How To Buy a House in Georgia as a First Time Home Buyer

Buying your first home in Georgia might feel overwhelming, but with the right guidance, it doesn’t have to be. Whether you’re eyeing a condo in Atlanta or a single-family home in the suburbs, this step-by-step guide will help you get started—from connecting with our mortgage team to closing day.

Speak with one of our Licensed Georgia Mortgage Lenders

Kick things off by speaking with one of our licensed Georgia mortgage loan officers. They’ll help you discover which programs you qualify for and provide options that suit your goals.

Gather Your Documents & Start the Pre-Approval Process with a Go Direct Approval

Get a head start on your journey by applying for a Go Direct Approval. By submitting basic documents like W-2s and bank statements, our team can help you move through the process quickly with a customized loan plan.

*When compared to turn times for conventional programs. Approval times may vary depending on individual circumstances.

Go Under Contract

Once you’ve found the right property, your loan coordinator will walk you through inspections, appraisals, and other steps to make sure everything stays on track.

Home Appraisal

We utilize a state-of-the-art appraisal system to streamline coordination across our team. Working with top professionals ensures your appraisal process is accurate and efficient from start to finish.

Processing

Before underwriting begins, our processor will thoroughly check your file for accuracy. If anything is missing or unclear, we’ll request clarification to keep your timeline intact.

Final Mortgage Approval

Our in-house underwriter will complete a final review of your loan file to confirm all conditions have been met. Once approved, you will receive your final loan commitment, putting you just one step away from closing on your new home.

Closing On Your New Home

Our in-house underwriter will conduct a final review of your mortgage application to make sure all requirements are met. You’ll then receive your final mortgage commitment—just one step from becoming a homeowner.

First Time Home Buyer Georgia Loan Options

There are a variety of loan products available in Georgia, each tailored to meet the needs of different types of homebuyers. Whether you’re a first time home buyer, a veteran, or looking for low down payment loan options, here’s a breakdown of some of the most common home loan types.

FHA Loans

FHA loans are among the most accessible mortgage options for first time home buyers, especially those who may not have perfect credit or a large amount saved for a down payment. These loans are backed by the Federal Housing Administration, which allows lenders to offer more flexible terms and qualifications. With a credit score of 580 or higher, you could qualify with just 3.5% down. If your score falls between 500–579, you may still be eligible with a 10% down payment.

In addition to lower credit score requirements, FHA loans typically offer more lenient debt-to-income ratio standards compared to conventional loans. However, they do require you to pay mortgage insurance premiums (both upfront and monthly), which helps protect the lender in case of default. For many buyers, the trade-off is worth it in exchange for easier qualification and less upfront cash needed to close. FHA loans are a great stepping stone into homeownership—especially for those rebuilding credit or purchasing their first home without significant savings.

VA Loans

VA loans are an incredible benefit for eligible members of the military community, including veterans, active-duty service members, and surviving spouses. These loans are partially guaranteed by the Department of Veterans Affairs, giving lenders confidence to offer more favorable terms. One of the biggest advantages of VA loans is that they require no down payment, helping you purchase a home without the need to save tens of thousands upfront.

VA loans also don’t require no private mortgage insurance (PMI), which can save buyers hundreds of dollars per month compared to other loan types. Add in competitive VA mortgage rates, and it’s easy to see why this option is so popular among qualified borrowers. If you’ve served in the military, a VA loan could be the most affordable and straightforward path to owning a home in Georgia.

USDA Loans

USDA loans are designed to help low- to moderate-income buyers purchase homes in rural and some suburban areas. These government-backed mortgage loans provide 100% financing, meaning no down payment is required—making them one of the few zero-down options still available to homebuyers today.

To qualify for a USDA loan, the property must be located in an eligible rural area, and your household income must fall within the program’s income limits for your region. USDA loans also do not require PMI, although there is a small annual fee. These loans are especially helpful for buyers looking to settle in quieter communities while taking advantage of affordable homeownership options.

Conventional Loans

Conventional loans are a strong choice for first time buyers who have good credit and some savings. Unlike government-backed loans, conventional loans are not insured by a federal agency, but they follow guidelines set by Fannie Mae and Freddie Mac. These loans offer a wide range of down payment options and more flexibility in choosing mortgage insurance. They’re ideal for buyers who want more control over their loan structure and are comfortable meeting stricter credit and income requirements.

Conventional 97 Loans

Conventional 97 Loans are a popular option for first time home buyers who have good credit but haven’t had time to save a large down payment. This program allows you to finance up to 97% of the home’s value with just 3% down. It follows the same general guidelines as other conventional loans, but its reduced down payment requirement makes it an attractive middle ground between FHA and standard conventional options.

The program is ideal for buyers who meet credit and income requirements and want to avoid the mortgage insurance premiums associated with FHA loans. Mortgage insurance is still required with a Conventional 97, but unlike FHA, you can remove it once you reach 20% equity in the home. It’s a strong option for financially stable buyers who want long-term flexibility.

Fannie Mae HomeReady

HomeReady is a Fannie Mae program tailored specifically for low- to moderate-income borrowers, especially those buying in high-cost areas. With only a 3% down payment required, it’s highly accessible for many first time buyers. One of the standout features of HomeReady is the $2,500 credit that eligible borrowers can use toward closing costs or their down payment, helping ease the financial burden at closing.

HomeReady also allows for broader income qualification. For instance, you can include income from household members not listed on the loan application to help you qualify. This flexibility can make a big difference for multigenerational households or buyers who share living expenses with family. If your income falls within program limits, HomeReady could provide the boost you need to purchase your first home.

Freddie Mac Home Possible

Home Possible is Freddie Mac’s answer to the challenges first time buyers often face. Much like HomeReady, this program offers a 3% down payment, reduced private mortgage insurance (PMI) costs, and flexible credit requirements. Where Home Possible really shines is in its flexibility: it allows co-borrowers who don’t plan to live in the home, enabling family members to help you qualify.

This can be especially helpful if you’re buying a home with support from a parent or relative. The program also permits a wider range of income sources, making it accessible to self-employed individuals, gig workers, and others with non-traditional income. For moderate-income buyers looking for support in qualifying, Home Possible is a well-rounded solution.

Piggyback Loans

Piggyback loans are a smart workaround for borrowers looking to avoid private mortgage insurance (PMI) without putting down a full 20%. This strategy involves taking out two loans simultaneously: a first mortgage for 80% of the home’s value, and a second, smaller loan—often called a home equity loan or HELOC—for an additional 10% or so. You cover the remaining 10% with your own funds, completing the 90/10/10 formula.

This structure keeps the first loan under the 80% threshold, eliminating the need for PMI. Piggyback loans can be particularly beneficial in higher-cost areas or for buyers purchasing above conforming loan limits. If you have strong credit and a solid income, but not enough saved for a full 20% down payment, this strategy can reduce your monthly mortgage costs significantly.

Georgia Down Payment Assistance & Home Buying Programs Through Direct Mortgage Loans

Direct Mortgage Loans is proud to offer a variety of home buying solutions to eligible buyers in Georgia, including the Go Direct FHA 100% Financing program, which provides a powerful path to homeownership with no down payment required. In addition, we support those who serve our communities through our Law Enforcement Home Buying program, offering exclusive mortgage benefits for police officers and first responders as a lending partner of the Fraternal Order of Police.

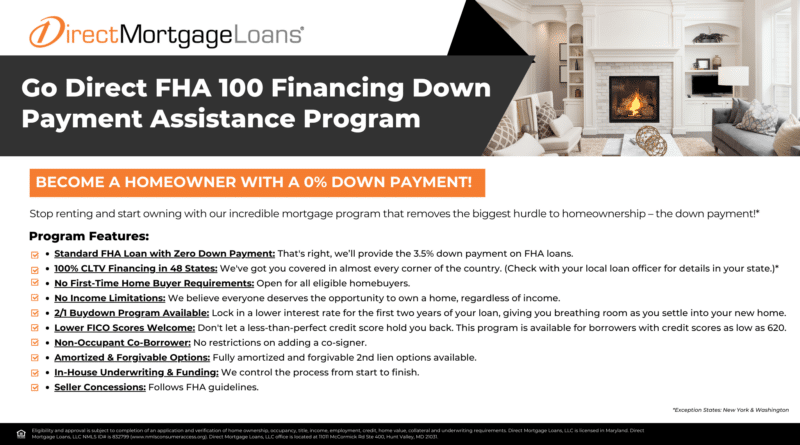

Go Direct FHA 100% Financing for Georgia Home Buyers

This program combines a first and second mortgage to fully finance your home purchase when using an FHA loan. The second mortgage can cover up to 3.5% of the purchase price or appraised value (whichever is less), with a repayment term of 10 years.

Go Direct FHA 100% Financing Benefits for Georgia Home Buyers

The Go Direct FHA 100 loan is designed to enhance homeownership opportunities by offering key benefits that boost both accessibility and affordability.

- 0% Down Payment – Keep more cash in your pocket for moving costs, furnishings, or emergency savings.

- Standard FHA Guidelines – Benefit from flexible credit and income requirements.

- Second Lien Financing – Cover your down payment with a second loan structured to fit your budget.

Go Direct FHA 100% Requirements for Georgia Home Buyers

To qualify for this program, applicants must meet a few basic standards:

- Minimum FICO credit score of 620

- Completion of a Home Buyer Education course, which helps prepare you for the responsibilities of homeownership

Eligible property types include:

- Single-family homes

- Duplexes

- Manufactured homes

- PUDs

- Townhouses

- Condos

How do I apply for the Go Direct FHA 100% Financing Program as a first time home buyer in Georgia?

To apply for the Go Direct 100% FHA Financing Loan Program in Georgia, follow these steps:

- Apply with Direct Mortgage Loans: Our experienced team will guide you through the application process.

- Verify Eligibility and Get Pre-Approved: Once your mortgage application is submitted, the next step is to verify your eligibility for the program. If you qualify, Direct Mortgage Loans will review your financial details and issue a pre-approval so you know your homebuying budget.

- Complete a Homebuyer Education Course – This required step prepares you for the financial and practical aspects of owning a home.

- Close on Your New Home – With everything in place, you’re ready to finalize your purchase and step into homeownership.

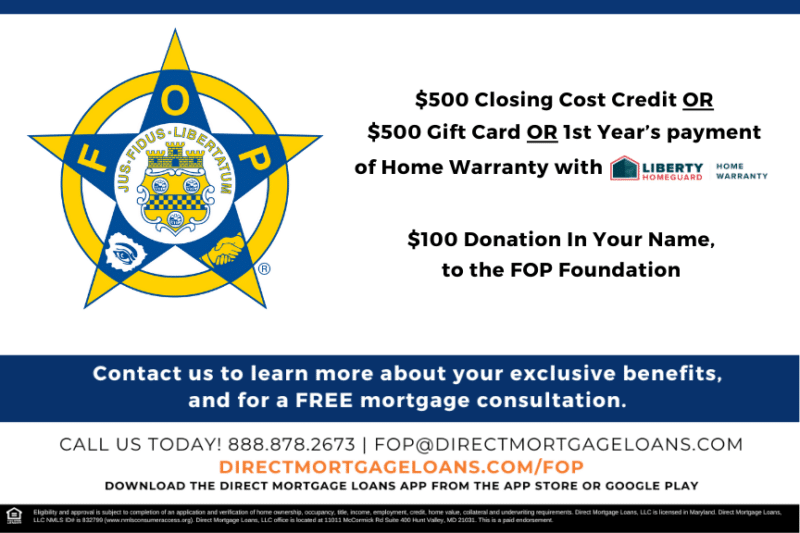

Direct Mortgage Loans Law Enforcement Home Buying Program

Direct Mortgage Loans is proud to support those who serve our communities by partnering with the Fraternal Order of Police. Through our Law Enforcement Home Buying Program, we offer exclusive mortgage benefits for cops and first responders.

Direct Mortgage Loans Law Enforcement Home Buying Program Benefits

Qualified law enforcement professionals can choose from one of the following benefits:

- $500 Closing Cost Credit – Lower your out-of-pocket expenses at closing

- $500 Gift Card – Use for moving expenses, home repairs, or anything else you need

- First Year’s Payment of a Home Warranty – Provided through our partnership with Liberty Home Guard

In addition, Direct Mortgage Loans donates $100 to the FOP Foundation in honor of the participating officer. It’s our way of giving back to those who protect and serve.

Other Ways to Buy a House as a First Time Home Buyer in Georgia

Buying your first home in Georgia is an exciting milestone but coming up with a down payment can sometimes feel like the biggest hurdle. The good news is that there are several creative and practical ways to make homeownership more achievable, even if you don’t have a large amount saved. From receiving financial help from family to tapping into your retirement savings or investment accounts, these alternative strategies could help bridge the gap and get you closer to owning your first home. Let’s explore some of the most effective ways to fund your down payment and make your dream of homeownership a reality.

Gift Funds

If you have family members willing to help, gift funds can be used toward your down payment and even closing costs, depending on the loan program. The key is documentation—your lender will require a gift letter and possibly bank statements to show the source of funds. Be upfront with your loan officer so they can guide you on how to meet the program’s rules.

Borrow From 401(k)

Your 401(k) could be a useful resource for homebuying. Many plans allow you to borrow from your retirement account without early withdrawal penalties, as long as you repay it over time (often through automatic payroll deductions). However, it’s important to review the terms carefully—especially if you’re planning to change jobs or if paying it back could strain your finances.

Savings

Saving remains the most traditional and reliable method for covering a down payment. Set up a high-yield savings account and allocate a portion of your income every month toward your home fund. In addition to growing your down payment, consistent saving habits demonstrate financial responsibility to lenders.

Cash Out on Investments

If you’ve built a strong investment portfolio, selling part of it could help you buy your first home. Before cashing out, talk with a financial advisor to understand the tax implications and weigh them against the long-term benefits of homeownership. This option can be especially smart if your investments have significantly appreciated and you’re ready to transition those funds into real estate.

First Time Home Buyer GA FAQ’s

Who is considered a first time home buyer in Georgia?

In Georgia, a first time home buyer is anyone who has not owned a primary residence in the past three years. This includes people who may have owned rental or investment properties, but did not live in them as their main home.

How much do first time home buyers have to put down in Georgia?

Down payments vary depending on the loan type and your qualifications. Some programs, such as a USDA or VA loans, offer the ability to purchase a home with zero money down if you meet the eligibility requirements.

Can you buy a home in Georgia with no money down?

Yes, eligible homebuyers could purchase a home in Georgia with no money down. Programs like the Go Direct 100% FHA financing may be available through certain lenders. Additionally, if you qualify for a VA or USDA loan, there is no down payment requirement, making homeownership more accessible for many Georgians.

What is the minimum credit score to buy a house in Georgia?

In Georgia, the minimum credit score required for a mortgage depends on the type of loan you choose. While a score of 620 is typically recommended, some programs may require a minimum of 640 or higher to qualify. However, Direct Mortgage Loans offers options for borrowers with credit scores as low as 580, providing more flexibility for those with less-than-perfect credit.

Eligibility and approval is subject to completion of an application and verification of home ownership, occupancy, title, income, employment, credit, home value, collateral and underwriting requirements. Loan products described here may not be available at the time of application. All products are subject to eligibility and availability. Reach out to your lender to learn more. Direct Mortgage Loans, LLC NMLS ID# is 832799 (www.nmlsconsumeraccess.org). Direct Mortgage Loans, LLC office is located at 11011 McCormick Rd Suite 400 Hunt Valley, MD 21031. Equal housing lender.

Leave A Comment

You must be logged in to post a comment.