lenient credit requirements and offer lower down payment options, making them ideal for first-time buyers.

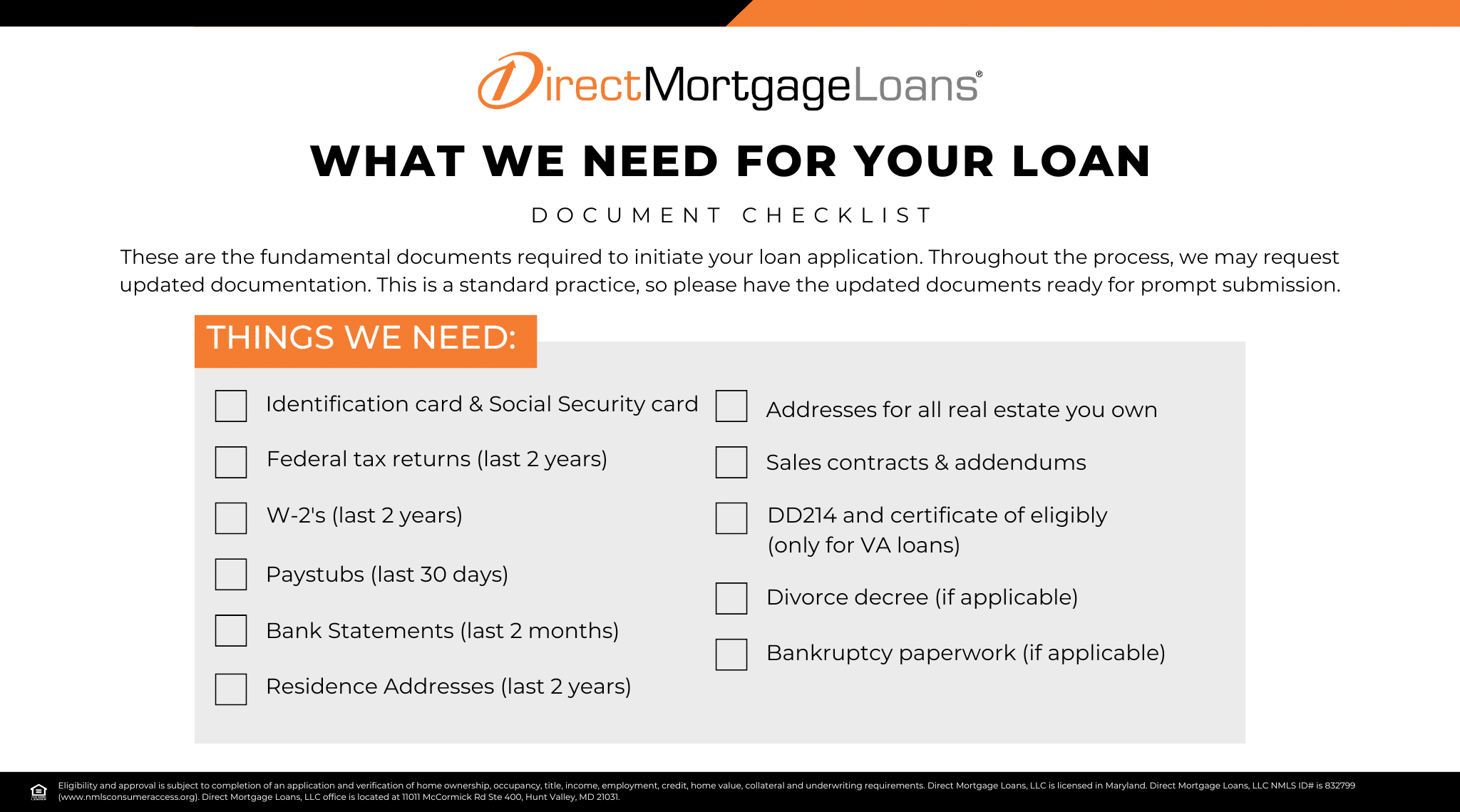

Gather Your Financial Documents

The mortgage pre-approval process involves a lender assessing your financial health to determine your loan eligibility and affordability. To complete this evaluation, you’ll need to provide documentation verifying your income, assets, debts, and credit history.

Get Pre-Approved For A Mortgage Loan

After collecting your financial documents, the next step is to submit your pre-approval application. This step requires a detailed review of your finances by the lender, offering you a clearer view of how much you could borrow for your home.

Find A Realtor

Working with a knowledgeable realtor can make your home-buying experience much easier. A realtor will help you locate homes that suit your needs, handle negotiations, and support you through the entire process. If you need recommendations, our Loan Officers can connect you with a trusted realtor.

Start The Home Buying Process

With your budget set and pre-approval in hand, you’re ready to begin house hunting. Work with your realtor to compile a list of must-have features and start scheduling viewings to find a property that you want to make a home.

Get an Updated Pre-Approval Letter

Before submitting an offer on a home, make sure to get an updated pre-approval letter. This shows the seller that you are a serious buyer and that your financing is in place.

Make An Offer

At this point, once you’ve found your ideal home, the next step is to make an offer. Your realtor will work with you to negotiate the best price and terms for the purchase.

Lock In Your Interest Rate

After your offer is accepted, it’s time to lock in your interest rate to protect against fluctuations in the market.

When To Lock In Your Interest Rate

Locking in your interest rate at the right moment is key. While it may be tempting to wait for lower rates, this can be risky. Discuss the potential market factors with your Loan Officer to determine the best time to lock in your interest rate.

Factors That Affect Interest Rates

Several factors can impact your mortgage interest rate, such as your credit score, the type of loan you choose, the size of your down payment, and current market conditions.

Order A Home Appraisal

Before moving forward, your lender will require a home appraisal to confirm the property’s value aligns with the amount you’re borrowing. The appraisal protects both you and the lender by providing an unbiased estimate of the home’s value.

Schedule A Home Inspection

A home inspection helps identify any potential issues with the property, such as structural problems or needed repairs. While inspections are not required for all loan types, they could provide peace of mind before committing to the purchase.

Prepare For Closing

As you near the end of the process, it’s important to prepare for closing. Take the time to carefully review the closing disclosure and confirm all required documents are in place before closing day.

Close On Your New House

On closing day, you’ll finalize the transaction by signing the necessary paperwork and paying your closing costs. Once everything is completed, you’ll receive the keys to your new home and can begin the process of moving in. Congratulations—you’re officially a homeowner!

First Time Home Buyer Mistakes To Avoid

While buying your first home is exciting, it’s easy to make mistakes along the way. Here are some common pitfalls to watch out for:

Skipping Mortgage Pre-Approval

Not getting pre-approved before house hunting can lead to disappointment if you find a home you love but aren’t financially prepared to make an offer.

Financing Large Purchases Before Buying a Home

Avoid making large purchases, such as cars or furniture, before closing on your home. These transactions could affect your credit score and debt-to-income ratio, which could impact your mortgage approval.

Maxing Out Credit Cards

Using too much of your available credit could lower your credit score and make it harder to qualify for a loan. Keep your credit utilization below 30% to maintain a healthy score.

Changing or Quitting Your Job Before Buying a Home

Stability is important when applying for a mortgage. Avoid switching jobs or quitting your job before closing on your home, as this could delay or jeopardize your loan approval.

Leave A Comment

You must be logged in to post a comment.